The traditional American dream of homeownership continues despite some challenging years in the housing market. Most Americans believe that owning a home is still attainable, but for many would-be homebuyers, it depends on an interest rate reduction to less than 6%, according to a recent Realtor.com survey.

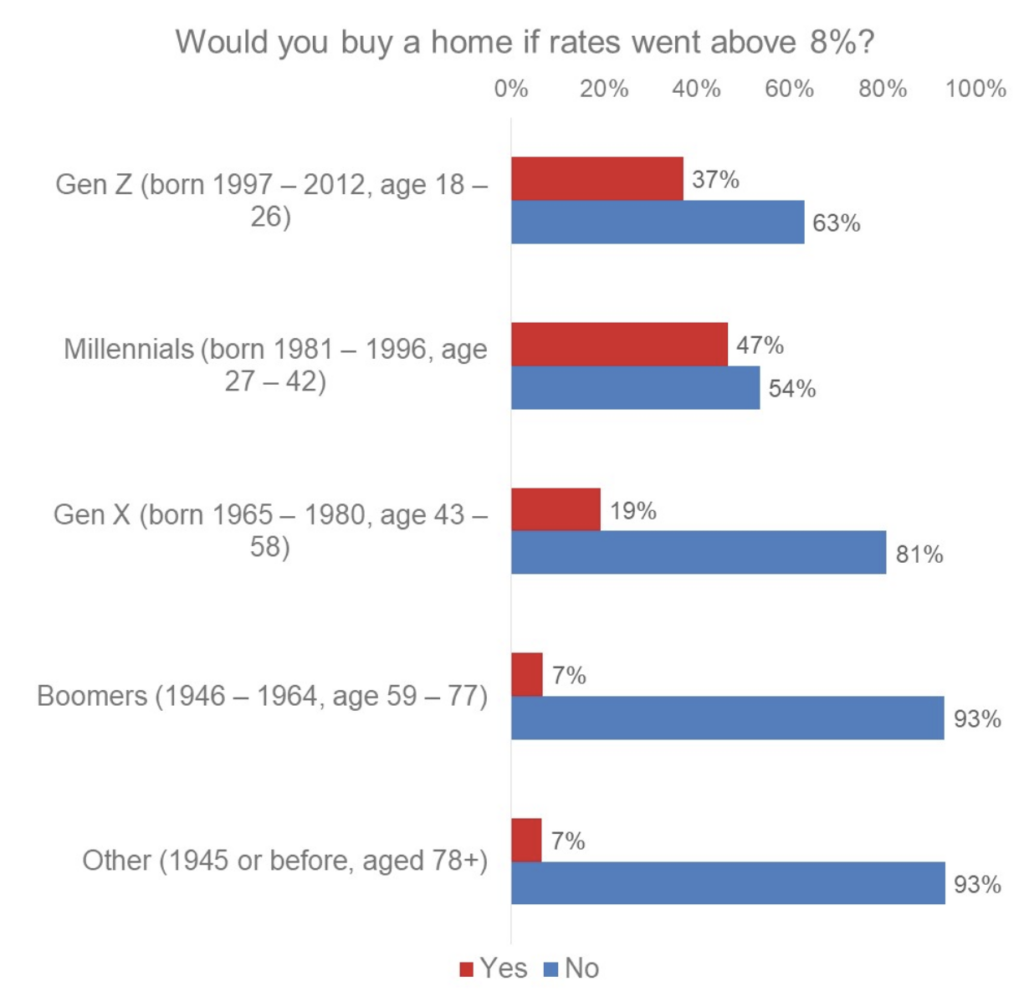

While most generations share this opinion, Millennials and Gen Z respondents indicate they would be slightly more flexible, with nearly half (47%) and 37%, respectively, saying they would still buy a home if rates rose over 8%.

“The current market is very different from where it was before the pandemic, but many Americans still have a positive outlook towards achieving the dream of buying a home,” said Danielle Hale, Chief Economist at Realtor.com. “This optimistic lens may shape the way younger shoppers in particular view mortgage rates. Although mortgage rates are up from a year ago, they have declined more than a percentage point from their recent peak. While some home shoppers and sellers are likely holding out for even lower rates, the improvement in affordability as rates fall has already ushered in an uptick in listings and contract signings.”

Lower Interest Rates Are the Key for Hopeful Homebuyers

Although many Americans still want to buy a home, they are waiting for mortgage rates to decrease in order to make that happen. If interest rates fall below 6%, four out of ten Americans who plan to purchase a home in the next year would think it is feasible.

Most notably, some 18% of aspiring homeowners believe that purchasing is doable if the mortgage rate falls below 7%—a barrier that was exceeded in late 2023; another 22% of consumers believe they can purchase if the rate falls below 6%; 32% would enter the market if rates dropped below 5%; an additional 18% are searching for mortgage rates below 4%; and the remaining 9% of respondents are unsure of what rate would enable them to purchase.

According to Realtor.com’s 2024 Housing Forecast, rates are not expected to fall below 6.5%, but research indicates that every half-percentage point decrease in the mortgage rate results in a $120 monthly payment reduction for the average home for sale. This translates into annual savings of $1,400 and $43,000 over the course of a 30-year mortgage.

Millennials and Gen Z Remain Positive About Homeownership

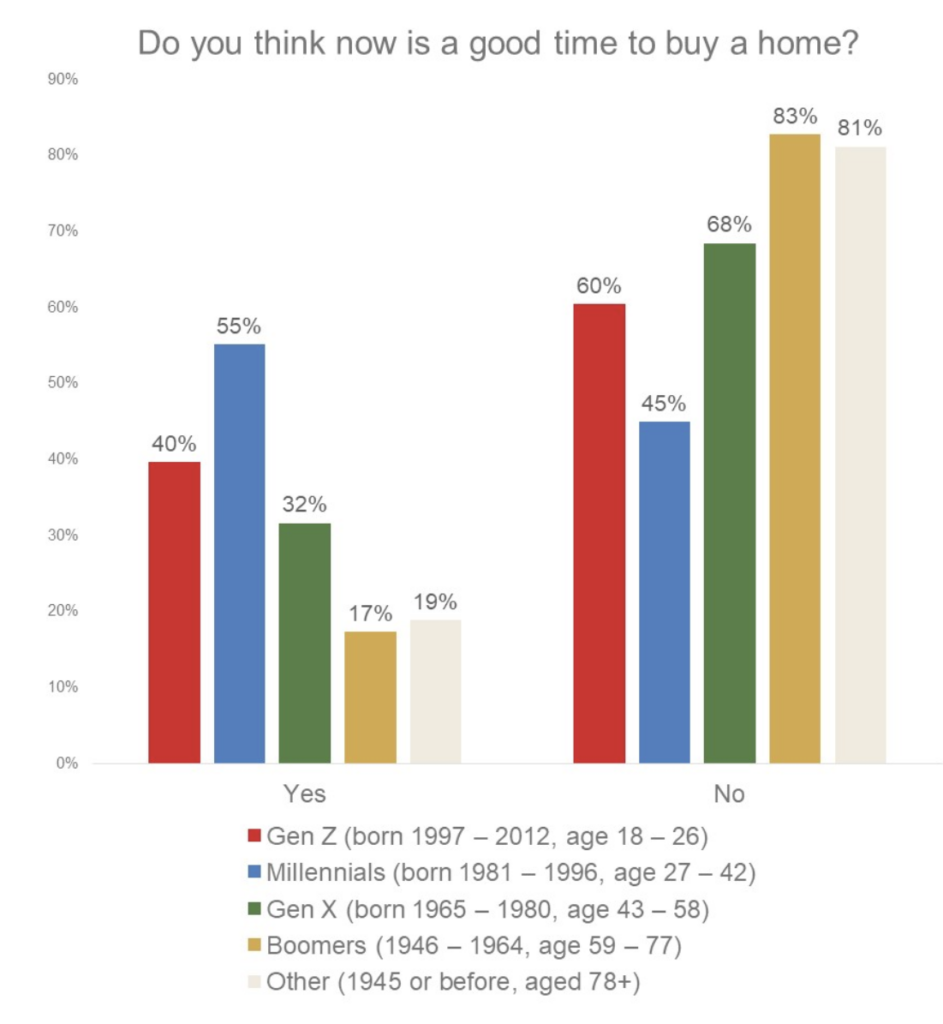

It’s evident that Millennials and Gen Z are more optimistic than previous generations about purchasing a home in the current market. A majority of Millennials (55%) and Gen Zers (40%) believe that the current market is favorable for purchases. In contrast, only 17% of Boomers and 32% of Gen X agree.

Similarly, 43% of Millennials believe they will be able to afford to buy a home within the next year, compared to around 20% of Gen Zers and Xers and only 13% of boomers. Millennials are also the most enthusiastic about being able to afford to buy a home in the very near future. Despite making up only 4% of all homebuyers, Gen Z is the most optimistic generation for the somewhat distant future, as well as being bullish right now, according to the National Association of Realtors (NAR).

“Over the last year the real estate market has made it feel less than possible for Americans to achieve the dream of owning a home,” said Mickey Neuberger, CMO of Realtor.com. “Given the reality of our current environment we are seeing an inspiring level of optimism shine through, indicating that not only is the dream alive, it’s something that the American people are still working towards, and believe they can achieve.”

To read the full report, including more data, charts, and methodology, click here.