According to a new Redfin survey, an estimated 26.1% of low-priced U.S. homes that sold in Q4 were purchased by real estate investors. That number is up from 24% a year ago and represents the biggest share on record.

In comparison, investors bought 15.9% of high-priced homes that sold and 13.6% of mid-priced homes that sold (compared to 14.3% and 15.4% a year earlier).

The same reason homebuyers are drawn to affordable homes also attracts investors to them: their lower expenses, which are particularly alluring when both house prices and borrowing costs are high. Additionally, there may be more opportunity for value rises in the lower price range, which would mean more opportunity to develop equity when housing affordability is this tight.

In Q4, investor purchases consisted of 46.5% of all low-priced properties (compared to 47.2% a year earlier), some 24.6% of mid-priced properties (compared to 26.4% a year earlier), and 28.8% of high-priced properties (compared to 26.5% a year earlier).

“I get tons of emails every day from investors looking for properties, but of course, they only want homes that are under market value, which are hard to come by. When they find those properties, they pile in,” said Carrie Caruthers, a Redfin Premier Real Estate Agent in Riverside County, CA. “I’ve recently seen an uptick in foreclosures, which investors are interested in because they often sell at a discount. I just sold one foreclosed house to an investor for $400,000. It probably would’ve sold for around $500,000 if it hadn’t been a foreclosure, but the investor got a deal because foreclosure purchases come with risks.”

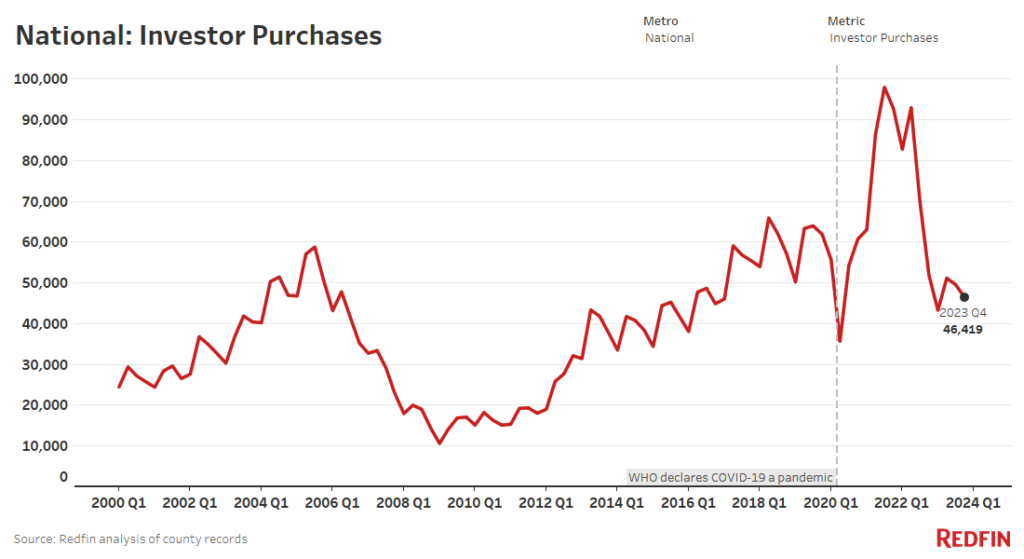

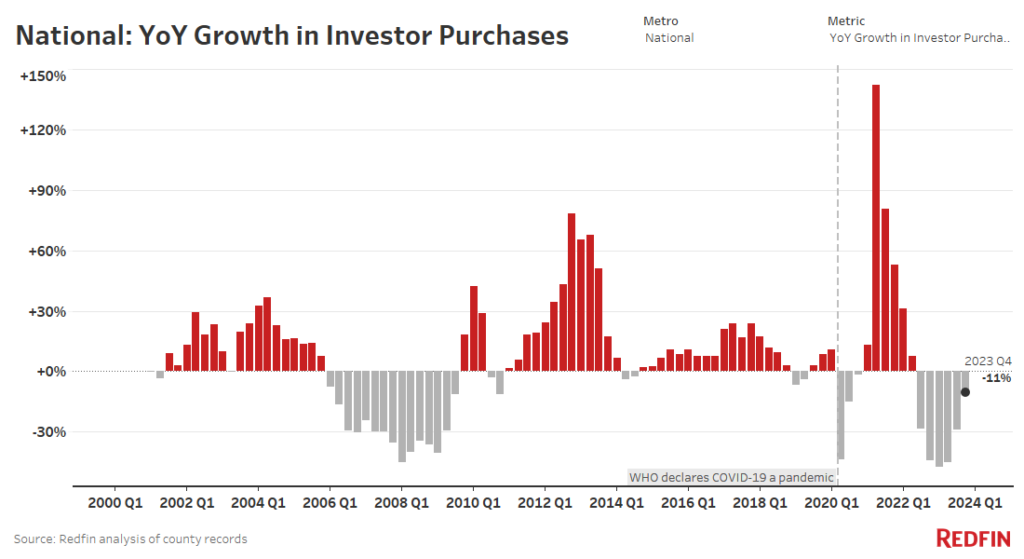

Overall Investor Home Purchases Dropped 11% in Q4

The number of homes in the U.S. purchased by investors in Q4 dropped 10.5% year over year to 46,419, the lowest since 2016. The overall decrease in U.S. house purchases was significantly bigger, coming in at 251,462, down 12.2% from the previous quarter and the lowest since 2012.

The decline in investor home purchases can be blamed, in part, to the more costly nature of investment due to high interest rates, increasing home prices, and a weak rental market. Some investors have moved their capital to safer and more lucrative alternatives, such Treasury bonds. However, Florida and California Redfin agents reported that there is still a high demand for homes among investors.

“There are a lot of investors out there fighting for properties,” said Juan Castro, a Redfin Premier Real Estate Agent in Orlando, FL, which posted the third largest drop in investor purchases in the country last quarter. “There just aren’t enough properties to go around, which is putting a cap on how many homes investors can buy.”

While most homeowners stayed put to keep the extremely low mortgage rate they were able to secure during the pandemic, the overall availability of homes for sale in the U.S. decreased 5.1% year-over-year in December and remained far below pre-pandemic levels.

Due to a small increase in U.S. home prices, the average home bought by investors in Q4 cost $453,271, up from $426,573 a year earlier. In sum, investors purchased $32.3 billion worth of property in the U.S., a slight decrease from $33.6 billion the previous year.

Investors Purchases Didn’t Fall Nearly as Fast as They Did Last Year

Q4 experienced a 10.5% reduction in investor home purchases, representing the sixth consecutive year-over-year decline. However, that is the smallest decrease since investor purchases began to decline in Q3 of 2022 and is modest compared to the 44.1% decline in the previous year.

As the shock of high mortgage rates has worn off and the U.S. economy has proven to be more resilient than many had anticipated, the decrease in investor purchases has moderated.

“It’s too early to say that investor purchases have hit a bottom, but they’re unlikely to shoot up like they did during the pandemic anytime soon,” said Sheharyar Bokhari, Redfin Senior Economist. “That’s because borrowing costs and home prices remain high, the number of homes available to buy remains low and rents remain lackluster. If the Fed cuts interest rates later this year as expected, we may see more investors wade into the housing market.”

Investors Bought Nearly 1 of Every 5 Homes That Sold in Q4

An estimated 18.5% of U.S. properties that sold in Q4 were purchased by investors, up from 18.1% in Q3 of last year. They did not retreat as quickly as individual homebuyers, thus their market share probably increased marginally.

Single-Family Homes Represented Over Two-Thirds of Investor Purchases

In Q4, approximately 68.6% of investor purchases were single-family homes (compared to 68.8% a year earlier). The next greatest share was made up of townhouses (7.1% vs. 8% a year earlier), multifamily properties (5.1% vs. 5.3% a year earlier), and condos/co-ops (19.2% vs. 17.9% a year earlier).

Metro-Level Highlights: Q4 2023 Investor Activity

Cities where investor purchases increased the most from a year earlier include:

- Riverside, CA (+25%)

- Chicago (+20.9%)

- San Jose, CA (+18%)

Cities where investor purchases decreased the most:

- Cincinnati (-28.8%)

- Providence, RI (-27.7%)

- Orlando, FL (-26.5%)

Where Investors Bought the Highest/Lowest Share of Homes That Sold:

The highest share of homes that sold was in Miami, where investors bought 31.5% of homes, followed by Jacksonville, FL (25.6%) and Anaheim, CA (25.5%).

The lowest share of homes that sold were in Providence, RI (9.9%), Warren, MI (10.1%), and Montgomery County, PA (10.2%).

Where The Share of Homes Bought By Investors Increased/Decreased Most From A Year Earlier:

In Sacramento, CA, investors bought 21.5% of homes that sold, up 4.6 percentage points from a year earlier, followed by San Diego (+4.6 ppts) and Riverside (+4.3 ppts), representing the highest share of homes.

The biggest decreases were in the popular Atlanta (-3 ppts), Orlando (-2.7 ppts), and Miami (-2.5 ppts) metros.

To read the full report, including more data, charts, and methodology, click here.