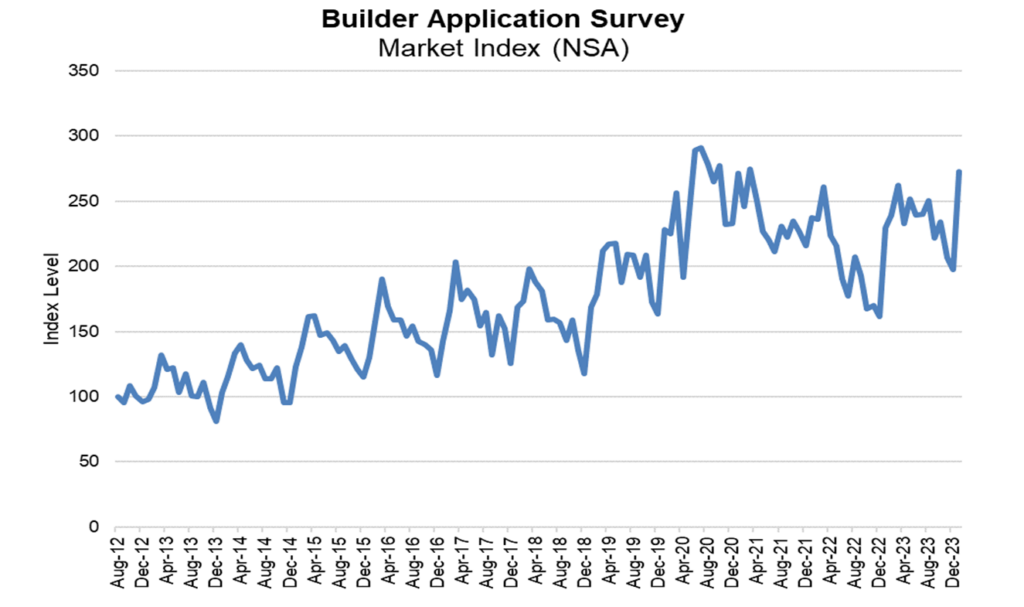

According to new data from the Mortgage Bankers Association‘s (MBA) Builder Application Survey (BAS) for January 2024, there was a 19.1% rise in mortgage applications for the purchase of new homes over the previous year. In December 2023, there was a 38% rise in applications.

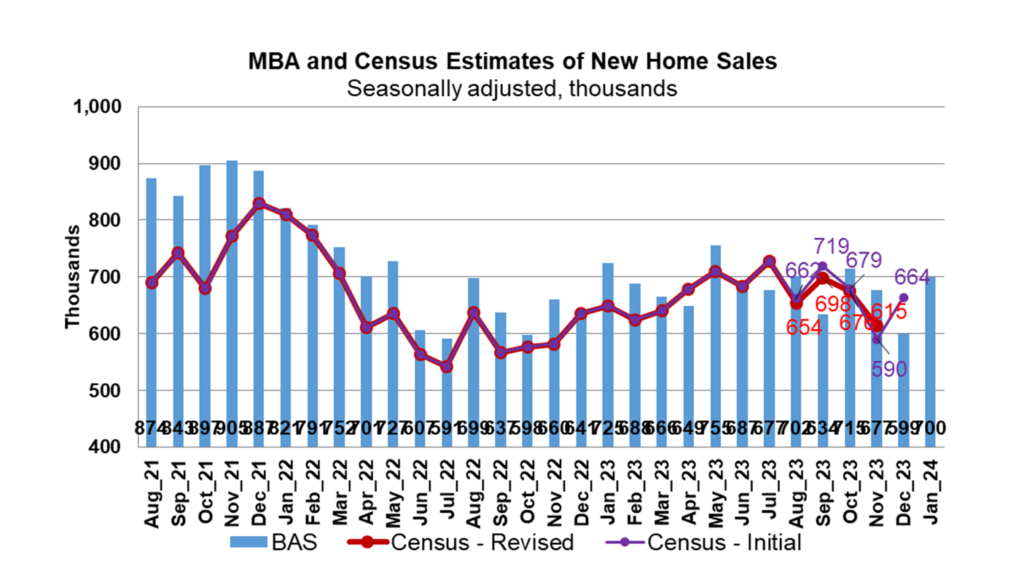

According to MBA estimates, new single-family home sales in January 2024 were running at a seasonally adjusted annual pace of 700,000 units. These sales have continuously been a leading indication of the U.S. Census Bureau’s New Residential Sales report.

“Applications for new home purchases were strong in January, as newly built homes remained an attractive option for prospective homebuyers who looked to take advantage of lower mortgage rates during the month,” said Joel Kan, MBA’s VP and Deputy Chief Economist. “Applications were up 19 percent from a year ago—the 12th consecutive annual increase—and the non-seasonally adjusted index was the strongest January reading in the survey’s history. The seasonally adjusted annualized pace of new home sales was 700,000 units, the highest sales pace since October 2023.”

According to MBA, the total number of new single-family home sales in January 2024 was 700,000 units, a seasonally adjusted annual rate. This number continues to be a leading indicator of the U.S. Census Bureau’s New Residential Sales report.

In January, the seasonally adjusted estimate is higher by 16.9% compared to the December rate of 599,000 units. MBA projects that, on an unadjusted basis, there were 63,000 sales of new homes in January 2024, up 37% from 46,000 sales in December.

Conventional loans accounted for 64.5% of loan applications by product type, followed by FHA loans (24.8%), RHS/USDA loans (0.4%), and VA loans (10.3%). In December, the average loan amount for new homes was $405,368; in January, it was $401,282.

To read the full report, including ore data, charts, and methodology, click here.