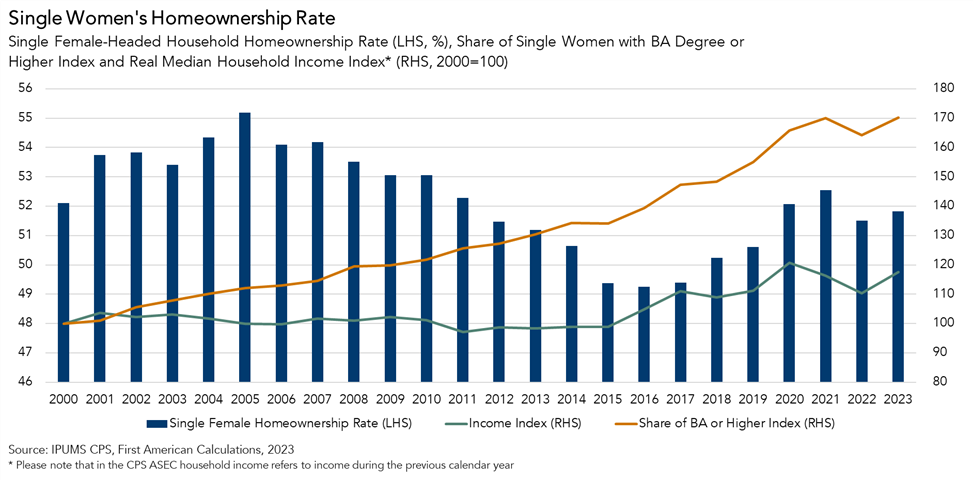

According to a new First American study, a recent examination of household-level survey data from IPUMS CPS, the homeownership rate among single, female-headed households—including widowed, separated, or divorced—grew to 51.8% in 2023, up from 51.5% the previous year and recovering from the most recent low of 49.3% in 2016.

With the U.S. recently observing International Women’s Day and Women’s History Month, now is an excellent opportunity to recognize the accomplishments that single women have made in achieving the American Dream of homeownership.

In 2023, there were approximately 20 million single, female-headed homeowner households, much outnumbering single, male-headed households in terms of both population and homeownership rate. With the newly revealed 2023 data, the pandemic’s impact on women’s wealth and homeownership becomes clear, and single, female homeownership continues to rise.

Pandemic Challenges Did Not Deter Wealth Creation for Women

According to First American, the epidemic had a disproportionate impact on women’s economic prospects, prompting many to refer to this period as a “she-cession.”

Women had higher unemployment and dropped out of the labor force in greater numbers, while performing more domestic tasks such as housekeeping and childcare. This resulted in a drop in financial confidence in home buying, particularly among single women, who were concerned about saving a down payment or affording a monthly mortgage. According to a Freddie Mac 2021 study, an estimated 60% of head-of-household renters who were single women believed that homeownership was permanently out of reach.

Despite the challenges of the COVID-19 pandemic, single women’s wealth has increased in recent years. The median net worth of single, female-headed households climbed from $54,400 in 2019 to $74,500 in 2022, according to the Survey of Consumer Finances (SCF), a triennial poll that collects extensive household financial data. Single women who are also homeowners had their median net worth rise from $199,400 to $266,500 during the same period.

In reality, a primary dwelling is the single greatest asset owned by the majority of homeowning households, with single women’s primary residence accounting for 66% of all assets in 2022. Homeownership is still a significant engine of wealth generation, and women—particularly single women—are taking notice.

2024 Forecast: Women’s Homeownership Rate to Increase Further

First American’s study revealed that the values fueling women homeownership are showing no signs of fading. Women have increasingly pursued higher education, which is associated with higher household income, and higher income increases the likelihood of homeownership.

The proportion of unmarried women with a bachelor’s degree or more has climbed from 20% in 2000 to 34% in 2023. The proportion of unmarried women holding a graduate degree has more than doubled throughout the same period. Similarly, from 2000 and 2022, the actual median family income for single women climbed by around 15%, giving them more purchasing power.

Overall, single women are increasingly using their purchasing power to buy homes, regularly outperforming single males two to one over the last several years. As women’s educational attainment and household income increases, it is realistic to expect an increase in homeownership. Furthermore, despite the “she-cession,” single women are increasingly pursuing homes and reaping the financial perks.

To read the full report, including more data, charts, and methodology, click here.