Amid rising inflation, interest rates, home prices, and living expenses, an increasing share of renters are looking into new housing options that better fit their budgets at the beginning of 2024, according to a new RentCafe study.

The Sunbelt states, renowned for their pleasant weather and business-friendly atmospheres, have historically drawn a sizable number of tenants, with Miami being the most popular rental market. But the Midwest began to draw greater attention in the first few months of 2024, earning seven slots in the top 20 rental markets in the U.S.

The Northeast and Florida—both very far behind—left their marks with four slots in the top 20.

Key Findings:

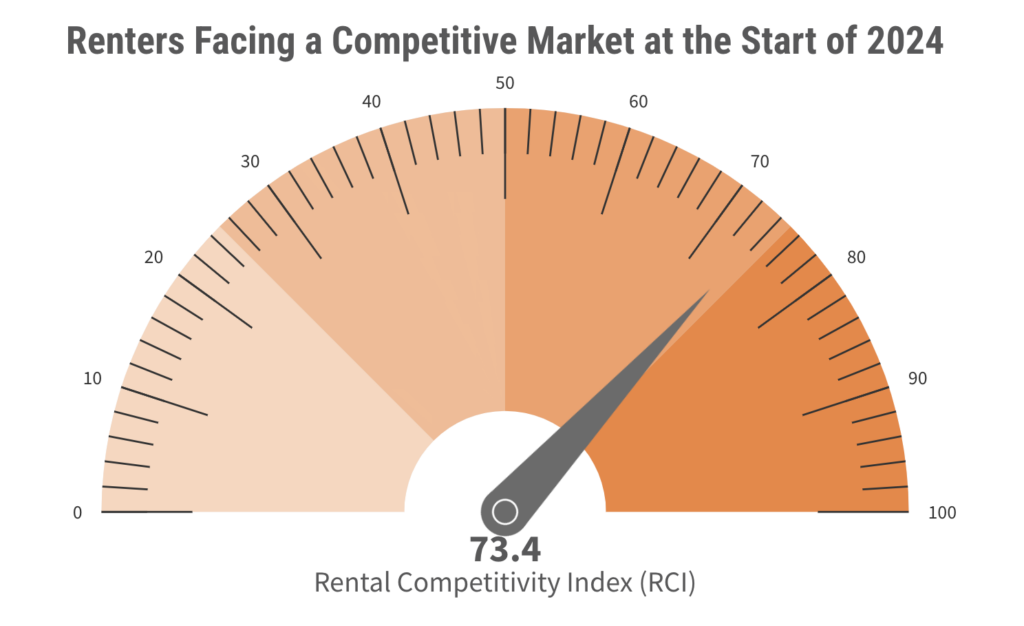

- The national competitivity score stands at 73.4 out of 100 in early 2024, with vacant apartments finding occupants within 41 days, on average.

- Miami kicks off the year as the hottest rental market in the U.S., with its thriving economy attracting professionals and intensifying the competition for apartments.

- The Midwest’s shift from its “Rust Belt” past to tech and manufacturing has heightened its rental competitivity, particularly in Milwaukee.

- Rising living costs, remote work, and high demand from students and faculty staff are heating up the competition in undersupplied college towns, including Fayetteville, AR, which leads the pack.

Renters Face a Competitive Market at the Start of 2024

In most markets, the number of days until vacant units are occupied has increased. The large share of new apartments that have opened during the last three years continue to have an impact on some important factors in RentCafe’s analysis. This indicates that, compared to the previous year, the U.S. rental market is more relaxed than it was at the beginning of 2024.

The increased amount of time it takes to fill a typical apartment is the most obvious difference. More specifically, as newly constructed apartments account for 0.67% of all housing supply, unoccupied flats now remain unoccupied for 41 days—as opposed to 38 days at the beginning of 2023—on average. In contrast, only 0.43% of all rental apartments in the U.S. were new a year ago.

This resulted in a decline in the total U.S. occupancy rate, which currently stands at 93% as of early 2024 compared to 94.2% a year earlier. The report showed that even if they had more options, more apartment dwellers chose not to move in the first few months of 2024 because it’s the off-rental season. Consequently, the overall rate of lease renewals was 61.5%, higher than the 60.7% share of lease renewals at the beginning of 2023.

Compared to the end of 2023, some 61% of the 66 major markets that RentCafe examined have less competition. Similarly, compared to the last quarter of 2023, competition is less fierce in nearly 47% of the 73 small markets examined. The most common trend is an increase in the number of days that empty apartments stay on the market.

Top 10 Most Competitive Rental Markets at the Start of 2024:

- Miami-Dade, FL (RCI: 91.9)

- Milwaukee (87.0)

- North Jersey, NJ (85.4)

- Suburban Chicago, IL (85.3)

- Grand Rapids, MI (84.5)

- Oklahoma City (82.8)

- Bridgeport-New Haven, CT (82.7)

- Cincinnati (82.4)

- Lansing-Ann Arbor, MI (82.3)

- Orlando, FL (81.4)

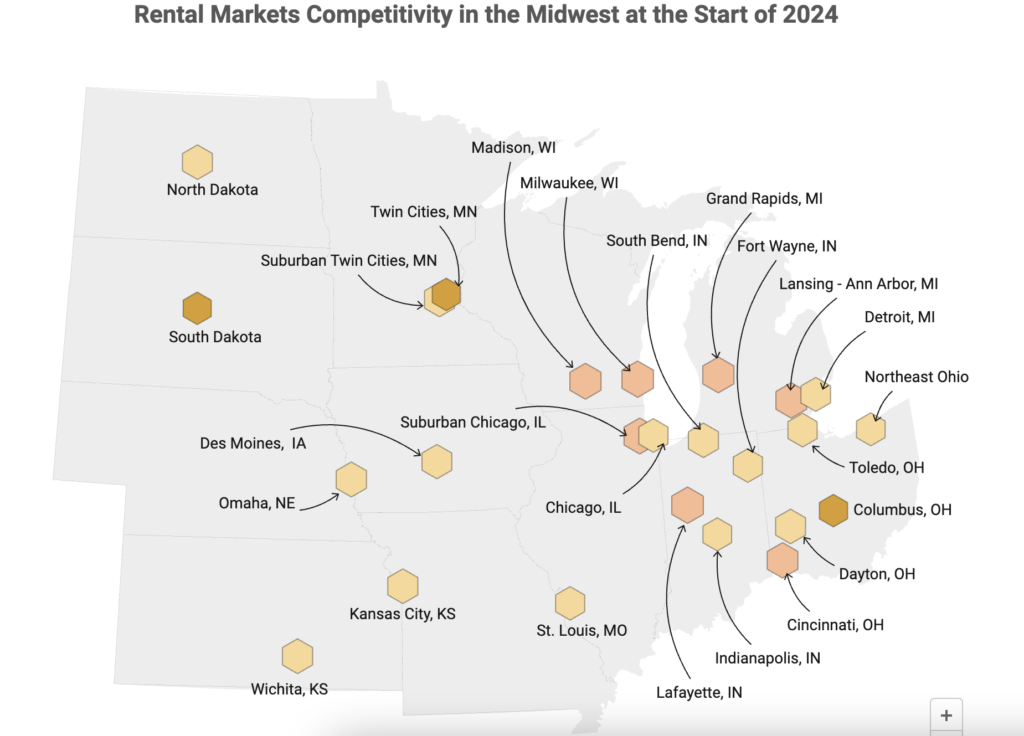

At the beginning of 2024, the Midwest had become the most competitive rental market because of its affordability and newly revitalized economy, which is driving up demand for rental units. The Midwest of today has mostly shed the “Rust Belt” label in addition to being cost-effective.

Miami’s Apartment Market is Sizzling-Hot, Outshining Florida’s Waning Appeal

With a Rental Competitiveness Index (RCI) score of 91.9 at the beginning of the year, the popular Miami metro maintains its status as the most competitive rental market in the United States.

As a result, there are vast job opportunities, drawing in a large number of professionals who frequently choose to rent initially, increasing the rivalry for rental houses. Plus, the city’s relaxed way of life, prime location, and nice climate only serve to heighten its appeal, drawing visitors all year round and increasing demand for its apartment supply.

It takes an average of 36 days to fill an empty apartment in Miami, and a staggering 14 applicants vie for each one, making it the nation’s highest rental turnover rate, surpassed only by vacant apartments in Worcester-Springfield, MA.

Additionally, only 3.5% of its rental units were available to renters, particularly considering that the percentage of newly constructed flats only made up 0.97% in the beginning of 2024—down from 1.24% the year before. In the first several months of 2024, over three-quarters (73.4%) of Miami residents who were already renting stayed put due to these difficult conditions.

Milwaukee Becomes the Nation’s Second-Hottest Renting Spot in Early 2024

Milwaukee, with an RCI score of 87, has emerged as the second-hottest rental location in the country in the first few months of 2024 and is leading the charge in the Midwest.

Many aspiring homeowners in the Midwest—newcomers and established residents—have deemed renting a good choice to ease their way into long-term homeownership. This is because their current living situation enables them to accumulate savings for down payments until they can achieve the traditional American dream of becoming homeowners.

Renters are able to find appealing housing options throughout the city of Milwaukee, particularly in sought-after neighborhoods close to employers and businesses.

Due to a combination of high demand and a lack of available apartments—newly constructed rentals make up just 0.53% of all rental units in the metro area—72.3% of Milwaukee renters renewed their leases in the first few months of 2024. This caused the occupancy rate to rise to 95.1%, which is much higher than the average for the country. On average, unoccupied units were occupied in 37 days, with nine applicants vying for each available space.

Surprisingly, Milwaukee’s rental market is marginally more competitive than it was a year ago, despite the fact that there are fewer potential tenants fighting for each available unit (down by two since early 2023) and it takes an extra day for units to be occupied. This is primarily due to the fact that there are less options available to renters in early 2024 compared to the same period in 2023, when 0.74% of the available rentals in the area were brand-new units.

Cost-Effective Midwest Claims One-Third of the Nation’s Hottest Rental Markets

Renters who are faced with higher rents in other parts of the U.S. may find the Midwest to be an appealing alternative due to its comparatively lower living costs when compared to other regions. The popularity of remote work has also raised demand for larger living spaces in once-affordable neighborhoods. The Midwest is the hardest area in the country to rent in, despite the limited inventory failing to keep up with the high demand for flats. Twelve of the Midwest’s cities topped the list of locations to watch in 2024, making the region the #1 most sought-after area for rentals.

Milwaukee is not the only very competitive rental market in the Midwest; Suburban Chicago, which came in fourth in RentCafe’s rating (RCI: 85.3), is also rather tough.

The strong demand for apartments in the Midwest is outpacing the supply, with just 0.51% of all apartments for rent in the Chicago suburbs being brand-new rentals. In the first few months of the year, over two-thirds (68.2%) of the current tenants extended their leases, resulting in a 95% occupancy rate throughout Suburban Chicago. Because of this, some ten applicants compete for each available apartment, and available units usually sell out in less than 37 days.

Other small markets in the Midwest that are highly competitive in the early months of 2024 included Knoxville, TN (RCI score 85.6); Harrisburg, PA (RCI score 85); Little Rock, AR; Providence, RI; Worcester-Springfield, MA; Tulsa, OK; Palm Beach County, FL; Youngstown, OH; Portland, ME; Wichita, KS; Buffalo, NY; Dayton, OH; Rochester, NY; North Dakota; South Bend, IN; and Asheville, NC.

North Jersey Takes Charge in the Northeast Amid Insufficient Apartments in the Region

While the Midwest dominated ratings as of early 2024, the Northeast is up against fierce challenges. In this instance, the high cost of buying in the area has made renting a more appealing option for many individuals, which is primarily driving the lack of available apartments amid rising demand.

While it’s still difficult to find an apartment in North Jersey, the research notes that the market has somewhat softened from a year ago, when it peaked as the most competitive rental hub in the country. With an RCI score of 85.4, North Jersey was the third-hottest rental market in the country at the beginning of 2024.

This metro region primarily consists of outlying New Jersey communities like Newark, Lindhurst, and Orange, as well as Manhattan neighborhoods just over the river like Jersey City, Hoboken, and Union City, NJ, where tenants can find more affordable housing while still being close to the Big Apple.

Generally, just 0.51% of the rental units in these places are new apartments, which helps to explain the high occupancy rate of slightly less than 96% in the midst of a 73.1% lease renewal rate at the beginning of the year. In addition, unoccupied apartments in North Jersey remain on the market for an average of 38 days, with nine interested tenants competing for each property.

In conclusion, the Midwest is home to seven spots in the top 20 most competitive small rental markets, indicating the growing desirability of the area to tenants. In fact, given the increasing demand for rentals in this area from prospective tenants in the previous year, it became the most anticipated region for 2024.

To read the full report, including more data, charts, and methodology, click here.