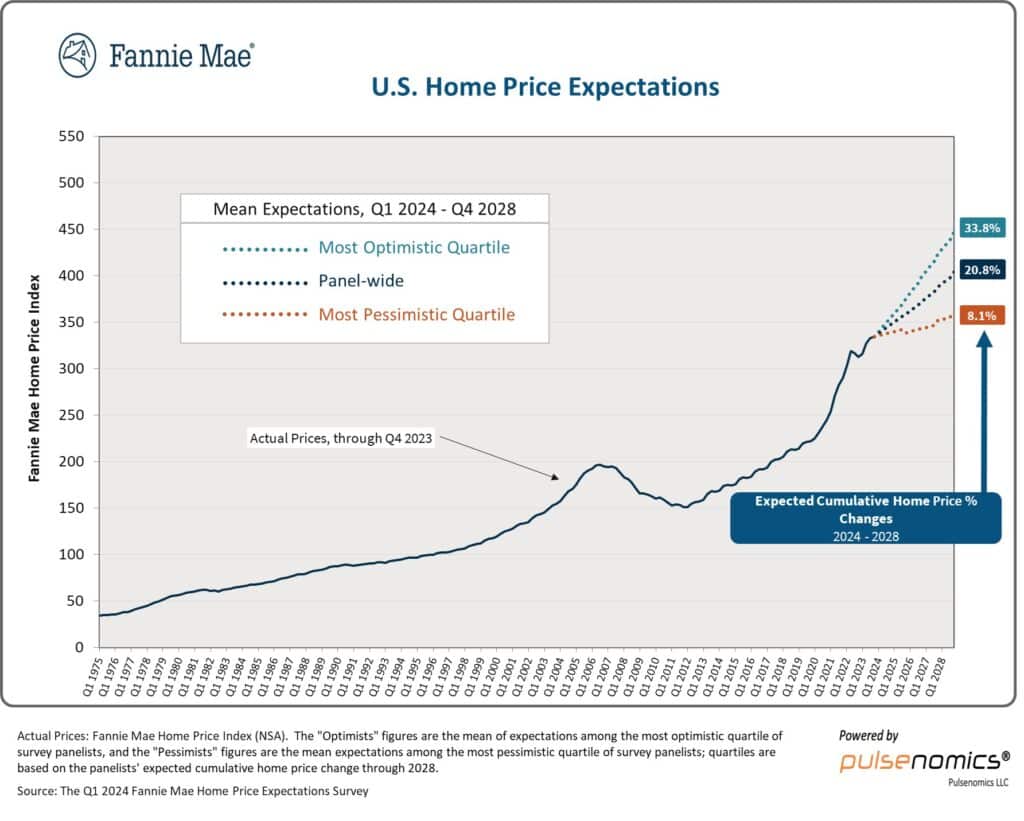

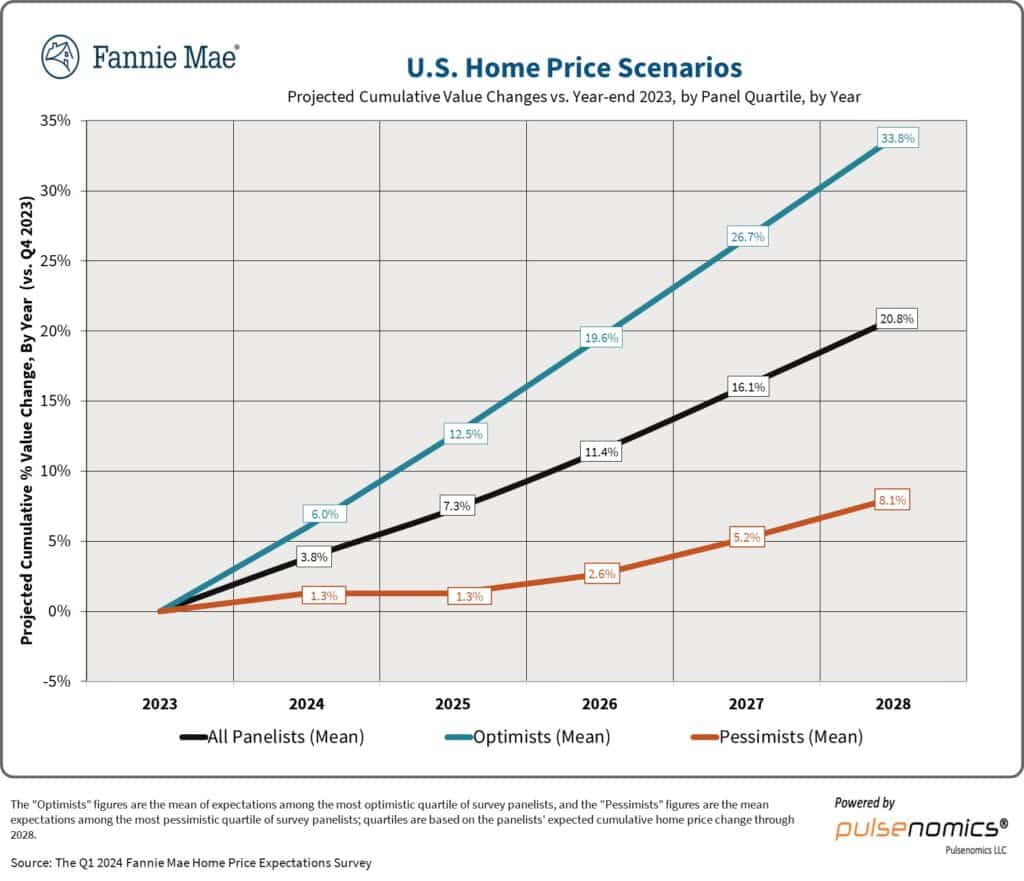

The Q1 2024 Fannie Mae Home Price Expectations Survey (HPES)—conducted in collaboration with Pulsenomics, LLC— showed that a panel of housing experts project an annual national home price rise of 3.8% in 2024 and 3.4% in 2025.

The most recent national home price increase forecasts from the panel exceed the 2.4% and 2.7% growth predictions for 2024 and 2025 made last quarter.

“On average, our panelists continue to expect home price growth to decelerate this year, but their overall outlook was revised upward this quarter, with most now reporting greater upside risk to home prices than downside risk,” said Hamilton Fout, Fannie Mae VP of Economics. “If mortgage rates move toward the panel-predicted six percent median rate by the end of 2024, we would expect this to be supportive of continued home price growth, particularly given the persistent supply-side challenges facing the housing market.”

Additionally, a larger percentage of panelists indicated a bigger upside risk to their home price estimates (41% in Q1 2024 vs. 26% in Q4 2023), with the majority supporting this belief with references to continuing housing supply constraints and decreasing mortgage rates.

“This is a positive outlook for those who already own a home, but as the dearth of listings boosts both prevailing values and expected future prices, the affordability concerns of prospective homebuyers are unlikely to fade soon,” said Terry Loebs, Founder of Pulsenomics.

To read the full report, including more data, charts, and methodology, click here.