According to a new Bright MLS report, the service area’s total closed sales for January were greater than they were a year earlier, suggesting that homebuyers took advantage of declining mortgage rates at the end of 2023. Still, there weren’t many recent pending sales or showing activity.

The reduced activity can be partially attributed to the wintery weather, while the limited supply in the Mid-Atlantic, which continues to remain at historically low levels, was the other reason.

The report showed that there were an estimated 26,962 active listings as of the end of January 2024. Although there is a 1.7% shortfall in inventory compared to a year ago, the difference has been closing for the past eight months as the inventory has decreased over the previous year.

Bright MLS January 2024 Housing Report Highlights:

- The median sale price in the Bright MLS service area increased by 5.7% in January. Prices in the Mid-Atlantic have been rising for 143 consecutive months (with one exception last April when the median price was flat).

- Falling mortgage rates at the end of last year encouraged more closed sales activity in January compared to last year. The number of closed sales in the Mid-Atlantic was up slightly, though sales were up more strongly in more affordable regions.

- New listing activity continues to be very low. Overall, new listings in the Bright MLS service area were 9.9% lower in January 2024 than what they were in January 2023.

- Active listings have been declining for eight consecutive months. The year-over-year gap has narrowed, down to a 1.7% difference in January.

2024 Kicks Off With Higher Home Prices in the Mid-Atlantic

“Demand outpaced supply in 2023, and the trend will continue in 2024,” said Dr. Lisa Sturtevant, Chief Economist for Bright MLS. “More sellers should be joining the market this year, and additional new listings will be a welcome sign for buyers, but it will still be a very competitive market.”

Although the number of new listings increased seasonally in December, January experienced 9.9% fewer new listings than the previous January. However, it is expected that the market will strengthen in spring, providing more inventory and giving consumers more choices.

Early in 2024, mortgage rates will likely fluctuate before declining later in the year. The market will remain competitive, and buyers will have to act quickly.

Market Forecasts by Metro Area:

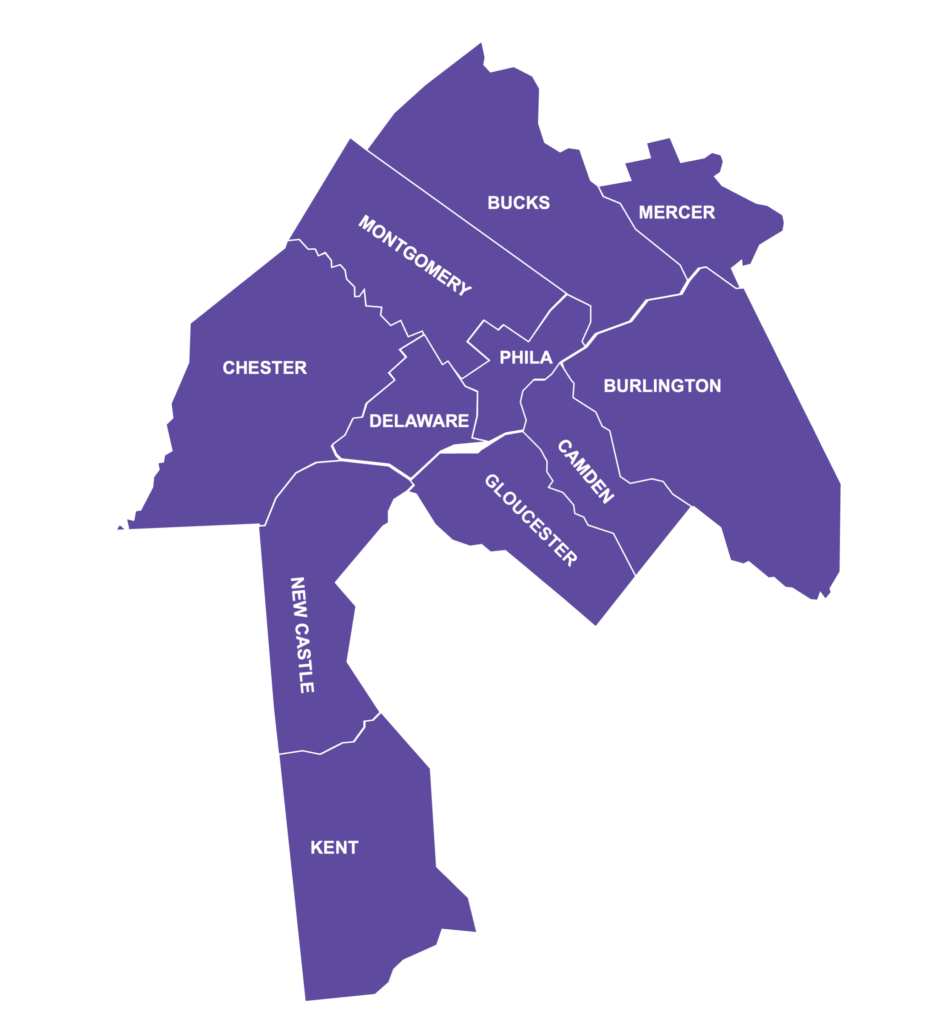

No. 1: Philadelphia—No Relief in Prices to Start 2024

Inventory remains limited, impacting activity in Pennsylvania’s largest city.

- In January, home prices were up in all counties, with the metro area median price up 8.3% year-over-year. The median price in the Philadelphia metro area is now 55% higher than it was in January 2019.

- Inventory is still very limited across the region. There were just 8,511 active listings across the region at the end of January, down 6.5% compared to a year ago. There is very little new listing activity, as current homeowners are still sitting on the sidelines, holding onto low mortgage rates.

- Buyers who are in the market need to act quickly. In January, the typical home sold in just 18 days, which is three days faster than a year ago.

- Showing activity is lower than it was last year, but that is not an indication of less demand. Rather, it is an indication of too few homes available for sale.

No. 2: Baltimore—Homebuyers Enticed by January Dropping Rates

Buyers continue to face higher prices and a quick market in this harbor area and birthplace of the national anthem.

- Closed sales outpaced last year’s level, which reflected more buyers putting in offers at the end of the year. There were 1,728 closed sales in January 2024, 1.6% higher than January 2023.

- In January, the median sold prices was $355,000, up 7.6% from a year ago. Prices were up strongly in all local markets in the metro area.

- Half the homes in January 2024 were off the market in 19 days or fewer. The median days on market is 3 days quicker than last year.

- Overall, there were 3,519 active listings at the end of the month, which is 1.8% lower than a year ago. Inventory is less than half of what it was in 2019. There has been a dearth of new listing activity across the Baltimore area, as current homeowners are staying on the sidelines, holding onto low mortgage rates.

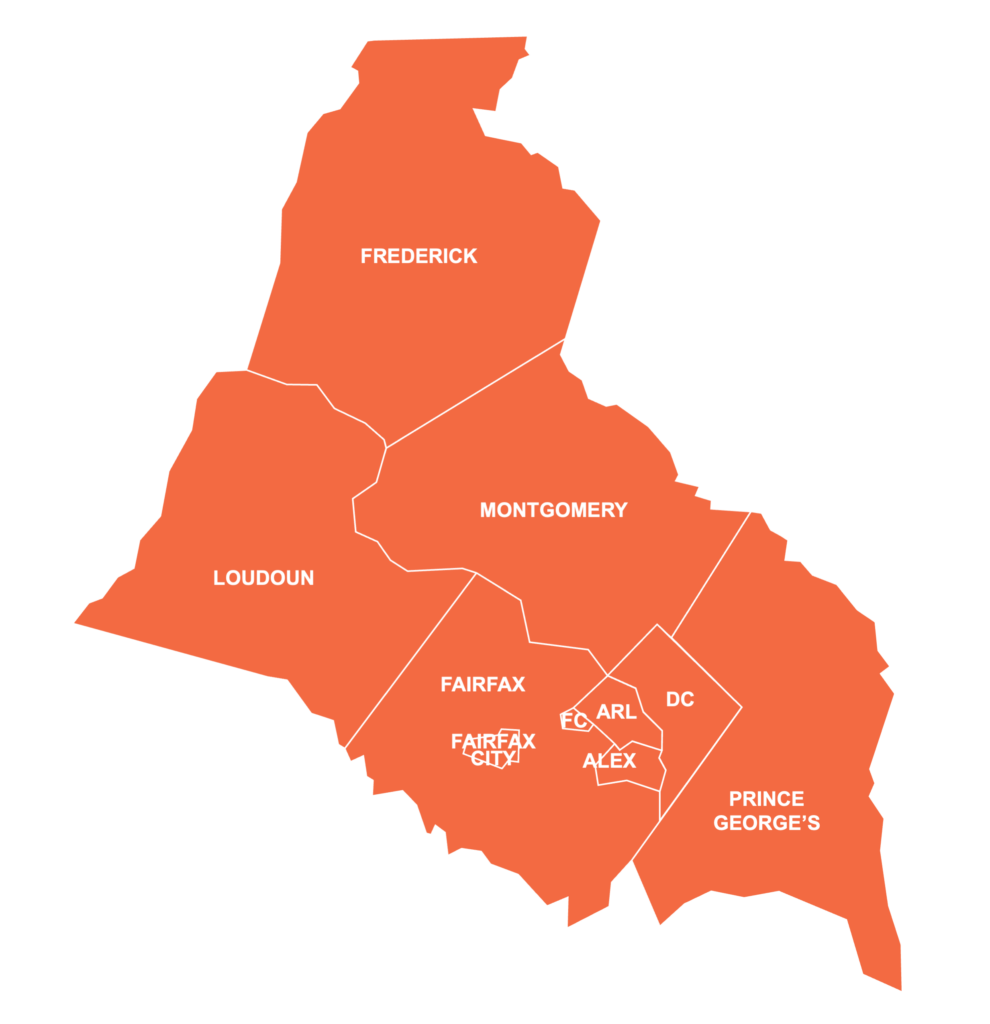

No. 3: Washington, D.C.—Buyers Undeterred by High Prices and Elevated Rates

Median price growth started strong in 2024, with an increase of 7% in the famed U.S. capital.

- Closed sales inched above last year, increasing a slight 0.2% compared to January 2023. Despite affordability challenges, there remains a strong desire for homeownership in the Washington, D.C. metro.

- In January, the median sold price in the Washington, D.C. metro was $535,000, rising 7.0% year-over-year. Prices in the region have been rising steadily since last summer and the median price is now 29% higher than it was in January 2019.

- Showing activity and new pending sales were lower in January than they were last year. Elevated rates have tempered some demand yet the major constraint on the Washington D.C. metro area housing market is a lack of inventory.

- There was a total of 4,930 active listings at the end of January, down 4.8% compared to a year ago. New listing activity has been at historically low levels, as current homeowners remain on the sidelines, holding onto their low mortgage rate.

Buyers will look to smaller and more affordable Mid-Atlantic markets, accelerating price growth in areas like Philadelphia, Central Pennsylvania, and the Maryland–West Virginia Panhandle.

Price growth may slow even more in 2024 as inventory rises, but there are no indications that prices will drop in Bright MLS markets.

To read the full report, including more data, charts, and methodology, click here.