Reggora, an appraisal management software company, has announced its first-ever Appraisal Performance Index, a study to index appraisal operations trends across the mortgage industry.

The year 2022 began with interest rates close to 3%, and then climbed to 7% before retreating in mid-December, and this increase in rates caused mortgage volumes to plummet, creating a unique scenario where the number of loan originations went from too many for appraisers to handle to a manageable number and a reasonable flow of work.

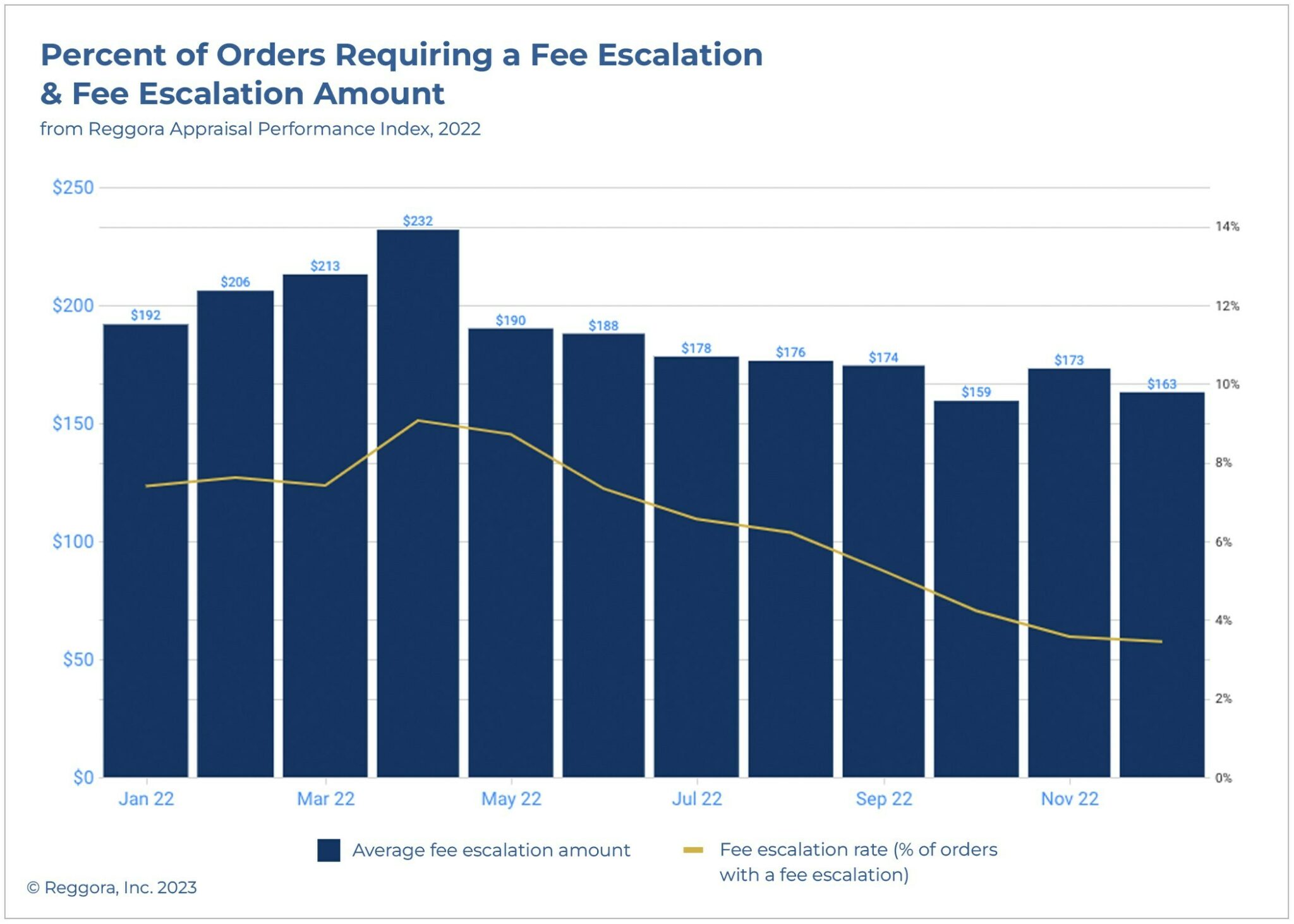

Observations of the Index revealed, the average appraisal fee slowly dropped throughout the 2022 calendar year. The year began with an average fee of $620 per appraisal, and peaked in March at $635, but fell to $592 by November. This declining average was tied to fewer fee escalations as the year progressed. With a reasonable caseload, appraisers do not need to raise fees to expedite orders. The average fee escalation rate peaked at 9% in April and May, likely due to both seasonality, and a surge in loan application volume facing a trend of rising interest rates, adding up to an average of $232 to an initial estimate in April.

“Tepid home sales and refinances in 2022 put less strain on the fulfillment logistics and allowed appraisal turn times to improve from the difficulties in 2021,” said Brian Zitin, Co-Founder and CEO of Reggora. “The data reveals that with a heavy case load, appraisers require multiple days to complete each appraisal. When appraisers can accept fewer assignments, the work is manageable, and appraisals can be completed more quickly with greater satisfaction from the lender and the borrower.”

This study is a comprehensive review of appraisal activity through the Reggora platform from January to December 2022. All appraisals in the study were completed Form 1004 or Form 1073 orders, and include a broad range of coverage across the 48-contiguous United States. Turn time in the study refers to the number of business days from the date the order was placed to the date of the first appraisal submission. Revision rate is defined as any appraisal with multiple submissions and does not discern between appraiser or lender driven resubmission requests.

To develop the Appraisal Performance Index, Reggora aggregated 2022 data from its platform to learn how the industry performs in four of the most important categories:

- Appraisal Fees

- Fee Escalations

- Turn Times

- Revision Rates

The data, which can be analyzed down to individual U.S. counties, revealed a pattern of trends that matched the ebb and flow of originated mortgage loans across the country.

During 2021, there was heightened demand for appraisals and appraisers struggled to keep pace with market needs. With the drop in volume throughout 2022, appraisers were more effectively able to manage the demand and deliver their appraisal reports in significantly shorter windows.

“The ability to complete an appraisal quickly has always been a sticking point,” said Ken Dicks, Reggora’s Director of Appraisal Compliance. “In 2022, we saw turn times come in line with expectations. Appraisals in locations where there are fewer appraisers, typically outside of centralized urban areas and their neighboring suburbs, generally take longer on average than appraisals in those centralized urban and suburban locations, but turn time performance improved for both segments as the demand slowed.”

Reggora also reviewed revision rates. As interest rates rose and local markets became more volatile, it can be speculated that appraisals became more closely scrutinized leading to a higher rate of revision requests throughout the year—an attribute expected to continue as market conditions fluctuate in 2023.