The latest S&P Dow Jones Indices (S&P DJI) CoreLogic Case-Shiller index for December 2023 showed that 17 out of the top 20 metropolitan areas reported month-over-month price decreases.

On a year-over-year basis, the S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 5.5% annual gain in December, up from a 5.0% rise in the previous month. The 10-City Composite showed an increase of 7.0%, up from a 6.3% increase in the previous month. The 20-City Composite posted a year-over-year increase of 6.1%, up from a 5.4% increase in the previous month.

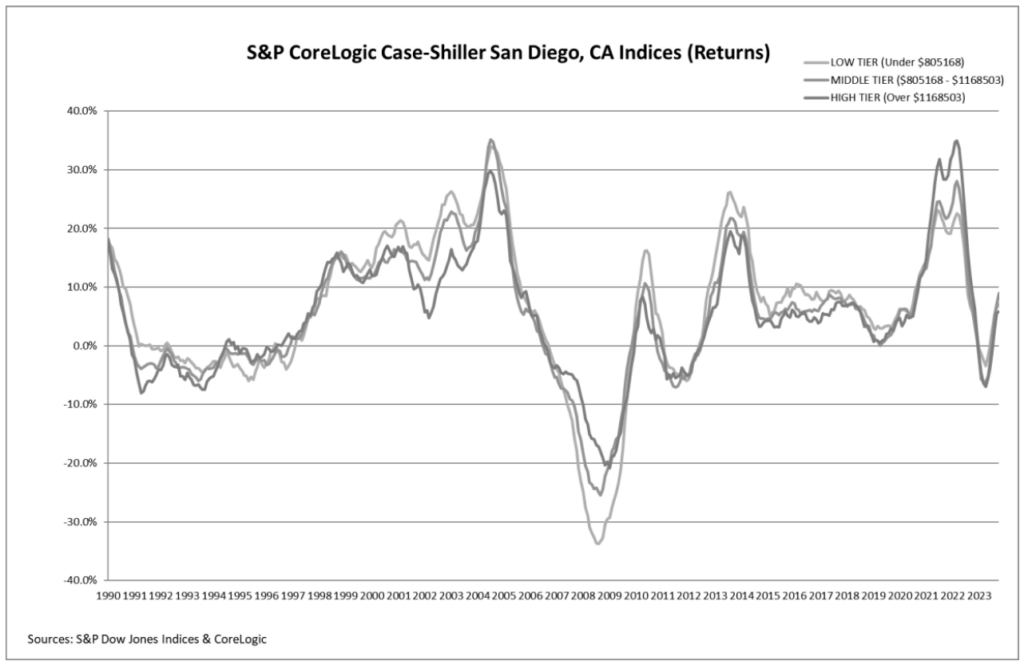

Looking at a few cities in particular San Diego reported the highest year-over-year gain among the top-20 cities with an 8.8% increase in December. San Diego was followed by Los Angeles and Detroit, who both posted an 8.3% increase. Portland posted a small gain, 0.3%, the lowest ranking city that saw an increase.

On a monthly basis, the U.S. National Index showed a continued decrease of 0.4%, while the 20-City Composite and 10-City Composite posted 0.3% and 0.2% month-over-month decreases respectively in December.

After seasonal adjustment, the U.S. National Index, the 20-City Composite, and the 10-City Composite all posted month-over-month increases of 0.2%.

Case-Shiller Commentary from Brian D. Luke, S&P Dow Jones Indices

“U.S. home prices faced significant headwinds in the fourth quarter of 2023,” says Brian D. Luke, Head of Commodities, Real & Digital Assets at S&P Dow Jones Indices. “However, on a seasonally adjusted basis, the S&P Case-Shiller Home Price Indices continued its streak of seven consecutive record highs in 2023. Ten of 20 markets beat prior records, with San Diego registering an 8.9% gain and Las Vegas the fastest rising market in December, after accounting for seasonal impacts.”

“2023 U.S. housing gains haven’t followed such a synchronous pattern since the COVID housing boom. The term ‘a rising tide lifts all boats’ seems appropriate given broad-based performance in the U.S. housing sector. All 20 markets reported yearly gains for the first time this year, with four markets rising over 8%. Portland eked out a positive annual gain after 11 months of declines. Regionally, the Midwest and Northeast both experienced the greatest annual appreciation with 6.7%.”

“Looking back at the year, 2023 appears to have exceeded average annual home price gains over the past 35 years. With trend growth at the national level of 4.7%, a 5.5% return demonstrates solid, steady growth. While we are not experiencing the double-digit gains seen in the previous two years, above-trend growth should be well received considering the rising costs of financing home mortgages. We previously suggested that the surge in home prices during the COVID pandemic could have accelerated home ownership temporarily. The past two years reflect consistent growth slightly above trend, suggesting a more secular shift in home ownership post pandemic. In the short term, meanwhile, we should be able to measure the impact of higher mortgage rates on home prices. Increased financing costs appeared to precipitate home price declines in the fourth quarter, as 15 markets saw lower values compared to September.”

Commentary from Dr. Lisa Sturtevant, Bright MLS

Bright MLS Chief Economist Dr. Lisa Sturtevant had the following comments on today’s release of the S&P CoreLogic Case-Shiller Home Price Inde

“The S&P CoreLogic Case-Shiller Home Price Index showed that U.S. home prices posted their second consecutive month of declines, with the December 2023 index dropping by 0.4% compared to November. This is the biggest monthly decline since January 2023. Home prices are still increasing on a year-over-year basis, with the index up 5% over the 12-month period from December 2022 to December 2023. All metros report positive year-over-year price growth in December, but more than half reported declines between November and December.”

“The most recent Case-Shiller index reflects market performance at the end of last year, but there is evidence that market conditions are changing. For example, price indices were down by 0.8% in San Diego and by 0.9% in San Francisco between November and December, but were still rising year-over-year in both metros. According to Bright MLS analysis of Altos Research data, these California metros are seeing some of the fastest growth in new listings, which could put downward pressure on prices.”

“Although there is evidence that more sellers are dropping their list price, the markets with the share of price drops are highly concentrated in Florida, according to our analysis. Of the 10 U.S. metros with the highest share of listings with a price drop, eight are located in Florida. (Fresno, Calif., and Phoenix, Ariz., are the other two.)”

“The December 2023 Case-Shiller index for Miami indicates very strong price growth at the end of the year, but that could shift this spring. Similarly, prices are down modestly month-to-month in Tampa, according to the December 2023 Case-Shiller index, but nearly half of all listings currently on the market have had a price drop, according to Bright MLS’s analysis of Altos Research data.”

“Overall, the U.S. median home price will likely rise in 2024, but there will be a lot of variation, which will be strongly correlated with supply—both new construction and the inventory of existing homes for sale.”

Commentary from Hannah Jones, Realtor.com

Realtor.com Sr. Economic Research Analyst Hannah Jones also commented on the report:

“Pending home sales gained ground in December, improving 8.3% relative to November and 1.3% relative to a year prior. Surging new home sales, which are also a measure of contract signings, up 8.0% in December, as well as falling mortgage rates, thawed buyer activity. Many buyers, faced with limited existing home inventory, have pivoted to new construction options, which have grown to 31.2% of total inventory.”

“Though for-sale inventory remains scarce, new listing activity picked up 9.1% nationally in December, which pushed overall for-sale inventory 4.9% higher than a year prior. Mortgage rates fell through the end of 2023, lifting expectations for the 2024 housing market. However, recent inflation data emphasized that the path to 2% inflation is likely to be long, and mortgage rates leveled out in the 6.6 – 6.7% range in January.”

“Pending home sales improved most significantly in the West with a 14.0% improvement relative to November, followed by the South (+11.9%) and the Midwest (+5.6%). All three of these regions also saw contract signings pick up relative to one year prior, ranging from 1.5% year-over-year in the South and West to 4.3% in the Midwest. The Northeast was the only region to see declining contract signings with a drop of 3.0% month-over-month and 3.9% year-over-year.”

“Pending home sales or contract signings measure the first formal step in the home sale transaction, namely, the point when a buyer and seller have agreed on the price and terms. Pending home sales tend to lead existing-home sales by roughly one-to-two months and are a good indicator of market conditions.”

“Recovering pending home sales activity emphasizes the impact of a small win in affordability, namely lower mortgage rates. Buyers who are currently priced out of the market are eagerly awaiting progress, which could come in the form of lower mortgage rates, more for-sale options, or lower prices.”

“Though an uptick in buyer activity is promising, seller activity may not respond as quickly. If for-sale inventory isn’t able to soak up buyer demand, it is possible that prices will start to climb once again. Inventory is likely to remain low, which will keep home prices high, underlining the importance of mortgage rate improvement for increasing home sales.”

Click here to see the report in its entirety.