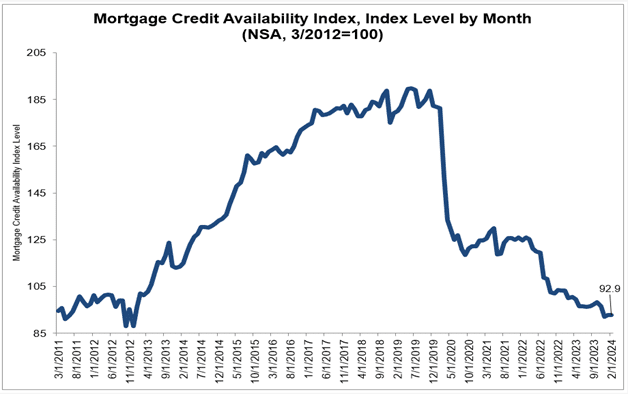

According to the Mortgage Credit Availability Index (MCAI)—a report from the Mortgage Bankers Association (MBA) based on data analysis from ICE Mortgage Technology—there was a rise in mortgage credit availability in February.

In February, the MCAI increased by 0.2% to 92.9. While increases in the index point to looser credit, a decrease in the MCAI suggests tighter lending requirements. In March 2012, the index was benchmarked at 100. The Government MCAI barely changed, whereas the Conventional MCAI rose by 0.5%.

The Conforming MCAI increased by 1.6%, while the Jumbo MCAI increased by 0.1% among the Conventional MCAI’s component indices.

“Mortgage credit availability remains quite tight—near the lowest levels in MBA’s survey—even as application volume lags last year’s pace and as the industry continues to reduce capacity. Despite these factors, credit criteria remain conservative,” said Joel Kan, MBA’s VP and Deputy Chief Economist. “There was a slight increase in credit availability for refinance loan programs last month. The purchase market, however, continues to be impacted by supply and affordability constraints, due to higher mortgage rates.”

Conventional, Government, Conforming, & Jumbo MCAI Component Indices

The MCAI rose by 0.2% to 92.9 in February. The Conventional MCAI increased 0.5%, while the Government MCAI decreased by 0.0%. Of the component indices of the Conventional MCAI, the Jumbo MCAI increased by 0.1%, and the Conforming MCAI rose by 1.6%.

To read the full report, including more data, charts, and methodology, click here.