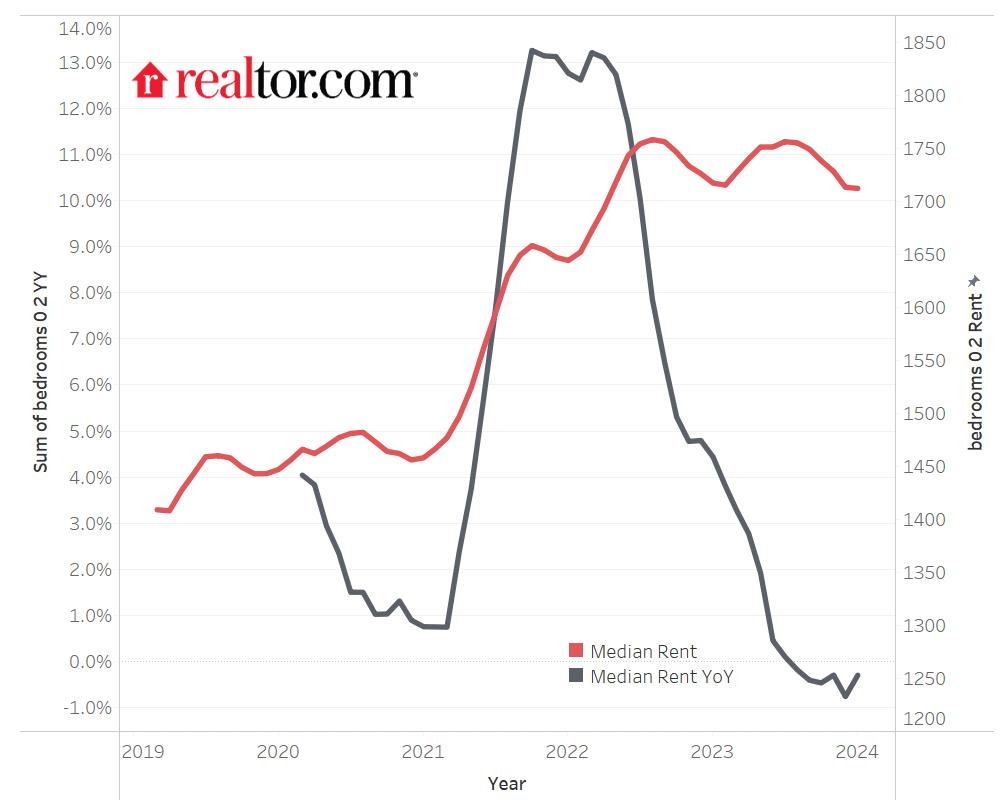

In January, rents decreased for the sixth consecutive month, with year-over-year prices declining by -0.3%, according to Realtor.com’s monthly Rental Report.

Renters are somewhat relieved by this, but prices are still higher than they were before the pandemic because of such high demand and a shortage of new apartments in many areas.

Key Findings: January 2024 Rental Report

- January 2024 marks the sixth year-over-year rent decline in a row for 0–2-bedroom properties observed since trend data began in 2020. Asking rents dipped by $5 or -0.3% year-over-year.

- The median asking rent in the 50 largest metros decreased to $1,712, down by $1 from last month and down $46 from its August 2022 peak.

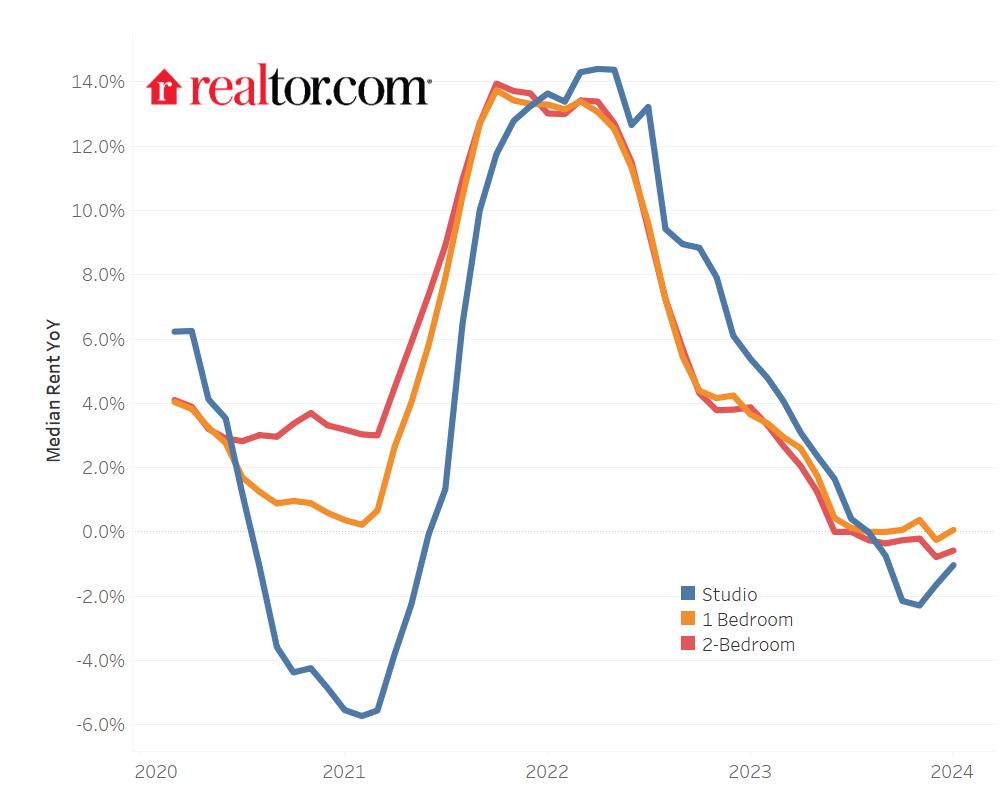

- Median rent was mixed across size categories: Studio: $1,434, down $15 (-1.0%) year-over-year; 1-bed: $1,591, up $1 (0.1%) year-over-year; 2-bed: $1,892, down $11 (-0.6% ) year-over-year.

- Regionally, median asking rents in western big metros such as Los Angeles (0.2%) and Seattle (1.3%) started to rebound on a yearly basis while major Northeastern areas continued to see growth. Rents in the Midwest continued to grow (0.2%) while rents in the South continued to drop year-over-year (-1.2%).

According to the Realtor.com Avail Landlord & Renter Survey, the number of landlords planning to increase rent in the upcoming year has declined in the last few quarters. Even still, costs have increased by an estimated 18.3% in the past four years.

Different unit sizes have different median rentals. Regionally, some large Western metro areas started to recover as the South saw a decrease in prices due to an excess supply of new multifamily housing units.

“Rental prices are declining, especially in places where new units are entering the market, but there’s still plenty of demand driven by the large population of renters, including potential first-time homebuyers who remain on the sidelines for now,” said Danielle Hale, Chief Economist at Realtor.com. “Looking forward, Realtor.com anticipates the rental market to decline only slightly in 2024, as an increase in the supply of new units is balanced out by continued enthusiasm for renting as a more affordable alternative to purchasing.”

Studio Apartments Experienced the Largest Rent Declines

While 3.8% less than its October 2022 record, the median asking rent for studios dropped by 1.0% to $1,434, making it 11.9% more than it was four years prior. Two-bedroom unit asking rents dropped to $1,892 (-0.6%).

However, over the previous four years, rent costs increased by $321 (20.4%) in those larger units. In the meantime, one-bedroom apartment asking rentals have increased to $1,591 in January, marking a 0.1% annual increase after falling since July 2023. The idea that one-bedroom apartments represent a sweet spot in the market—much roomier than a studio and more reasonably priced than a two-bedroom unit—might be driving demand for these flats.

Large Western Metros Start to See Rebound

The West saw a decrease in median rent in January 2024 of -0.3% from the previous year, with decreases primarily in Phoenix (-4.0%), Riverside, CA. (-2.6%), and Las Vegas (-1.8%). However, after eight consecutive months of fall, rents increased year over year in certain major metro areas, including Los Angeles (0.2%) and Seattle (1.3%).

Many first-time buyers are opting to rent instead of purchase because property values are still high and mortgage rates are predicted to stay high in the near future. Large Northeastern metros with robust labor markets and sluggish new home supply development—such as New York (2.3%) and Boston (2.7%)—have higher rent growth rates.

Rents Growing in Midwest Markets, Dropping in the South

In January, asking rents increased by 0.2% in the Midwest, propelled by places like Indianapolis (3.5%), Chicago (4.2%), and Kansas City, Mo. (3.1%). These areas continue to be reasonably priced when compared to other regions of the nation, and they benefit from low unemployment, which increases demand for rentals.

At $1,852, Chicago’s typical rent is over $1,000 cheaper than that of its big-city rivals, New York ($2,844) and Los Angeles ($2,829). In the meantime, the South had a 1.2% decrease in the median asking rent, with Memphis (-5.5%), TN, Atlanta (-3.8%), and Austin, Texas (-3.6%), seeing the biggest year-over-year drops. The popular Miami metro (-3.4%) and St. Louis (-3.6%) also experienced significant price declines. While the South has low unemployment rates, as more multifamily homes become available, rental costs will continue to decline.

To read the full report, including more data, charts, and methodology, click here.