Fannie Mae’s latest Home Purchase Sentiment Index (HPSI) increased 2.1 points in February to 72.8, inching higher for the third consecutive month, due primarily to increased optimism around home-selling conditions.

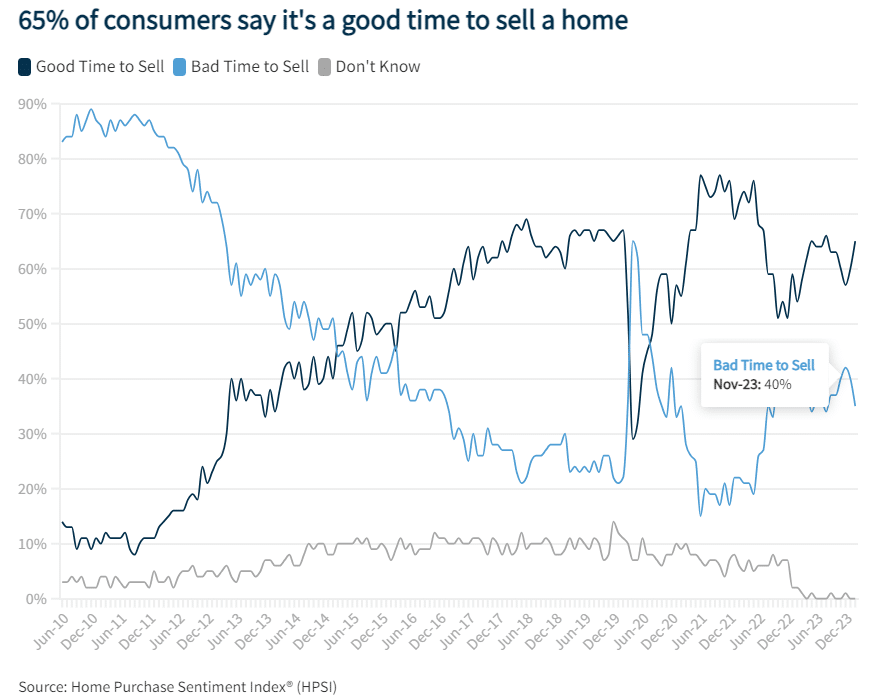

In February, Fannie Mae reported that 65% of consumers said it’s a “Good Time to Sell a Home,” up just 5% from 60% last month. The share of those who believe it’s a “Good Time to Buy a Home” ticked up slightly this month, but remains at just 19%.

Additionally, a number of consumers believe that mortgage rates will drop over the next 12 months, although on net that component fell slightly this month. Overall, the full index is up 14.8 points year-over-year.

Q1 closing with dip in rates

According to Freddie Mac, the 30-year fixed-rate mortgage (FRM) has risen to hover near the 7% mark, averaging 6.88% as of March 7, 2024, down from last week when it averaged 6.94%. This marked the first drop in rates after four consecutive weeks of rates on the rise. A year ago at this time, the 30-year FRM averaged 6.73%.

“The HPSI increased for the third straight month, continuing its slow but steady rise from the low-level plateau observed through much of 2023; and consumer sentiment toward housing now rests firmly above where it was this time last year,” said Douglas G. Duncan, Fannie Mae SVP and Chief Economist. “Consumer attitudes toward home-selling conditions increased markedly in February, with current homeowners, in particular, expressing greater optimism that it’s a ‘Good Time to Sell,’ a development that may foreshadow an upcoming increase in existing home listings. Additionally, despite the recent uptick in rates, consumers remain relatively optimistic that mortgage rates will decrease over the next 12 months. If their expectations come true and rates move closer to the 6% mark by the end of 2024, as we currently expect, then it’s likely that consumer sentiment on both sides of the transaction will improve, perhaps leading to a further thawing of the housing market. A decline in mortgage rates–and the resulting uptick in sentiment–would obviously bode well for the upcoming spring homebuying season, although affordability will likely remain a significant challenge for buyers, at least until there’s a meaningful addition to net supply.”

Spring is in the air

The slight dip in rates and the arrival of spring may have combined to boost overall mortgage application volume over last week, as the Mortgage Bankers Association (MBA) reported that mortgage applications increased 9.7%, according to data from the MBA’s Weekly Mortgage Applications Survey for the week ending March 1, 2024.

“A small decline in mortgage rates last week led to a nearly 10% jump in mortgage applications, with refinance and purchase activity both posting solid gains,” said MBA President and CEO Bob Broeksmit. “Housing inventory remains tight and home prices are elevated, but first-time buyer interest is strong this spring. FHA purchase applications jumped 16%.”

Home Purchase Sentiment Index–Component Highlights

Fannie Mae’s HPSI rose in February by 2.1 points to 72.8. The HPSI is up 14.8 points compared to the same time last year. Specifically, the HPSI found:

- Good/Bad Time to Buy: The percentage of respondents who say it is a “Good Time to Buy” a home increased from 17% to 19%, while the percentage who say it is a “Bad Time to Buy” decreased from 83% to 81%. As a result, the net share of those who say it is a “Good Time to Buy” increased four percentage points month-over-month.

- Good/Bad Time to Sell: The percentage of respondents who say it is a “Good Time to Sell” a home increased from 60% to 65%, while the percentage who say it’s a “Bad Time to Sell” decreased from 40% to 35%. As a result, the net share of those who say it is a “Good Time to Sell” increased 11 percentage points month-over-month.

- Home Price Expectations: The percentage of respondents who say “Home Prices Will Go Up” in the next 12 months increased from 37% to 42%, while the percentage who say “Home Prices Will Go Down” increased from 22% to 23%. The share who think “Home Prices Will Stay the Same” decreased from 40% to 34%. As a result, the net share of those who say “Home Prices Will Go Up” in the next 12 months increased four percentage points month-over-month.

- Mortgage Rate Expectations: The percentage of respondents who say “Mortgage Rates Will Go Down” in the next 12 months decreased from 36% to 35%, while the percentage who “Expect Mortgage Rates to Go Up” increased from 28% to 32%. The share who think “Mortgage Rates Will Stay the Same” decreased from 35% to 32%. As a result, the net share of those who say “Mortgage Rates Will Go Down” over the next 12 months decreased five percentage points month-over-month.

- Job Loss Concern: The percentage of respondents who say they are “Not Concerned About Losing Their Job” in the next 12 months decreased from 82% to 78%, while the percentage who say they are “Concerned About Losing Their Job” increased from 18% to 22%. As a result, the net share of those who say they are “Not Concerned About Losing Their Job” decreased eight percentage points month-over-month.

- Household Income: The percentage of respondents who say their household income is “Significantly Higher” than it was 12 months ago increased from 17% to 19%, while the percentage who say their household income is “Significantly Lower” decreased from 13% to 11%. The percentage who say their household income is “About the Same” increased from 69% to 70%. As a result, the net share of those who say their household income is “Significantly Higher” than it was 12 months ago increased five percentage points month-over-month.

Fannie Mae’s HPSI distills information about consumers’ home purchase sentiment from Fannie Mae’s National Housing Survey (NHS) into a single number. The HPSI reflects consumers’ current views and forward-looking expectations of housing market conditions and complements existing data sources to inform housing-related analysis and decision making. The HPSI is constructed from answers to six NHS questions that solicit consumers’ evaluations of housing market conditions and address topics that are related to their home purchase decisions. The questions ask consumers whether they think that it is a good or bad time to buy or to sell a house, what direction they expect home prices and mortgage interest rates to move, how concerned they are about losing their jobs, and whether their incomes are higher than they were a year earlier.