Discover Home Loans has issued a survey to understand how inflation and higher interest rates have impacted American homeowners’ sentiment around investing in their homes versus moving to new homes.

The survey of 1,500 homeowners was commissioned by Discover and conducted by Dynata (formerly Research Now/SSI), an independent survey research firm. The surveys were conducted online; the first was fielded from January 19th through January 29th, 2023. The maximum margin of sampling error was +/- 2% with a 95% level of confidence.

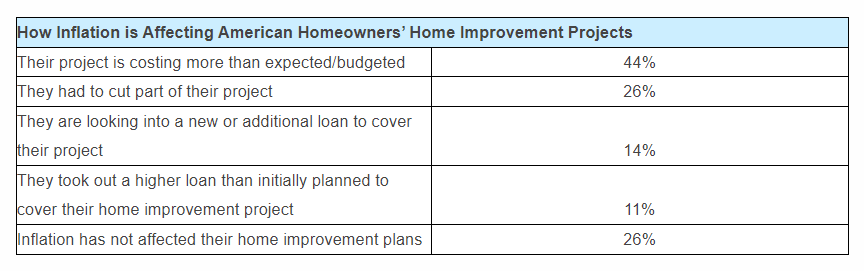

As inflation continues to impact a homeowners’ desire to undertake home improvement projects, 59% of Discover survey respondents chose to postpone their projects, while 26% stated they will seek to reduce the scope of their projects in the face of mounting home improvement costs. Despite the hurdles presented by inflationary concerns, there remains a strong demand for home renovation, with 79% of homeowners surveyed still preferring to renovate their current house rather than opting to move to relocate.

The current interest rate environment is also having an impact on consumers’ desire to move and purchase a new home. When asked how rising interest rates have specifically impacted their intention to purchase a new house, 42% of survey respondents said they are no longer looking to do so and an additional 21% are still looking, but are less set on buying a new home.

“Our survey results show that homeowners are still looking to invest in their homes, despite higher home improvement costs. With large amounts of existing home equity untapped, a home equity loan is an attractive option for many homeowners looking to finance large-scale home improvements or consolidate their debts,” said Rob Cook, VP of Marketing, Digital & Analytics of Discover Home Loans. “Since home equity loans are second mortgages, they allow homeowners to keep their existing primary mortgage, which can be beneficial if they have a low rate on that mortgage. Another benefit is that home equity loans typically offer lower rates than credit cards and personal loans, and unlike HELOCs, provide the certainty of a fixed interest rate.”

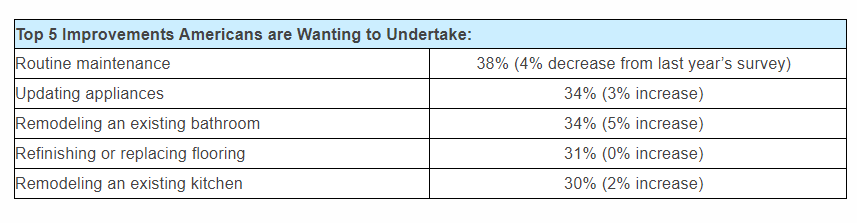

When asked what home improvements to undertake, homeowners are most interested in conducting routine maintenance, though the number of people wanting to do it decreased by four percentage points compared to last year’s survey. The number of Americans planning to remodel their existing bathroom jumped five percentage points, while those wanting to update their appliances increased by three percentage points.

Similar to last year’s findings, 80% of homeowners surveyed agree they are making improvements as a way to invest in their home, and 82% agree they plan to make cosmetic changes to their home to better fit their style and needs.

An interest in making “green” or eco-friendly renovations to homes was emphasized in these results, with 59% of homeowners fitting them into their renovation plans. Nearly half of respondents said they were doing so because they are environmentally conscious, while 68% aim to save money on their energy or water bill. Interestingly, Gen Z and Millennials were found to be most likely to make green updates to their homes at 67%, versus 56% of Gen Xers and 47% of Baby Boomers.

“As U.S. homeowners continue to deal with inflation and interest rate hikes, it’s important for homeowners to plan ahead and understand their budget before starting their renovation projects,” added Cook.