As Valentine’s Day approaches, singles are yet again reminded of the advantages of having a significant other.

But the same goes for homeownership, as a new Point2 study revealed that the time needed to save for a home purchase differs for single Americans and couples.

Key Highlights:

- In 50 of the country’s 100 largest cities, single people need two to 9 decades to save up enough to cover the difference between what the bank will lend them and the price of a starter home.

- In five cities, individuals would require just a few more months than couples to save up and become homeowners: buying solo in Ohio’s Toledo and Cleveland, Detroit, St. Louis, and Memphis, TN, wouldn’t take much longer than buying together.

- Singles in 13 major cities—including Philadelphia, Indianapolis, and Baltimore—could afford a mortgage equal to at least 80% of the local starter home price. Couples have this chance in 79 out of 100 cities.

- It’s hard to see homebuying through heart-shaped glasses in California, but relationship status might make a lifetime of difference in savings. With a partner, it can take around 30 years to comfortably bridge the gap between an affordable loan and the cost of a starter home. Doing it alone can take a daunting 50 years more.

In a housing market characterized by sky-high pricing, limited supply, and the nearly nonexistent concept of a starter home, singles have had it tough trying to attain homeownership. It may take a single person in America’s largest cities up to six years longer than a couple to save money for an entry-level home because the typical starter home price has more than doubled in the last 20 years.

It takes a lot of money to save up the amount that a bank loan doesn’t cover, especially for individuals who manage their own budgets.

In the report, Point2 revealed the highest-priced mortgage that could be financed with this in mind, considering the wages of both people and couples.

In just a few more months than couples, single homebuyers in thirteen cities are able to finance an 80% mortgage and save up the remaining balance.

However, it takes much longer for single people to save money for an entry-level home than it does for couples, particularly in large cities.

For example, it takes an average of 2.5 years for single people and 2 years for couples nationwide to close the $177,260 first home price difference between an affordable loan and a starter home.

However, research showed that a partner would not significantly boost homeownership savings in other cities, particularly in the more reasonably priced Midwest, where starter home prices are a portion of the national median.

One-third of the nation’s largest cities have mortgages that are more than half of the starting cost of a starter home in the area. Additionally, 13 of them allow a single individual to pay an 80% mortgage, which means that the remaining money may be saved and budgeted for in less than three years and six months.

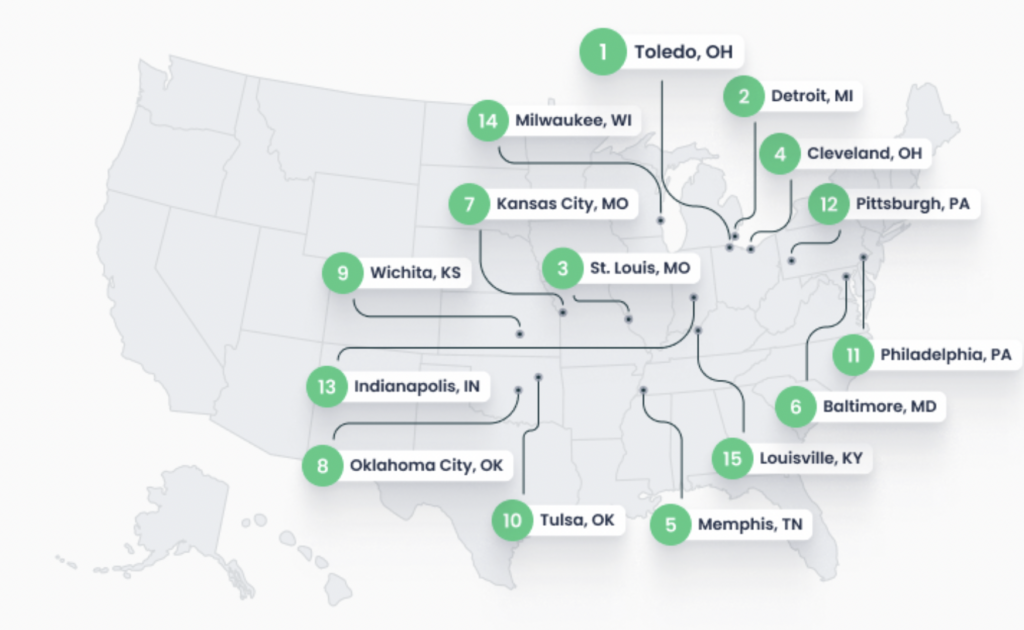

Single vs. Couples: Top 10 Cities With the Smallest Difference in Years Needed to Save for a Home

- Toledo, OH (the difference in time to save: 9 months)

- Detroit (10 mos)

- St. Louis (11 mos)

- Cleveland (11 mos)

- Memphis, TN (1 year)

- Baltimore (1 year 1 month)

- Kansas City, MO (1 year 6 mos)

- Oklahoma City (1 year 6 mos)

- Wichita, KS (1 year 7 mos)

- Tulsa, OK (1 year 8 mos)

According to the 50/30/20 rule, a single person may need to save money for a family of two in Toledo, OH, Detroit, MI, St. Louis, and Cleveland in just nine to 11 months longer than that of a married couple. Single homebuyers in Memphis, TN, Baltimore, Kansas City, MO, or Oklahoma City would need to save up to 1.5 years longer than couples in the same areas in order to fund the gap between a bank loan and the cost of a starter house.

These are the same cities where people would need to save the least amount of money to become homeowners on their own: less than two years in Toledo, Detroit, and St. Louis, and 2 to 3 years in Memphis, TN, Baltimore, Kansas City, MO, and Oklahoma City, as well as in Cleveland and Wichita, KS.

Saving Up for Homeownership in California Could Take a Lifetime

In eight cities, an estimated 20% income set aside for singles puts them 40 years or older behind couples.

Determining someone’s likelihood of purchasing a home depends a lot on the conditions of the local housing market. An individual in Arlington, Virginia, for example, earns twice as much as a couple in Laredo, Texas.

Still, it would take more than eight years for a single Arlington, VA resident with a reasonable mortgage to save the $146,600 needed for a $409,700 starting home. A Laredo couple, however, can pay the $39,440 required for a $137,200 entry-level house in half the time.

And if the Midwest and Southeast can offer hope to solo homeowners, then California’s single population needs all the assistance it can get.

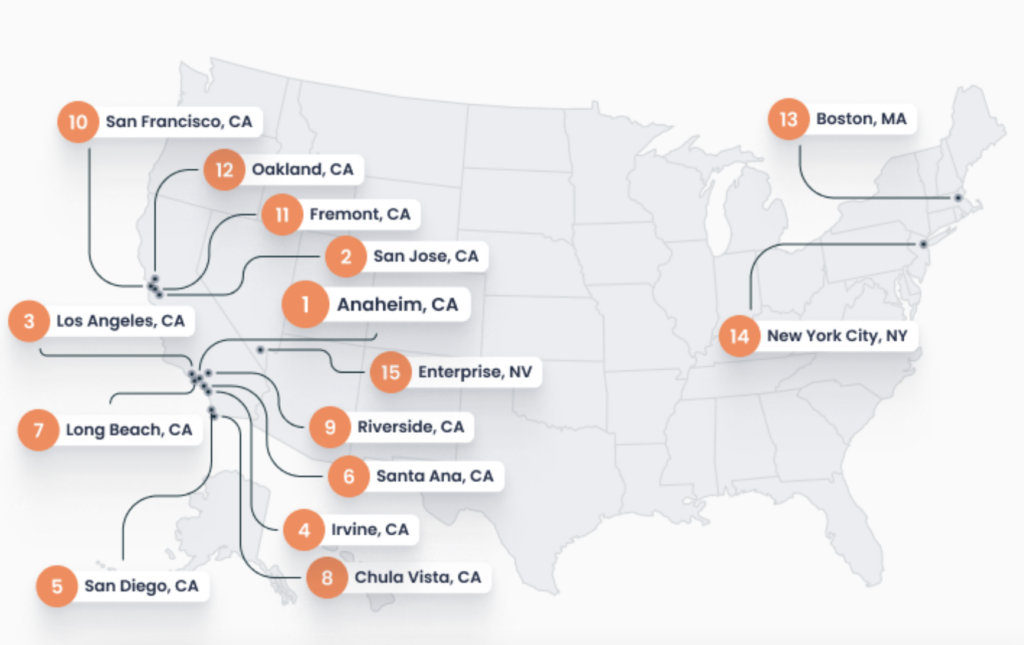

Single vs. Couples: Top 10 Cities With the Largest Difference in Years Needed to Save for a Home

- Anaheim, CA (the difference in time to save: 57 years 11 mos)

- San Jose, CA (56 years 6 mos)

- Los Angeles (53 years 3 mos)

- Irvine, CA (44 years 11 mos)

- San Diego (42 years 11 mos)

- Santa Ana, CA (42 years 5 mos)

- Long Beach, CA (42 years 3 mos)

- Chula Vista, CA (40 years 10 mos)

- Riverside, CA (39 years 5 mos)

- San Francisco (37 years 11 mos)

Major markets in the Golden State disagree with single first-time homeowners. While Fresno is the fastest large city here to save money on one’s own, it’s still a big deal—in a major California city, it can take over twenty years to save 20% of the $33,500 median income and cover the lowest remaining deficit for an individual.

Anaheim, where an attainable mortgage for an individual is only 8% of the starting home price, is the city where saving is slowest for single people. This indicates that a sizeable chunk of the $702,900 price of an entry-level house is represented by the amount that still must be saved.

According to the 50/30/20 rule, San Jose single homebuyers are also as unfortunate: since the mortgage only covers 11% of the $920,000 starting property price, it may take them about 75 years to save up 20% of their income to meet the depressing $819,000 amount that is still required.

Purchasing a home alone in Los Angeles is challenging, even with the unexpectedly lower starting home price. After taking out the bank’s maximum acceptable loan, you will need to budget five times as much as a couple in order to cover the remaining balance.

Although purchasing a property with someone has historically been linked to romantic or married couples, non-romantic homebuying partnerships are on the rise as a result of the severe housing market conditions.

The reason for this is the same: having two salaries allows you to save more quickly and increases your chances of getting approved for a mortgage. However, it also makes a larger, more expensive home necessary.

In the most expensive housing market since the early 1980s, economic considerations have had a noticeable impact on home purchases. Budgeting will and has become a priority that everyone can relate to, and big life decisions like choosing to live a single, fulfilling life or raising a family become less important or are temporarily placed on the back burner.

To read the full report, including more data, charts, and methodology, click here.