According to a new Realtor.com-Avail Landlord & Renter Survey, renting has been more expensive than it has ever been in the past several years. And, since rental affordability is a major national concern, both landlords and tenants believe it is affecting their future plans.

While fewer independent landlords asked said they planned to raise rent this year, many renters said it would likely impact their plans to buy a home this year because more tenants have been paying consistently higher rents in recent years.

“The once-hot rental market has been stabilizing and softening year-over-year since May 2023, mostly from a surge in new rental options coming to the market that gave renters more to choose from. But the surge in rents and the sheer number of renters, many of whom have held off on buying in recent years, continue to minimize any potential price impacts that increased rental inventory could have on the market,” said Danielle Hale, Chief Economist at Realtor.com.

According to the report, this year, fewer landlords are increasing rent.

The survey shows that although 60% of landlords anticipate raising rent in the upcoming year, this percentage has decreased recently, from 65% in Q1 2023. Most landlords who responded to the study—roughly 69%—stated that they raise rent for renewals and new leases in different ways, choosing to increase rent by 0-5% for renewals and by 0–10% for new leases. Among the landlords that do not set separate rent rates for new compared to renewed renters, some 50% want to hike rent by 0–5%.

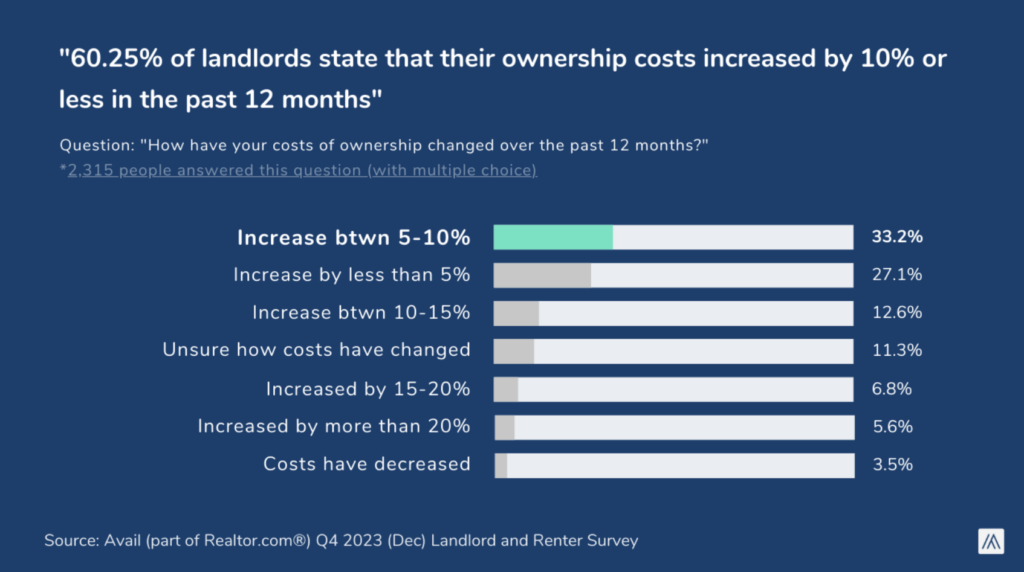

Anticipated rent hikes correspond with rising expenses for many Americans, including landlords who are charging their renters more for their services. Most landlords (60%) reported that during the previous year, their ownership costs went up by more than 10%. 72% of landlords who say they don’t intend to raise rent this year do so because their units are currently priced at or above the value of the local market.

Relentlessly high expenses are squeezing tenants across the U.S.

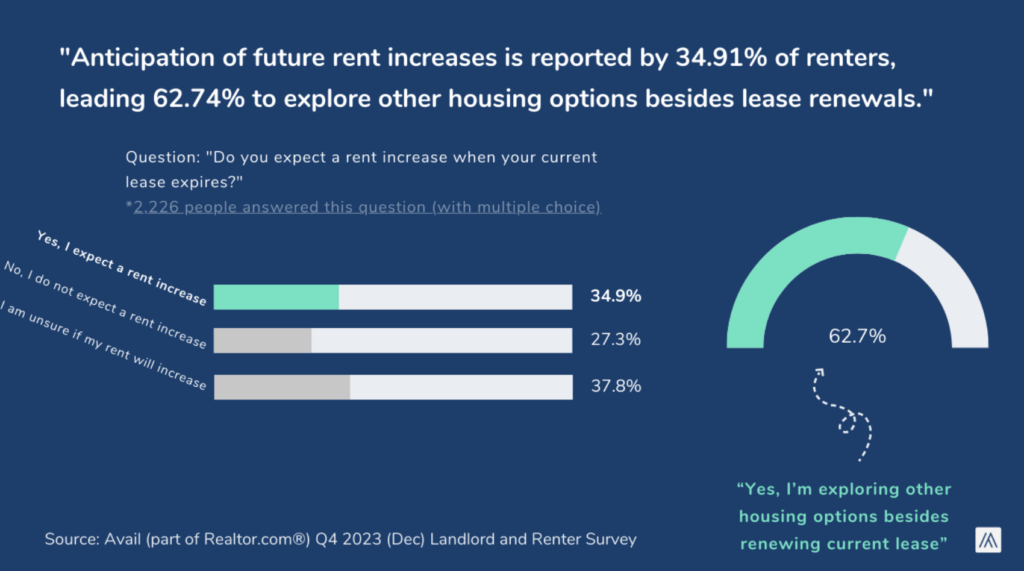

The study revealed that more renters are paying rents of $1000–$2000 per month than in prior surveys, showing significant rent hikes for many across the nation. The typical renter pays between $1,000 and $1,500 per month, according to the report. However, while renewing their most recent lease, 71% of polled renters reported an increase in rent. Furthermore, there isn’t much hope for respite from expensive housing costs, as roughly 35% of renters surveyed anticipate future rent rises, and 38% are unsure if they will see one.

As a result, nearly two-thirds (63%) are considering their choices for housing other than renewing their current lease. Those who did not renew their leases often cited high existing rent (43%), as well as costly rent increases (23%).

The number of renters who attempt to negotiate rent increases while renewing their lease went from 28% in Q1 2023 to 34% in Q4 2023. For some, remaining put when a lease is up and negotiating rent hikes may help save money. This would be particularly true in 2024, when landlords might be more motivated to secure renewals due to greater rental vacancy rates.

Budget constraints have halted American’s efforts to purchase a home.

Many renters who anticipate purchasing a home in the upcoming year are having their plans impacted by inflation and rising interest rates. According to a survey, approximately 82% of renters stated that their housing plans had been impacted by the economy. The majority of renters who said they are not thinking about buying a house this year (71%) said they don’t have enough money for a down payment (61%) and that interest rates are too high (42%).

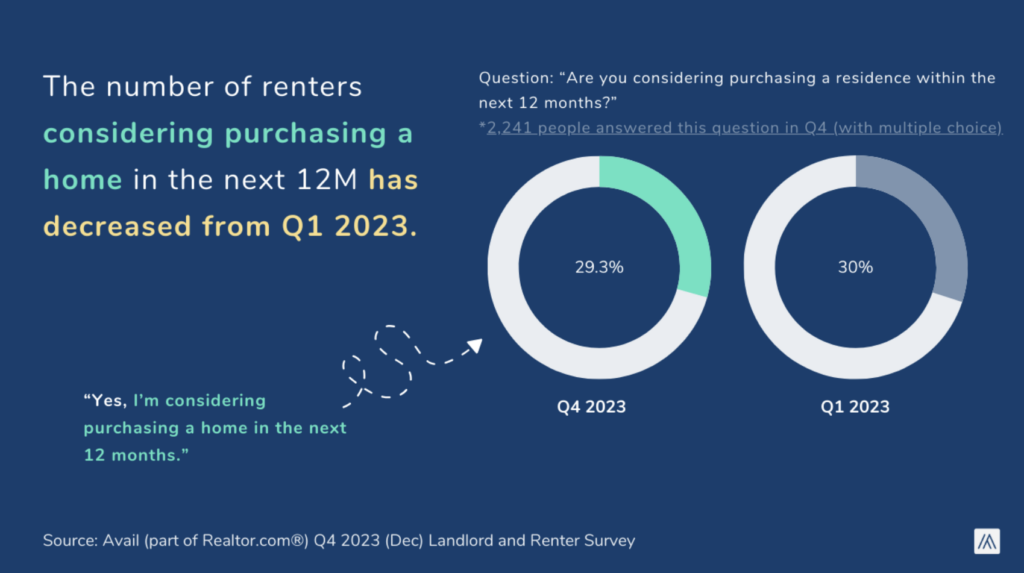

Renters who were thinking about buying a house in the upcoming year were less likely to do so (from 30% in Q1 2023 to 29% in Q4 2023), with worries about their inability to save money and their capacity to get a mortgage rising. Not surprisingly, considering that two thirds of tenants (68%) reported saving less each month than they were 12 months ago.

Rental owners are staying put.

Landlords’ plans to invest in more rental properties in the upcoming year are being impacted as a result of rising property prices and mortgage rates. It is not surprising that just 22% of landlords surveyed said they planned to purchase one or more rental properties in the upcoming year, considering that about 7 out of 10 landlords already had a mortgage on at least one of their properties and would probably use a mortgage to finance another purchase. Also, most landlords have no intention of leaving the market; some 73% of them said they have no plans to sell any of the properties in their portfolio in the upcoming year.

Homebuying remains unlikely for renters amid financial constraints.

In addition to other expenses brought on by inflation, renters are less able to preserve a portion of their income, and the prospect of ever-increasing loan rates discourages them from wishing to purchase a property. Renters who were thinking about buying a house in the following year were less likely to do so (30.01% in Q1 2023 vs. 29.36% in Q4 2023), with worries about qualifying and increasing costs.

Nearly half (42.35%) of those who believe that interest rates are too high, and the majority (60.49%) of those who say they are not considering buying a home do so because they do not have enough money for a down payment.

However, some 65.61% of those who are certain they would buy are thinking about postponing their plans—a steady increase from 65.95% in Q1 of 2023.

“The median asking rent in 2024 is expected to drop only slightly below its 2023 level (-0.2%), but with wages rising 4.5% in January and anticipated to continue growing, even the modest decline in rent is giving households a real break, reducing the share of each paycheck going toward rent,” said Hale.

While rising costs of property ownership may be unavoidable for landlords, effective procedures can help tenants use their units longer and avoid costly vacancies.

To read the full report, including more data, charts, and methodology, click here.