A new analysis from Realtor.com has found that the U.S. housing market is still missing up to 7.2 million homes, the result of more than a decade of underbuilding relative to population growth.

“The U.S. is in a long-term housing shortage with the construction of new homes failing to keep pace with a growing population. While a recent uptick in new construction has the potential to alleviate the historically low level of homes for sale on the market today, it’s going to take some time to close the gap,” said Danielle Hale, Chief Economist at Realtor.com. “That said, the elevated level of both single- and multi-family construction coming to market this year is likely to put downward pressure on rent prices in many markets, welcome news for renters. It also means that the higher than usual share of new homes for sale is likely to continue, giving home shoppers willing to consider new homes more options.”

Household Formation Outpaces Single-Family Home Construction

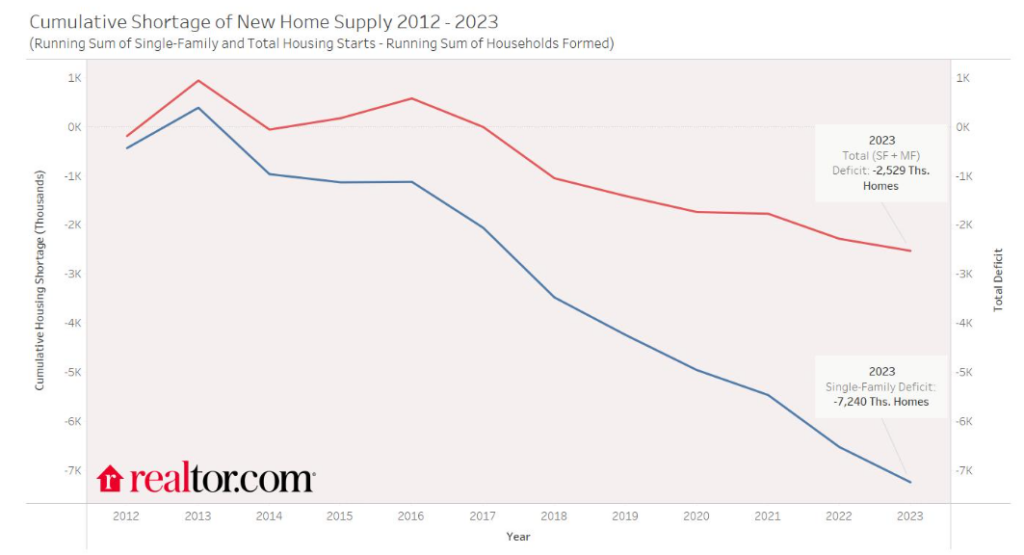

In 2023, Realtor.com reported that there was an additional 1.7 million households formed, resulting in a total of 17.2 million new households between 2012-2023. Homebuilders started construction on 947,200 single-family homes and 472,700 multi-family homes in 2023, bringing the 2012 to 2023 overall housing starts total to 14.7 million homes, roughly 10 million of which were single-family. The gap between single-family housing starts and household formations grew from 6.5 million at the end of 2022 to 7.2 million at the end of 2023 as household formations remained steady and single-family home construction waned. Though the gap widened, it was the third smallest single-year gap between households and housing starts since 2016.

“While the Fed’s fight against inflation is building progress, the lingering inflation challenge is housing inflation,” said National Association of Home Builders (NAHB) Chief Economist Robert Dietz at the recent NAHB International Builders Show in Las Vegas. “Shelter inflation—rent and homeownership costs—are still rising at a 5.4% rate, and for the past year, more than half of overall inflation in the economy has been shelter inflation. The only way to tame shelter inflation, and get overall inflation lower, is to build more housing.”

As household formations outpaced housing starts in 2023, the overall gap between household formations and total housing starts, including single- and multi-family homes, widened from 2.3 million housing units between 2012 and 2022 to 2.5 million units at the end of 2023.

And according to the latest report from Fannie Mae’s Economic and Strategic Research Group (ESR), existing home sales and new single-family housing starts are expected to grow modestly in 2024, amid lower mortgage rates and increasing homebuyer sentiments. The ESR’s latest report found that while housing affordability is still seriously constrained following the home price run-up of the past few years, the supply of existing homes available for sale is ultimately showing recent signs of loosening.

Affordable New For-Sale Inventory Begins Recovery

Realtor.com reports that in 2022, just 38% of new homes were sold for less than $400,000, however, in 2023, this share increased to 43%, indicating a shift toward more affordability in the new construction space. Many builders offered price cuts and other incentives in 2023 to prompt home sales and also focused on smaller units, which likely led to this progress in affordability.

At the metro-level, some areas have seen outsized household growth relative to permitting activity. Looking at just the gap between single-family permits and household formations reveals that permitting activity has lagged household growth in 73 of the top 100 metros in the U.S. The metros with the largest single-family gap include San Antonio-New Braunfels, Texas; Austin-Round Rock, Texas; and Deltona-Daytona Beach-Ormond Beach, Fla. The top 10 list of metros by size of gap relative to population includes three Texas metros, five Florida metros, and two Washington metros. Many of these areas have seen significant population growth because of their affordable cost of living and overall desirability.

Who Are Today’s New Construction Buyers?

Realtor.com has also released the findings of its New Construction Consumer Report, a survey of recent new home buyers that looked into their motivations and buying behaviors.

The report found that the typical new construction buyer today skews younger, wealthier and more pet friendly compared to non-new home buyers. While new construction buyers were previously more likely to be Boomers, today it’s millennials; among respondents who bought new construction in the past 12 months, nearly half (48%) were millennials. Despite skewing younger, most surveyed new construction buyers are experienced home purchasers, and 75% had previously owned a home. New home buyers are also more likely to be higher income earners, with more making between $100,000–200,000 versus non-new home buyers (30% compared to 22%).

Location Is a Draw for New Buyers

When it comes to the appeal of new homes, buyers purchased first for its newness, followed by customizability and resale value. Price is a top concern for new home shoppers, but location matters most; 28% of new construction respondents placed location above price (24%) as their prime initial consideration factor. When choosing a builder, their reputation rounded out the top three most important factors, and mattered to potential buyers almost as much as price and location. In fact, early half of surveyed buyers (48%) said they considered a builder’s reputation and ratings as part of their selection criteria, scoring higher than the ability to customize and the timing/availability of the home. Repeat customers are top future customers too; 91% of recent buyers say they’d purchase a new construction home again.