According to the National Association of Realtors (NAR), in January, existing-home sales improved. Sales increased in the Midwest, South, and West of the four main U.S. regions, while they remained stable in the Northeast. Sales in the West increased year-over-year while falling in the Northeast, Midwest, and South.

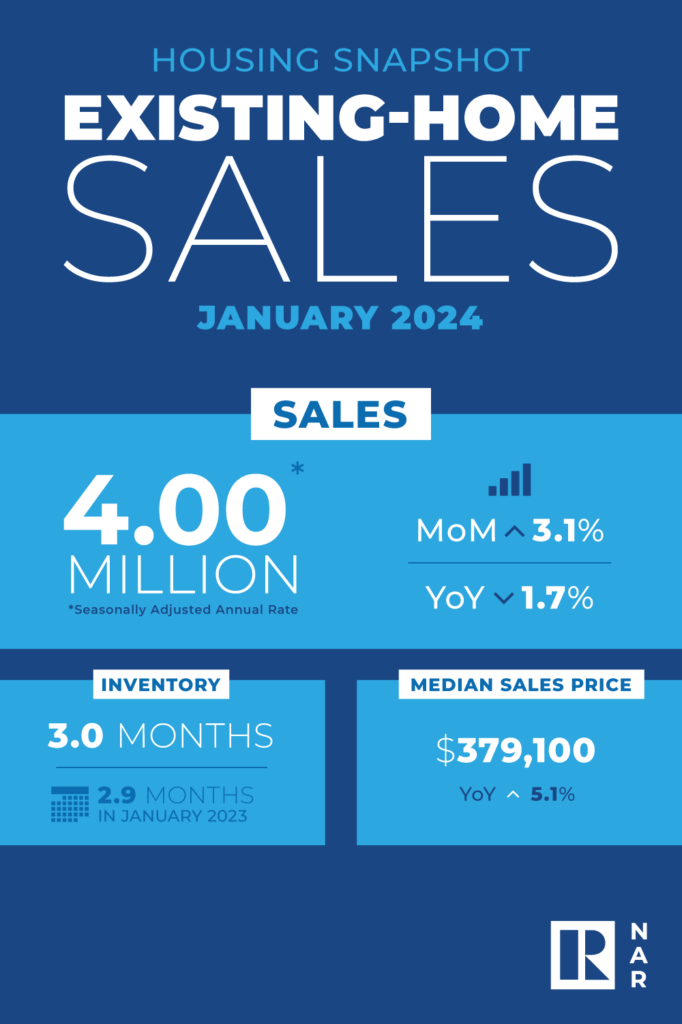

Completed transactions that included single-family homes, townhomes, condominiums, and co-ops represent total existing-home sales, which jumped 3.1% from December to a seasonally adjusted annual rate of 4.00 million in January. Sales decreased 1.7% from the previous year (from 4.07 million in January 2023).

“While home sales remain sizably lower than a couple of years ago, January’s monthly gain is the start of more supply and demand,” said Lawrence Yun, Chief Economist for NAR. “Listings were modestly higher, and home buyers are taking advantage of lower mortgage rates compared to late last year.”

As of February 15, the 30-year fixed-rate mortgage averaged 6.77%, according to Freddie Mac, representing an increase from 6.32% a year ago and 6.64% the previous week.

At the end of January, there were an estimated 1.01 million units in the total housing inventory, up 3.1% from a year earlier and 2% from December. At the current sales pace, unsold inventory is sitting at a 3.0-month supply, representing an increase from 2.9 months in January 2023 apart from a decrease from 3.1 months in December.

All property types combined had a median existing-home price of $379,100 in January, up 5.1% from the previous year ($360,800). Overall, price increases were reported in all four U.S. regions.

“The median home price reached an all-time high for the month of January,” said Yun. “Multiple offers are common on mid-priced homes, and many homes were still sold within a month. The elevated share of cash deals—32%—indicated a market full of multiple offers and propelled by record-high housing wealth.”

National Association of Realtors Confidence Index Highlights:

- The average time a property spent on the market in January was 36 days, up from 29 days in December and 33 days in January 2023, according to the monthly Realtors Confidence Index.

- In January 2023, an estimated 28% of sales were made by first-time buyers, a decrease from 29% in December and 31% in January 2023. According to NAR’s 2023 Profile of Home Buyers and Sellers, which was published in November 2034, 32% of buyers were first-time buyers annually.

- Some 32% of transactions in January were all-cash purchases, which is an increase from 29% in December and the same month last year.

- A significant portion of cash sales, made up primarily of individual investors or second-home buyers, bought 17% of properties in January 2023 compared to 16% in December and January 2023.

- Distressed sales—including short sales and foreclosures—accounted for 2% of sales in January, essentially remaining the same from the previous month and year.

Single-Family and Condo/Co-Op Sales Overview:

Single-family home sales increased to a seasonally adjusted annual pace of 3.6 million in January, down 1.4% from the previous year but up 3.4% from December’s 3.48 million sales. January had a 5.0% increase in the median price of an existing single-family home to $383,500 from January 2023.

Existing condo and cooperative sales in January were 4.8% lower than a year earlier (420,000 units), and they were unchanged from the previous month at a seasonally adjusted annual rate of 400,000 units. With a 5.7% increase from $321,100 in January of the previous year, the median price of an existing condo was $339,400.

Regional Breakdown: Existing-Home Sales

Sales of existing homes in the Northeast were down 5.9% from January 2023, but were steady from December at 480,000 units. In the Northeast, the median price was $434,300, a 10.1% increase over the previous year.

The Midwest saw a 2.2% increase in existing-home sales from the previous month, with an annual pace of 950,000 in January—a decrease of 3.1% from the previous year. In the Midwest, the median price was $271,700, a 7.6% increase from January 2023.

The South had a 4.0% increase in existing-home sales from December to an annual rate of 1.84 million in January, down 1.6% from the prior year. In the South, the median price was $345,100, a 4.1% increase over the previous year.

In the West, existing-home sales increased 2.8% from a year ago and by 4.3% from a month ago to reach an annual rate of 730,000 in January. In the West, the median price was $572,100, a 6.3% increase from January 2023.

“More listings will help Americans move,” said Kevin Sears, President of NAR and Broker-Partner of Sears Real Estate in Springfield, MA. “That’s why NAR has pushed for the passage of H.R. 1321—The More Homes on the Market Act—which would lower the tax hit on home sales and bring additional inventory to the market.”

To read the full report, including more data, charts, and methodology, click here.