According to the National Association of Realtors (NAR), pending home sales decreased by 4.9% in January.

The Midwest and South had monthly declines in transactions, while the Northeast and West saw increases. Every one of the four US regions saw declines from the previous year.

“The job market is solid, and the country’s total wealth reached a record high due to stock market and home price gains,” said Lawrence Yun, NAR Chief Economist. “This combination of economic conditions is favorable for home buying. However, consumers are showing extra sensitivity to changes in mortgage rates in the current cycle, and that’s impacting home sales.”

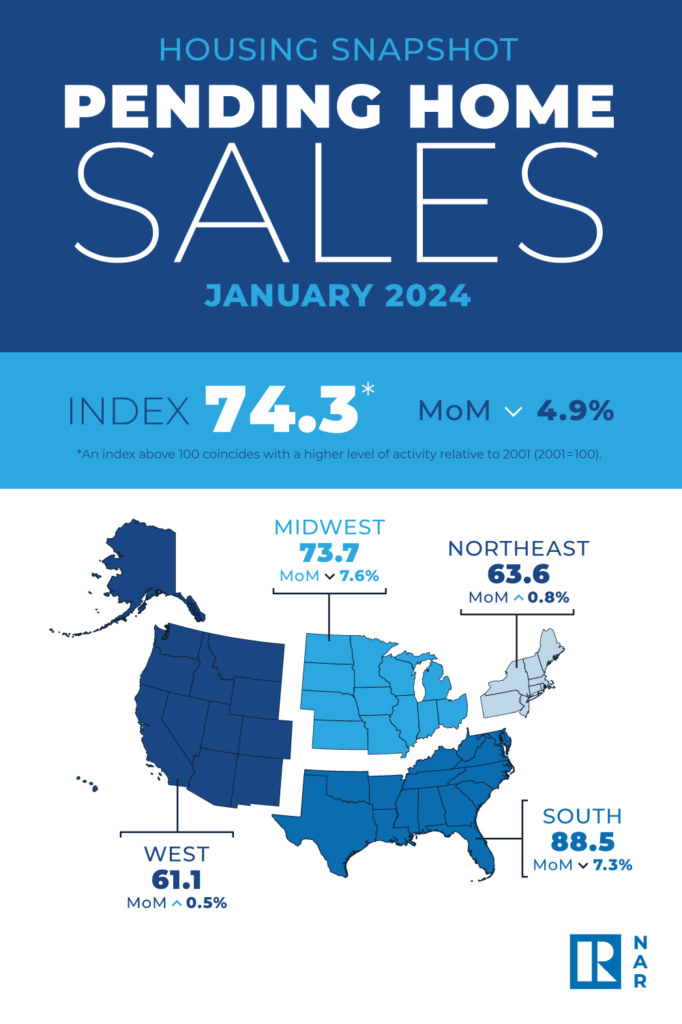

In January, the Pending Home Sales Index (PHSI)—which measures future home sales based on contract signings—dropped to 74.3. Pending transactions decreased 8.8% from the previous year.

“Pending home sales fell 4.9% month-over-month in January, settling 8.8% below last January’s level,” said Hannah Jones, Senior Economic Research Analyst at Realtor.com. “New home sales, which are also a measure of contract signings, ticked up just 1.5% in January as mortgage rates hovered in the 6.6% range. Existing-home inventory remained scarce in January, but overall active inventory improved 7.9% year-over-year in January. Buyer demand remained elevated to start the year as mortgage rates steadied at their lowest level since June 2023. Mortgage rates have since climbed back towards 7% on the heels of stronger-than-expected employment and inflation data but are likely to improve as these measures of economic strength ease.”

Pending Home Sales Regional Breakdown

The Northeast PHSI dropped 5.5% from January 2023 to 63.6, a rise of 0.8% over the previous month. In January, the Midwest index dropped 7.6% to 73.7, an 11.6% reduction from the previous year.

“Southern states and those in the Rocky Mountain time zone experienced faster job growth compared to the rest of the country,” said Yun. “As a result, long-term housing demand is increasing more significantly in these regions. However, the timing and number of purchases will largely depend on the prevailing mortgage rates and inventory availability.”

In January, the South PHSI fell 7.3% to 88.5, a 9.0% decrease from the previous year. January had a 0.5% increase in the West index to 61.1, a 7.0% decrease from January 2023.

According to Jones, a recent survey indicated that almost 40% of purchasers thought it would be possible to buy a house if interest rates fell below 6%. But for about one in three purchasers, rates would need to fall below 5% in order for them to consider buying a property.

As the spring homebuying season gets underway, the recent increase in rates may result in less seasonally adjusted sales.

“Should we be surprised that sales contracts signed in January, as rates were on the rise, retreated a bit?” said Mark Fleming, First American Chief Economist. “No. Rising rates hit affordability and discourage sellers from selling. Existing home sales advanced modestly in January because of sales pending in December. Expect existing home sales to retreat in February if this relationship between existing and pending (advanced one month) holds true.”

Fleming explained that when it comes to housing, the Fed needs to cease seeing the shadow of inflation. Rate reductions and a springtime sales boom may have to wait until later.

Jones further explained how high mortgage rates also make it more difficult for sellers to move, which exacerbates the effects of the housing supply imbalance that has developed over the past ten years. As a result, because too few new homes have been built in comparison to population growth for more than ten years, the U.S. housing markets are still experiencing an increasing lack of new homes.

To read the full report, including more data, charts, and methodology, click here.