A new Zillow analysis of 2023 home sales found that houses listed in the first two weeks of June sold for 2.3% more, a $7,700 boost on a typical U.S. home.

Leading up to the pandemic, the best time to list a home consistently was in early May. The shift to the month of June suggests that mortgage rates are strongly influencing demand on top of the usual seasonality that brings buyers to the market in the spring. This home-shopping season is poised to follow a similar pattern as that in 2023, with the potential for a second wave if the Federal Reserve lowers interest rates mid-year or later.

“Evidence that purchase demand remains sensitive to interest rate changes was on display this week, as applications rose for the first time in six weeks in response to lower rates,” said Sam Khater, Freddie Mac’s Chief Economist. “Mortgage rates continue to be one of the biggest hurdles for potential homebuyers looking to enter the market. It’s important to remember that rates can vary widely between mortgage lenders so shopping around is essential.”

Mortgage rates on the slide?

For the first time in four week, Freddie Mac reported that the 30-year fixed-rate mortgage (FRM) trended downward, averaging 6.88% as of March 7, 2024, down from last week when it averaged 6.94%. A year ago at this time, the 30-year FRM averaged 6.73%.

The sale price premium registered last June followed the first spring in more than 15 years with mortgage rates over 6% on a 30-year fixed-rate mortgage. Rates continued upward through May 2023, as prospective buyers were reassessing and less likely to bid boldly. In June, however, rates pulled back a little from 6.79% to 6.67%, which likely presented an opportunity for determined buyers heading into summer.

“The old logic was that sellers could earn a premium by listing in late spring when their home would be on the top of the pile of listings when search activity was at its peak. Now, with persistently low inventory, mortgage rate fluctuations make their own seasonality,” said Zillow Chief Economist Skylar Olsen. “First-time home buyers who are on the edge of qualifying for a home loan may dip in and out of the market, depending on what’s happening with rates. It is almost certain the Federal Reserve will push back any interest-rate cuts to mid-2024 at the earliest. If mortgage rates follow, that could bring another surge of buyers later this year.”

Fed actions to dictate mortgage rates

In late January for the fourth meeting in a row, the Federal Reserve’s Federal Open Market Committee (FOMC) made the call that their best course of action was to do nothing with interest rates, a developing trend as the FOMC chose to hold rates steady at 5.50% at their last three meetings.

The most aggressive series of rate hikes in history ended in June when the committee held off on raising rates due to a litany of positive factors which consisted of 11 straight rate hikes over 15 months. Since the post-pandemic rate hikes began, the FOMC raised rates in March 2022 (+25 points), May 2022 (+50 points), June 2022 (+75 points), August 2022 (+75 points), September (+75 points), November 2022 (+75 points), December 2022 (+50 points), February 2023 (+50 points), March 2023 (+25 points), May 2023 (+25 points), June 2023 (+0 points), July (+25 points), September (+0 points), November (+0 points), December (+0 points), and January (+0). This is equivalent to a rise of 5.00 percentage points in under two years.

Timing is everything

Mortgage rates have been impacting affordability and sale prices since they began rising rapidly two years ago. In 2022, sellers nationwide saw the highest sale premium when they listed their home in late March, right before rates moved past 5%, and continued climbing.

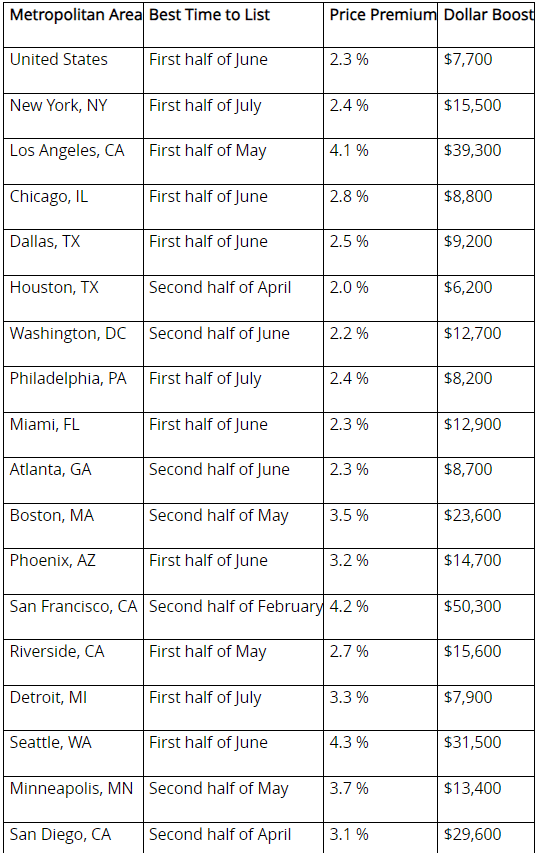

Zillow’s research finds the best time to list can vary widely by metropolitan area. In 2023, it was as early as the second half of February in San Francisco, and as late as the first half of July in New York. Thirty of the top 35 largest metro areas saw for-sale listings command the highest sale prices between May and early July last year.

Zillow also found a wide range in the sale price premiums associated with homes listed during those peak periods. At the hottest time of the year in San Jose, homes sold for 5.5% more, a $88,000 boost on a typical home. Meanwhile, homes in San Antonio sold for 1.9% more during that same time period.

“Most sellers don’t have the luxury of timing the market. The best time to list is when it makes the most sense for their lives,” said Olsen.

Boosting curb appeal

Zillow data finds there are other unexpected ways to sell a home faster and for more money in today’s market through:

- Screen appeal is the new curb appeal: A vast majority of buyers start their home search online. Sellers should highlight their home’s best features with larger, high-resolution photos, an AI-powered 3D home tour, and interactive floor plan.

- Highlight the right features: Certain home features, when mentioned in a listing description, can signal to a buyer that a home is desirable and up-to-date. As a result, those features can help a home sell faster and for more money. For example, mentioning a steam oven or a pizza oven in a listing description can help a home sell for as much as 5.3% more, while a mention of a doorbell camera can help a home sell five days faster.

- Make strategic improvements: Zillow research finds that most sellers make at least two improvements before listing their home for sale. Interior painting is one of the most common projects sellers take on. However, it pays to be strategic when picking paint colors. Zillow’s latest paint color analysis finds homes with a charcoal gray kitchen can sell for about $2,500 more.