When we think of what defines a catastrophic property claims season, damaging hurricanes are what usually come to mind. While these certainly mean severe impacts for the insurance industry and homeowners, a new trend is emerging. Secondary perils, which are less severe natural events such as wildfires in California and other states; river floods; and major thunderstorms, are becoming more common and costly. While these secondary perils are typically less severe individually than a primary peril like a hurricane, 2023 is shaping up to be a year where widespread thunderstorms and hailstorms are having an unprecedented impact.

An August report by Swiss Re provides context that severe convective storms—storms associated with thunder, lightning, heavy rain, hail, strong winds, and sudden temperature changes—caused $35 billion in worldwide insured losses in the first half of 2023, representing 68% of the insured natural catastrophe losses worldwide for the same time period.1

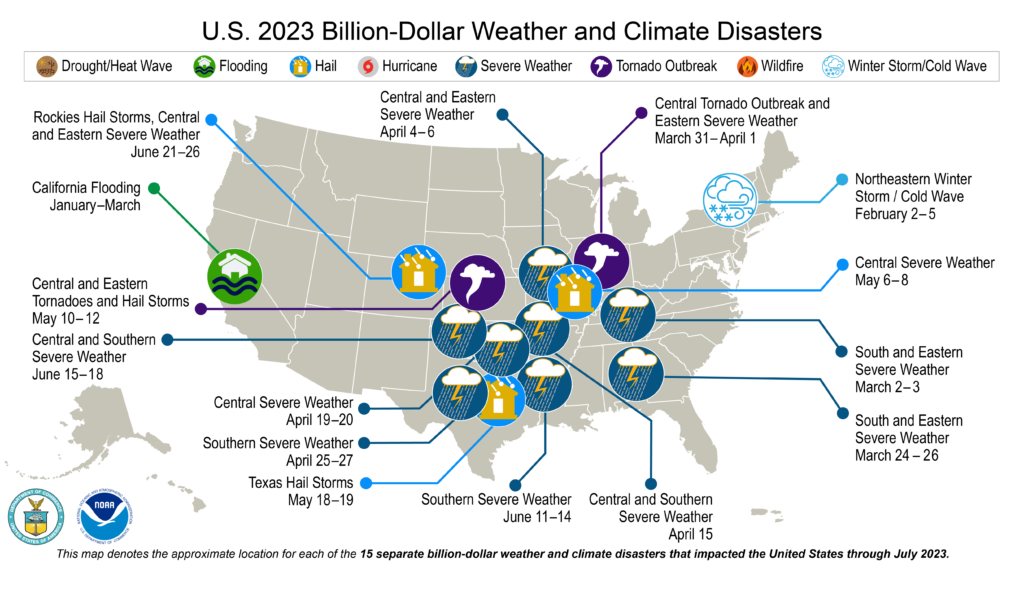

Separately, the National Oceanic and Atmospheric Administration (NOAA) released data showing that 15 individual weather events, with losses greater than $1 billion each, occurred during the period of January to July 2023. Since NOAA began tracking these billion-dollar disasters over 40 years ago, this is the highest recorded volume for the first seven months of a year.2 The map below from NOAA shows that severe thunderstorms and hail were the primary cause of the majority of these large loss events.

Thunderstorms are certainly not new occurrences, so why are the insurance damages from these events comprising a larger percentage of overall natural catastrophe losses? There are a few reasons to consider.

Severity of Climate Impacts

The changing climate is impacting the severity of weather events. S&P Global Commodity Insights reached out to Tim Raupach, a professor at University of New South Wales’ Climate Research Centre, who stated: “A warmer atmosphere can hold more moisture in the atmosphere [that] combined with higher temperatures make the atmosphere more unstable and therefore more prone to forming thunderstorms—with strong updrafts that can support the development of larger hailstones.”3

According to Swiss Re Group Chief Economist, Jérôme Jean Haegeli, “The effects of climate change can already be seen in certain perils like heatwaves, droughts, floods, and extreme precipitation. Besides the impact of climate change, land use planning in more exposed coastal and riverine areas, and urban sprawl into the wilderness, generate a hard-to-revert combination of high value exposure in higher risk environments.”1

More People Are Moving Into Areas With a Higher Risk of Natural Hazards

Net migration to high natural hazard risk areas has doubled since the COVID-19 pandemic began. With increased mobility, many Americans sought access to the outdoors and bigger living spaces. The search for affordable housing also led to Americans moving away from expensive coastal markets to parts of the United States that are more exposed to various natural hazards.4 In addition, more people are moving into areas vulnerable to hail and thunderstorms. The state of Texas, which accounted for most of the losses during the first half of 2023, saw its population grow 40% over the last 20 years. The population growth in the rest of the United States was less than half that.3

Inflationary Impact

Inflation is elevating property values as well as impacting the cost of materials and labor to complete repairs when there is damage to a home. Material and labor prices started increasing as a result of COVID-19 pandemic-related restrictions and associated supply chain disruptions, and these have subsequently been compounded by inflationary pressures and labor shortages.

Increasing Complexity of Exposures

In addition to the inflationary pressures, risks are becoming more technologically advanced and thus more expensive to replace or repair. A good example of this is the increasing popularity of rooftop solar panels, which are easily damaged by wind and hailstorms.

Reinsurance Market Conditions

Along with some increases in the cost of reinsurance coverage, there has also been an uptick in the point at which some reinsurers will begin to absorb losses. This means that primary insurers are faced with assuming a higher loss amount before reinsurance kicks in. Reinsurers are now typically seeking to start at the level of catastrophe losses that occur around once every 10 years, rather than the more typical starting point of one-in-three-year or five-year events, according to a January report from Gallagher Re. 5

Conclusion

The significant rise in the scale of losses that secondary perils are having on the insurance industry will likely have far-reaching impacts. While insurers will find ways to adapt and develop solutions to underwrite the evolving risks, consumers who live in areas not previously thought of as catastrophe-prone, but which now are contributing to large-loss events of $1 billion or more, will likely face increasing premiums, more restrictive coverage options, and reduced availability.