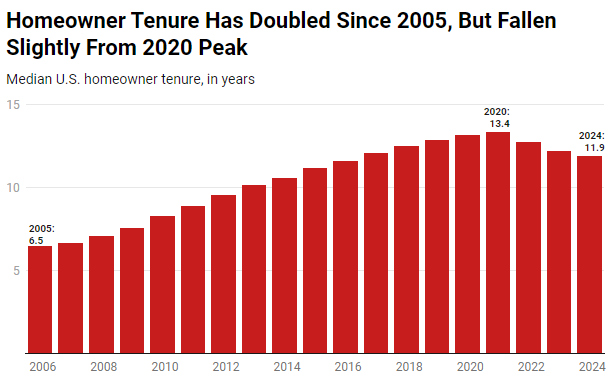

In the U.S., the average homeowner has lived in their house for 11.9 years, compared to 6.5 years some two decades earlier, according to Redfin’s latest market report. The average homeowner’s tenure has decreased since 2020, when the pandemic sparked a moving frenzy when it peaked at 13.4 years.

Baby Boomers Aging in Place, Driving Homeowner Tenure Upward

Longer homeowner tenure is largely due to older Americans staying in their homes. Approximately 40% of baby boomers have spent at least 20 years in the home they currently own, and another 16% have done so for 10 to 19 years. Over one-third (35%) of Gen Xers have spent at least 10 years in the house they now own.

Due in part to their younger age and the fact that they change employment more frequently than previous generations, millennials tend to live in their homes for shorter lengths of time. Of millennials, less than 7% have lived in their present home for ten years or more, 13% for five to nine years, and 30% for fewer than five years.

Given that the oldest Gen Zer was 26 in 2023, it makes sense that the majority of Gen Zers who own a home have owned it for less than five years.

For many reasons, baby boomers and Gen Xers have a disproportionate influence on general housing-market patterns. First, the aging of the American population as of 2020, 17% of Americans were 65 years of age or older, up from 13% in 2010. Second, they are more likely to be homeowners. Compared to 55% of millennials and 26% of Gen Zers, nearly 80% of baby boomers and 72% of Gen Xers are homeowners.

Where Homeowner Tenure is the Longest, Shortest

Homeowners stay put longest in California. The typical Los Angeles homeowner has lived in their home for 18.7 years, followed by 17.8 years in San Jose, CA. Next come Cleveland, OH (17.4), San Francisco (16.7) and Memphis, TN (16.5). Californians tend to hold onto their homes for a long time partly because they’re incentivized to do so by Proposition 13.

Homeowners move most often in relatively affordable metros, mostly in the South. Tenure is shortest in Louisville, KY (7.4 years) and Las Vegas (8). Next come Nashville, TN, Charlotte, NC and Raleigh, NC, which each have a median tenure of 8.5 years. Tenure is shorter in those metros partly because they have been popular migration destinations over the last few years, which means a lot of homes have changed hands recently.

Other Reasons Homeowner Tenure Has Increased Since the Early 2000s:

- Older Americans are hanging onto their homes because they’re financially incentivized to do so. Most (54%) baby boomers who own homes own them free and clear, with no outstanding mortgage. For that group, the median monthly cost of owning a home–which includes insurance and property taxes, among other things–is just over $600.

- Nearly all boomers who do have a mortgage have a much lower rate than they would if they sold and bought a new home with today’s 7%-ish rates.

- Some state tax systems have policies that make it financially beneficial for people to stay in their homes as they get older. Texas homeowners over 65 can defer property taxes until the home is sold, and in California, Proposition 13 limits property-tax increases.

- Many older Americans prefer aging in their family home rather than moving to a different house or entering an assisted-living facility: Nearly 9 in 10 Americans between 50 and 80 years old said in a recent survey it’s important to stay in their homes as they get older. And with medical and tech advancements, it’s increasingly possible to do so.

- It was cheap and easy to move in the early 2000s. More people than usual were able to get mortgages and buy homes because mortgage-lending standards were loose, which ultimately led to the subprime mortgage crisis.

Americans Holding Onto Their Homes Contributing to U.S. Inventory Shortage

People who stay in their houses longer tend to do so because there are fewer properties for sale and high housing costs, which in turn causes a shortage of inventory and higher prices.

Longer homeownership, especially among baby boomers, presents a barrier for young first-time purchasers attempting to enter the market. Baby boomers who are empty-nesters own twice as many three-bedroom plus homes as millennials who have children, according to a recent Redfin analysis. While some young families are renting homes, others are choosing to new construction.

Homeowner Tenure Fell 1.5 years From 2020 Peak, Expected to Remain Flat

Because of the pandemic-induced moving frenzy and historically low mortgage rates, homeowner tenure has decreased marginally every year since 2020. In 2021, more properties were sold than in any previous year since 2006.

Redfin predicts that, going forward, homeowner tenure will either remain the same or somewhat rise. Since many homeowners were trapped in by low mortgage rates, existing-home sales last year fell to a 15-year low. This year, sales should increase somewhat, but more like a trickle than a flood.

To read the full report, including more data, charts, and methodology, click here.