Capital markets software and service provider Mortgage Capital Trading (MCT) has published its MCTlive! Lock Volume Indices for May 2023 which aims to represent a balanced cross section of several hundred lenders. The broad-based view of the report of the entire market provides a more accurate picture of mortgage originations versus indices that are influenced by “mega lenders.”

Capital markets software and service provider Mortgage Capital Trading (MCT) has published its MCTlive! Lock Volume Indices for May 2023 which aims to represent a balanced cross section of several hundred lenders. The broad-based view of the report of the entire market provides a more accurate picture of mortgage originations versus indices that are influenced by “mega lenders.”

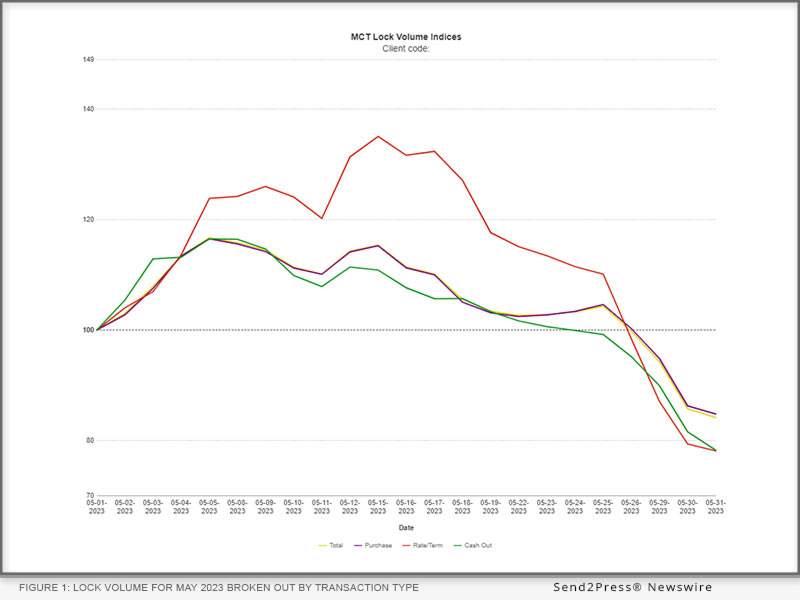

May’s MCTlive! Lock Volume Indices revealed that overall lock volume had a stronger downturn in May compared to April as purchase lack activity was down 15.20% month-over-month. Rate/term refinance volume was down 21.88%, and cash-out refinance volume was down 21.77%. Finally, lock activity in total was down 15.87% in total compared to April.

According to MCT, May had a stronger downward trend compared to April, the market should see an uptick in lock activity if the Federal Reserve’s Federal Open Market Committee decides if they have reached their terminal nominal interest rate as we move into the summer season.

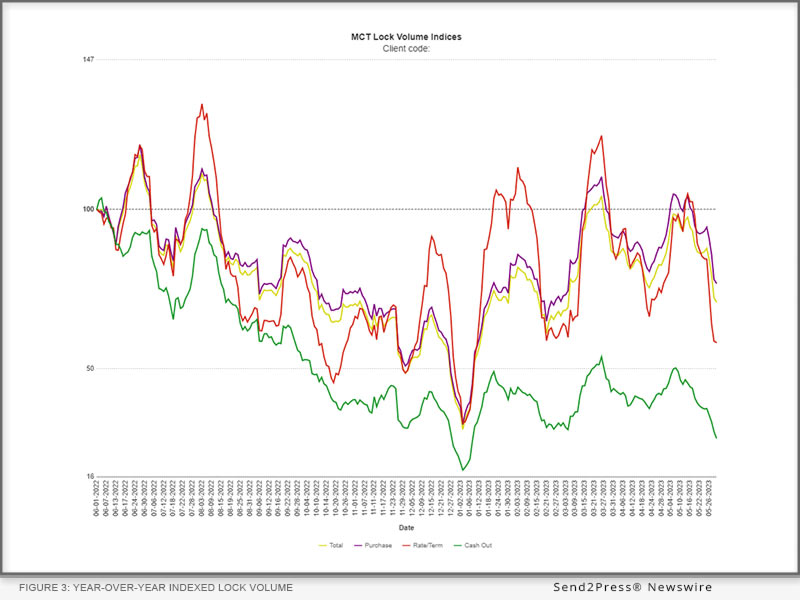

As it stands, total lock activity is down 29.09% from last year. Purchase lock activity sits 23.23% lower than at the same point last year. Rate and term refinance volume is down 41.85% from one year ago, and cash-out refinance volume is down 71.83% over that same period.

It is important to note that MCT’s rate lock activity indices are based on actual dollar volume of locked loans, not number of applications. Especially in a tight purchase market, MCT believes its methodology (using actual loans locked vs. applications) is a more reliable metric.

There is a higher likelihood of having multiple applications per funded loan, and prequals do not convert at as high of a rate in the current market as has historically been the case – especially when applications are counted at the early stage of entering a property address.