A new posting on the site HouseFresh by G. John Cole takes a deeper look at the pockets in the nation most at-risk of damage from weather events and other conditions brought on by global warming.

A recent study found that U.S. homes exposed to flood risk are overvalued by $121–$237 billion, and that lower-income households suffer “greater risk of losing home equity from price deflation.”

In the post, the HouseFresh team has identified the cities and states with the highest proportion of home listings at substantial risk from climate change-related to fire, flood, wind, or heat in the next 30 years.

To determine how climate risk factors affect house values, HouseFresh reviewed data on flood, fire, wind and heat risk from Risk Factor and Redfin. States were ranked based on the percentage of Redfin property listings in each state that carry a major risk of five or above on Risk Factor’s 10-strata risk scale, while cities were ranked based on the percentage of property listings that carry an extreme risk of 9 or above on Risk Factor’s 10 strata scale. Only cities with at least 100 properties listed on Redfin were considered.

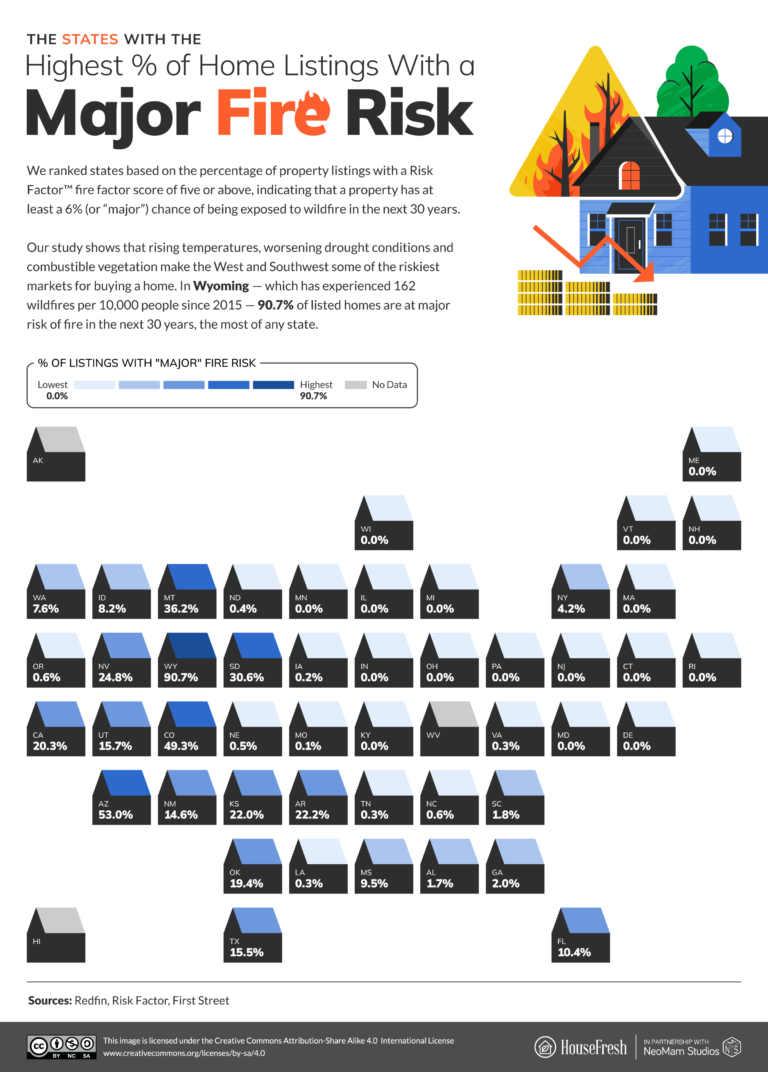

Areas most susceptible to wildfire

According to HouseFresh, wildfires are not just a result of increasing heat, but climate-related factors, such as increased droughts and tree-killing beetles, that make woodland more susceptible to fire.

From 1990-2010, the areas where wildfires were most pronounced experienced 41% growth in the number of houses built (33% growth by area). This made wildfire-prone land “the fastest-growing land use type in the conterminous United States” during that period, according to the study that produced those figures. According to Timothy Collins, a geography professor at the University of Utah, “people are drawn to those environments because of the amenities associated with forest resources.”

HouseFresh found that Wyoming was the state with the highest proportion of listings with a major fire risk, by a significant leap. Not only are many houses built with high-risk materials in high-risk areas, but Wyoming has a “significantly disproportionate land-to-resource ratio,” meaning a low proportion of firefighters and other resources compared to the extent of the fires it suffers. The study found that 62% of listed properties in Cheyenne, Wyoming were considered high-risk. However, Riverside, California was not far behind at 59.2%.

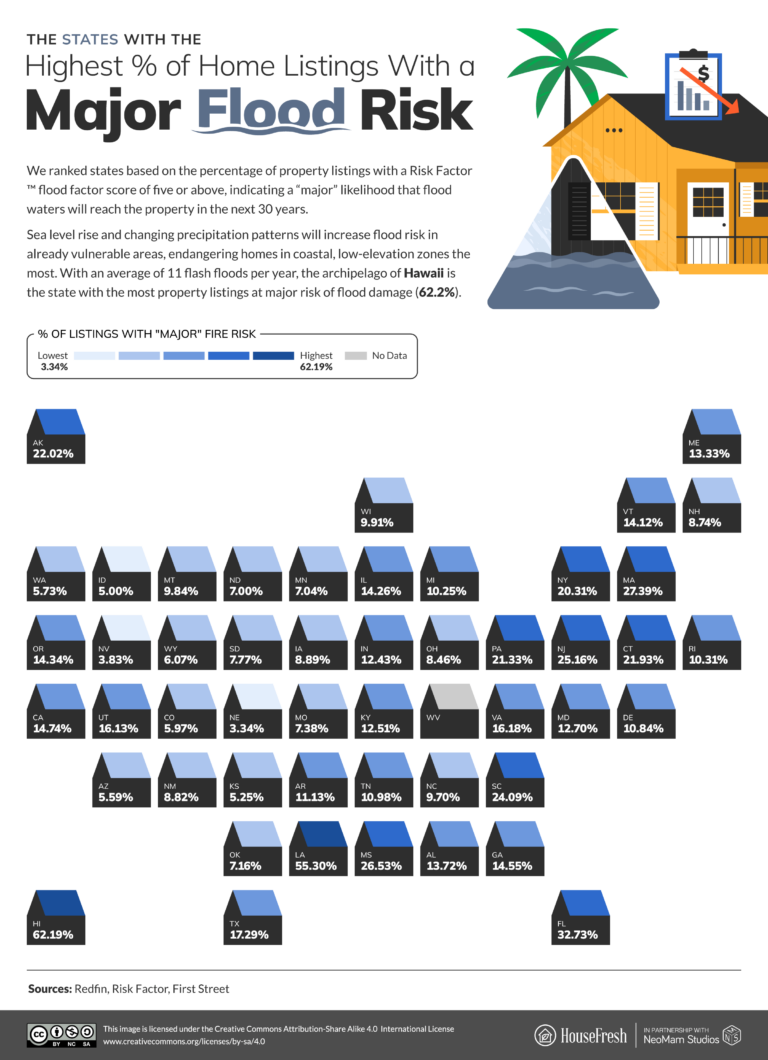

Flood risk on the rise

The impact of global warming is far reaching, but in terms of flood risk, the Environmental Defense Fund (EDF) reveals that a rise of just one degree Fahrenheit can lead to 4% more vapor in the air, and as much as 9% more moisture in the air now than in 2023.

HouseFresh found that Hawaiian properties are most at risk of flooding, citing that in the Hilo Bay region, the sea level has risen by 10 inches since 1950, and now rises by one inch every four years. The states of Louisiana (55.30%) and Florida (32.73%) round out the top three states most at-risk for flooding.

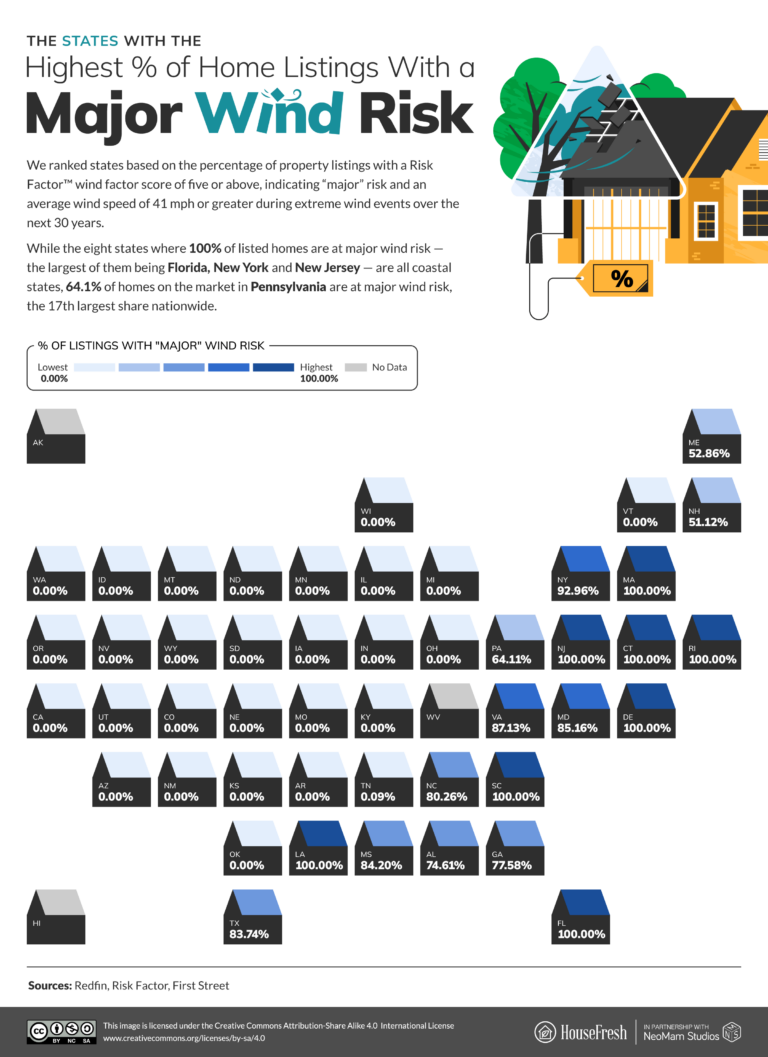

Wind risk and hurricanes cause the most damage

Researchers at HouseFresh found that major hurricanes caused more damage to local populations and ecosystems than any other natural disaster and this trend is on the rise. Warmer sea surface temperatures and a rise in sea levels are factors pushing the number of hurricane instances upward each year.

HouseFresh reports that there are eight states where 100% of listed property is considered at elevated risk of wind damage, dominated by Atlantic Coast states, from as far south as Florida, up northward to Massachusetts. The report also found that 100% of the listings in the top 14 cities are flagged for high wind risk. But in this case, the balance is more in the direction of the Gulf Coast in cities including Corpus Christi, Texas, which was the point of entry for Storm Harold in August—a storm where wind speeds of 45-50 mph were clocked in the area (note that winds are deemed “tropical storm” status when they hit 39 mph).

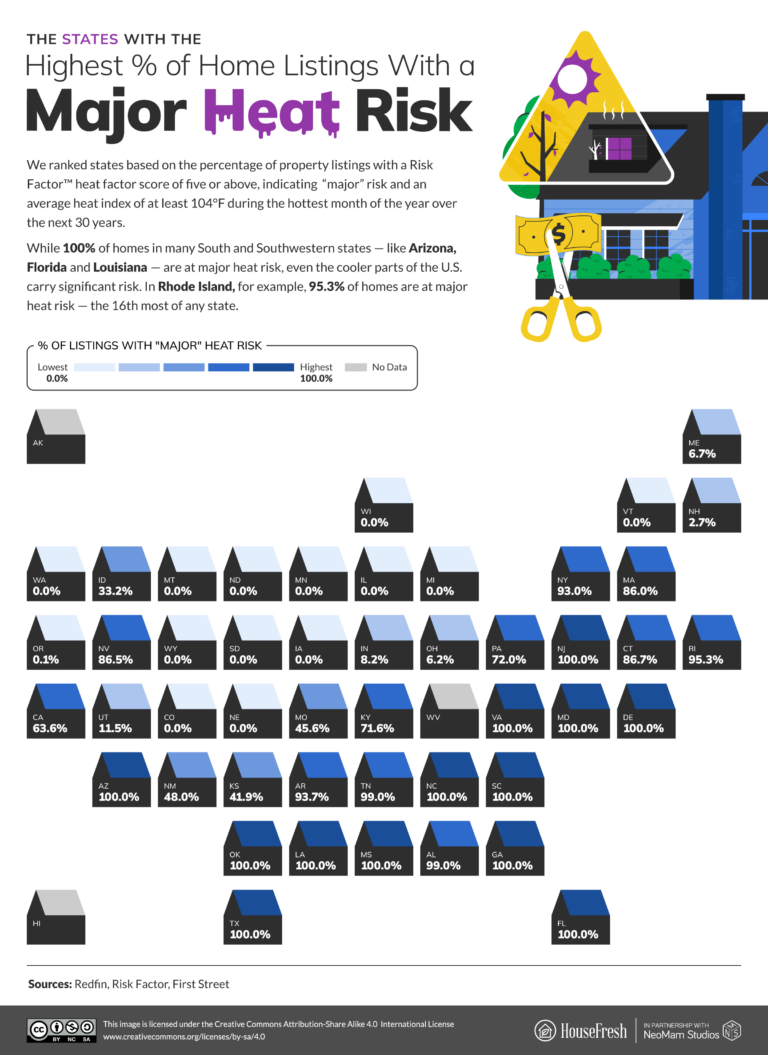

Extreme heat can cause structural harm

HouseFresh notes that the risk of extreme heat levels is measured according to an area’s hottest month of the year. Extreme heat levels can unsettle a home from its very foundations, drying out the soil beneath the concrete and causing walls to crack and floors to slope. The materials that homes and the surrounding infrastructure are made from can buckle and warp, and heat can also cause further damage and disruption to home sensors and devices such as solar panels.

States located on or near the Atlantic Ocean or the Gulf of Mexico were found to be most at risk of extreme heat levels. In the case of heat risk, 100% of the properties in 13 states are flagged, while Alabama and Tennessee are not far behind on 99% each. Oklahoma stands out among the highest-risk states for being positioned some distance from the Gulf of Mexico. By the mid-2080s, Oklahoma will likely experience three to four times as many days above 100 degrees as it has now.

Click here to view the full findings of HouseFresh’s study on climate change.