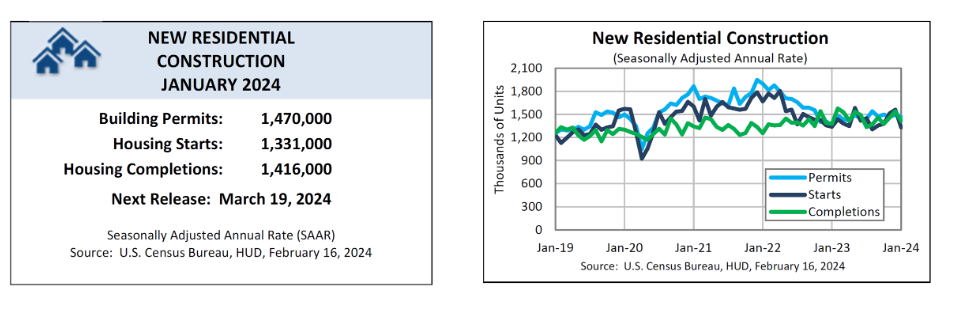

New residential construction statistics reported by the U.S. Census Bureau and the U.S. Department of Housing & Urban Development (HUD) for January 2024 found privately‐owned housing starts at a seasonally adjusted annual rate of 1,331,000, 14.8% below the revised December 2023 estimate of 1,562,000, and 0.7% below the January 2023 rate of 1,340,000.

Single‐family housing starts in January were at a rate of 1,004,000, 4.7% below the revised December 2023 figure of 1,054,000. The January rate for units in buildings with five units or more was 314,000.

“Single-family starts declined 4.7% to a seasonally adjusted annualized rate (SAAR) of one million in January, while both November and December single-family starts were revised modestly upward, according to the Census Bureau,” said Doug Duncan, Chief Economist at Fannie Mae. “The January drop was expected, as starts had previously surged in November to a pace that appeared unsustainable, and had only partially pulled back in December. Furthermore, a portion of this decline was likely due to the severe winter weather seen across the country in January, following unseasonably warm weather in December. More indicative of the underlying construction trend, single-family permits rose 1.6% to a SAAR of 1.02 million, continuing a recent trend of gradual increases. With single-family permits and starts now more closely aligned, we expect a gradual increase in both series over the coming months.”

HUD and the Census Bureau reported that privately‐owned housing units authorized by building permits in January were at a seasonally adjusted annual rate of 1,470,000—1.5% below the revised December 2023 rate of 1,493,000, but 8.6% above the January 2023 rate of 1,354,000. Single‐family authorizations in January were at a rate of 1,015,000—1.6% above the revised December figure of 999,000. Authorizations of units in buildings with five units or more were at a rate of 405,000 in January.

“Single-family permits, a leading indicator of future starts, reached the highest level since May 2022,” added First American Deputy Chief Economist Odeta Kushi. “This is consistent with the latest builder survey, which shows an increase in builder sentiment and future sales expectations. The uptick in single-family permits suggests cautious optimism on the part of builders, and suggests that the single-family market is poised for growth. Single-family completions decreased 16% compared with last month, and was also down 16% from one year ago.”

National Association of Home Builders (NAHB) Chief Economist Robert Dietz noted, “Multifamily construction is forecasted to post a large decline in 2024 as the number of units currently under construction is near the highest level since 1973. Meanwhile, single-family production, which is currently running at a one-million-unit annual rate, is roughly in line with builder sentiment that remains right below a breakeven level, according to our latest surveys. We are forecasting single-family starts to post a modest gain in 2024 as mortgage rates moderate on expected interest rate cuts by the Federal Reserve later this year.”

HUD and the Census Bureau also found that privately‐owned housing completions in January were at a seasonally adjusted annual rate of 1,416,000—8.1% below the revised December estimate of 1,541,000, but 2.8% above the January 2023 rate of 1,377,000. Single‐family housing completions in January 2024 were at a rate of 857,000—16.3% below the revised December 2023 rate of 1,024,000. The January rate for units in buildings with five units or more was 538,000.

The latest NAHB/Wells Fargo Housing Market Index (HMI), gauging builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor,” found builder confidence in the market for newly built single-family homes up four points to 48 in February, marking the highest level since August 2023.

“The improvement in builder sentiment has been driven by the gradual decline in mortgage rates since the fall of last year,” added Kushi. “Additionally, builders continue to benefit from a lack of resale inventory. They also can offer incentives, such as mortgage rate buydowns or even price cuts, to entice buyers. When there are no suitable existing homes for sale, a new home at the right price can be a good alternative.”

Multifamily housing starts dipped to a near-four-year low in January, falling 35.6% to a seasonally adjusted annualized rate of 327,000.

“Multifamily starts plummeted in January, falling 35.6% to a SAAR of 327,000, the lowest level since May 2020,” said Duncan. “The multifamily starts series is typically very volatile, thus a sharp movement in one month should be taken with caution, especially given that the drop followed a jump of 31.6% in December. However, looking at the big picture, weaker rent growth and a large number of expected multifamily completions this year will likely weigh on new multifamily construction going forward, which appears to be supported by the 7.9% decline in multifamily permits seen in January.”