You have probably heard the term “house poor” used among new homeowners, particularly millennials, who make a good income, but spend most of it on housing. But have you heard of the term “house rich?”

With the massive gain in home prices, and therefore equity, that started during the COVID-19 pandemic, “house rich” is used to describe places where homeownership is dominant, and homes are relatively affordable compared to the local median income.

Cities across the country are experiencing this phenomenon, but certain places stand out due to the high availability of affordable housing alongside homeownership rates.

But what causes a place to be house rich, and how does the typical home in every state measure up to this benchmark? All Star Home analyzed the latest numbers from the U.S. Census Bureau, breaking down the data and sharing the surprising places where homes are affordable and homeownership rates are high.

High-level key findings noted by the report include:

- West Virginia, Iowa, and Michigan are the top house rich states.

- Davie, North Carolina, is the most house-rich city in the entire U.S.

- Americans are the least house rich in California.

- Almost half (49%) of Americans stay right on budget when buying a home.

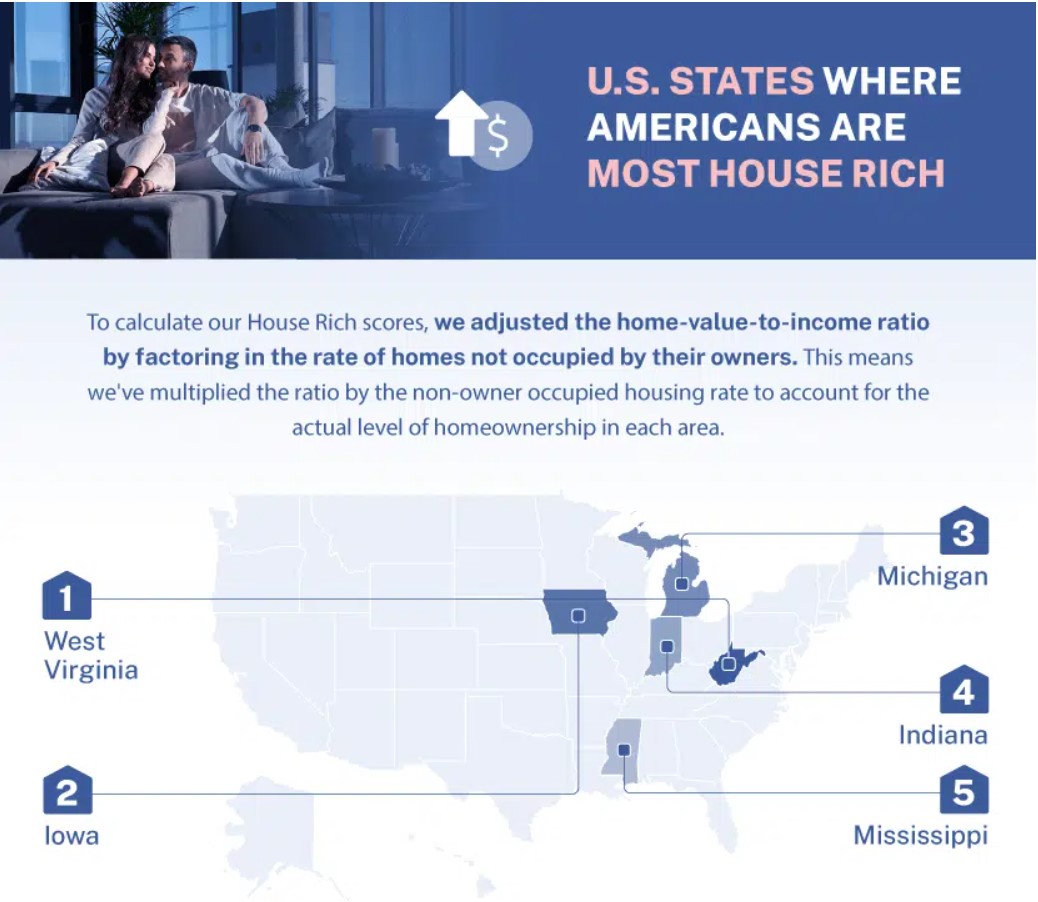

All Star Home defined “house rich” by comparing data from the Census Bureau on a state-by-state basis by comparing the median value of owner-occupied housing units and the median household income, which spits out a home-value-to-income ratio.

Then All Star Home incorporated the owner-occupied housing unit rate into our calculations to adjust the ratio. By multiplying the home-value-to-income ratio with the non-owner occupied housing rate, they gauged the dominance of homeownership in every locale.

After everything is computed, a low score indicates that a location is house rich, wherein housing is not only affordable but also where a majority of the populace reside in homes they own.

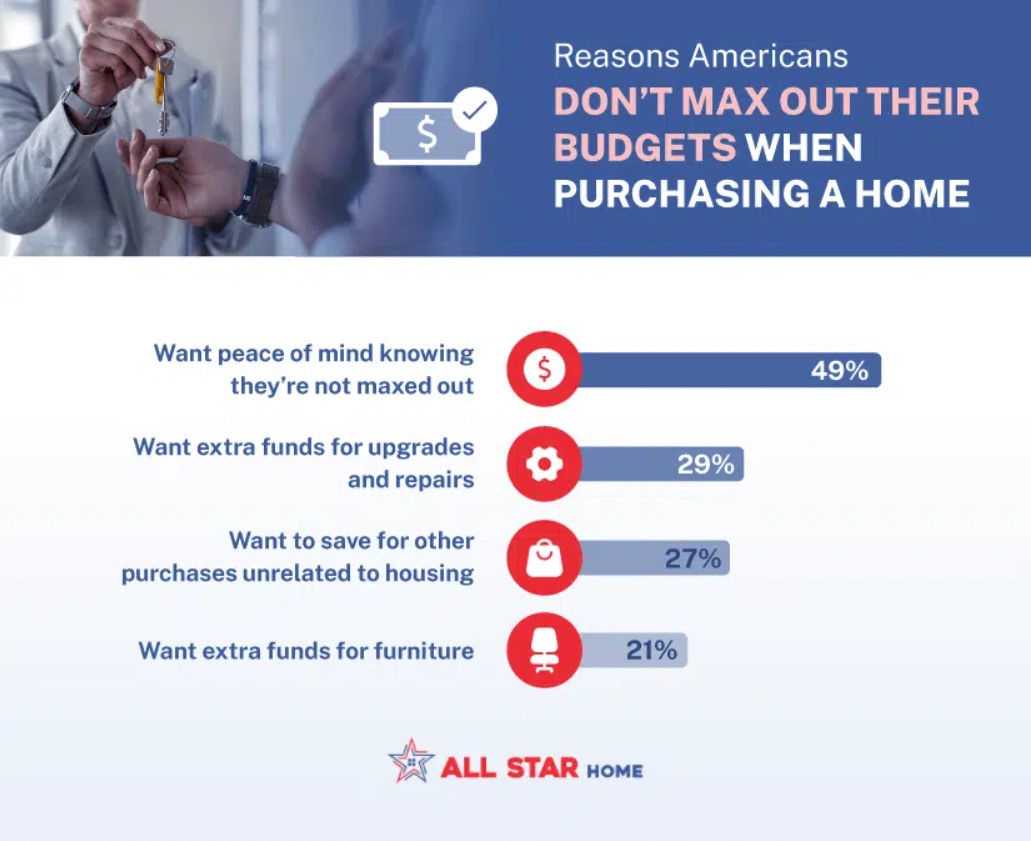

Additionally, All Star Home conducted a survey in which they found that while nearly half of Americans (49%) managed to stay within their budget (which was set at a standard deviation of 30% of monthly income) during a home purchase, a noteworthy 30% of respondents say they exceeded their financial limits of 30%, albeit slightly.

So All Star Homes asked the question “what drives the financial decisions of homebuyers?” Their research points to peace of mind being the paramount reason. Many Americans are unwilling to stretch their budgets to the brink, seeking stability over extravagance, which also speaks to the financial aptitude of the populous as a whole.

Overall, in order, the states with the highest amount of “house rich” homeowners are: West Virginia, Iowa, Michigan, Indiana, and Mississippi. The lowest were California, Hawaii, New York, Nevada, and Oregon.

Click here to see the research in its entirety, including graphics and a ranking of all 50 states.