A Decade of Data Driven Decisions

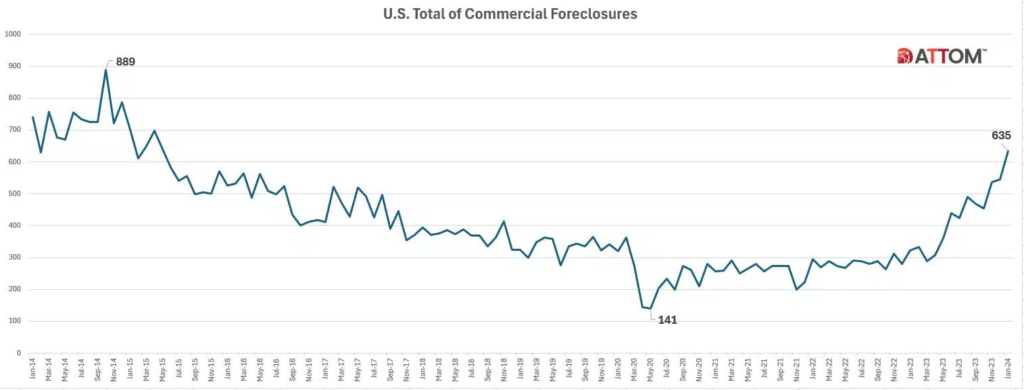

According to a new ATTOM report, the number of commercial foreclosures has increased significantly in recent years, rising from 141 in May 2020 to 635 in January 2024—indicating a consistent rise over the period.

When ATTOM began analyzing data in January 2014, the U.S. was just starting to emerge from the shadows of economic uncertainty, with 740 commercial foreclosures nationwide. ATTOM monitored changes during the ensuing ten years, with the greatest peak occurring in October 2014 with 889 foreclosures, a sign of the continuous corrections and adjustments in the market.

But the trajectory was not a steady course. Market flexibility was impressive in the face of obstacles like the COVID-19 pandemic and shifting economic policies. Foreclosures saw a spike during the pandemic, but as companies adjusted to the changing market conditions, there was a noticeable stability in the months that followed.

To illustrate the early effects of the COVID-19 epidemic and the quick reaction measures that followed, such as financial relief and moratoriums, the U.S. recorded 141 commercial foreclosures in May 2020, a considerable low. In sharp contrast to the 2020 low, business foreclosures had skyrocketed to 635 by January 2024.

“This uptick signifies not just a return to pre-pandemic activity levels but also underscores the ongoing adjustments within the commercial real estate sector as it navigates through a landscape transformed by evolving business practices and consumer behaviors,” said Rob Barber, CEO at ATTOM.

State-by-State Commercial Foreclosures

California saw roughly 209 foreclosures in January 2014. The state’s dynamic economic condition was reflected in the variations in the foreclosure statistics, despite a subsequent drop. With 181 commercial foreclosures in January 2024, California had the most of any state in the nation. This was an increase of 174% from the previous year and 72% over the previous month.

Over the course of the decade, there was notable variation in the foreclosure rates of New York, Texas, New Jersey, and Florida, as the distinct economic structure of each state had a role. In January 2024, for example, there were 59 commercial foreclosures in New York—an estimated 12% decline from the previous month and a 12% decrease from a year earlier.

To read the full report. Including more data, charts, and methodology, click here.