January’s homebuyer affordability index took a notable hit as the the national median payment applied for by purchase applicants increased to $2,134 from $2,055.

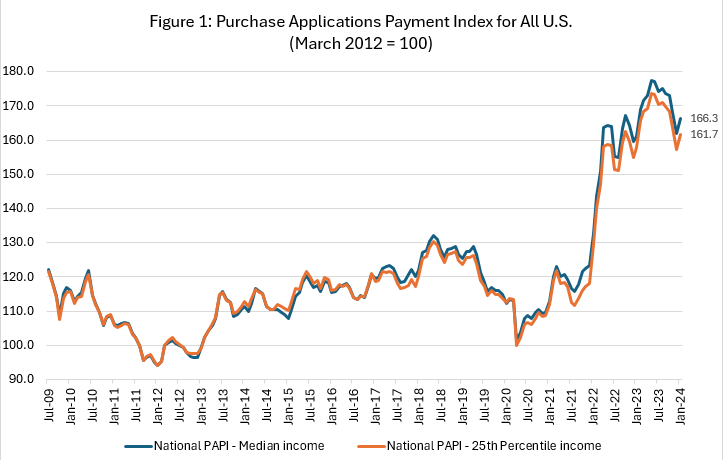

This information comes by way of the Mortgage Bankers Association’s (MBA) Purchase Applications Payment Index (PAPI), which measures how new monthly mortgage payments vary across time relative to income using proprietary MBA data.

“Homebuyer affordability conditions declined in January, with higher home prices pushing loan amounts upward and ultimately offsetting what was a monthly decline in mortgage rates,” said Edward Seiler, MBA’s Associate Vice President, Housing Economics, and Executive Director, Research Institute for Housing America. “Mortgage rates have risen throughout February and will likely continue to hamper affordability and prospective homebuyers’ ability to buy heading into spring.”

The national PAPI increased 3.8% to 166.3 in January from 161.8 in December. Median earnings were up 5.2% compared to one year ago, and while payments increased 8.6%, the strong earnings growth means that the PAPI is up 3.3% on an annual basis. For borrowers applying for lower-payment mortgages (the 25th percentile), the national mortgage payment increased to $1,438 in January from $1,375 in December.

Additional findings revealed in the MBA’s PAPI:

- The national median mortgage payment was $2,134 in January—up $78 from December. It is up $170 from one year ago, equal to an 8.6% increase.

- The national median mortgage payment for FHA loan applicants was $1,830 in January, up from $1,822 in December and up from $1,619 in January 2023.

- The national median mortgage payment for conventional loan applicants was $2,147, up from $2,053 in December and up from $2,009 in January 2023.

- The top five states with the highest PAPI were: Nevada (254.7), Idaho (251.6), Arizona (229.7), Florida (218.3), and South Dakota (213.3).

- The top five states with the lowest PAPI were: Louisiana (118.8), New York (120.9), Connecticut (121.7), West Virginia, (125.4) and Alaska (126.2).

- Homebuyer affordability decreased for Black households, with the national PAPI increasing from 158.2 in December to 162.6 in January.

- Homebuyer affordability decreased for Hispanic households, with the national PAPI increasing from 154.5 in December to 158.8 in January.

- Homebuyer affordability decreased for White households, with the national PAPI increasing from 165.1 in December to 169.7 in January.