Independent mortgage banks (IMBs) are not in a good position right now as the latest report from the Mortgage Bankers Association (MBA) found that IMBs and mortgage subsidiaries of chartered banks posted a pre-tax net loss of $2,109 on each originated loan during the fourth quarter of 2023, nearly doubling the loss of $1,015 per loan during the third quarter of 2023.

This information comes to us by way of the MBA’s quarterly Mortgage Bankers Performance Report.

“The fourth quarter of 2023 was about as challenging as it could get for mortgage lenders to generate a production profit,” said Marina Walsh, CMB, MBA’s VP of Industry Analysis. “The fourth quarter is typically the slowest pace of purchase activity for the year. This year was exacerbated by the current lack of housing inventory and mortgage rates that increased to their highest levels of the year, keeping refinancings volumes low. These factors contributed to a ‘perfect storm’ that resulted in a decline in production volume for the quarter that reached the lowest level for this report since 2014.”

Added Walsh, “While production revenues were relatively strong and even increased by five basis points, expenses were up more than $1,000 per loan from the previous quarter and the second-highest level ever reported in our series, indicating that lenders were unable to sufficiently adjust resources to align with fluctuating rates and volumes. At the same time, productivity metrics deteriorated, suggesting that there may still be excess capacity even after substantial employee reductions over the past two years.”

Finally, Walsh noted that, “Despite tough market conditions, some companies have been able to weather seven consecutive quarters of net production losses through cash reserves or infusions and strong servicing cash flows.”

Key findings of MBA’s Fourth-Quarter 2023 Quarterly Mortgage Bankers Performance Report include:

- Including all business lines (both production and servicing), 29 percent of the firms in the report posted pre-tax net financial profits in the fourth quarter of 2023, down from 51 percent in the third quarter of 2023.

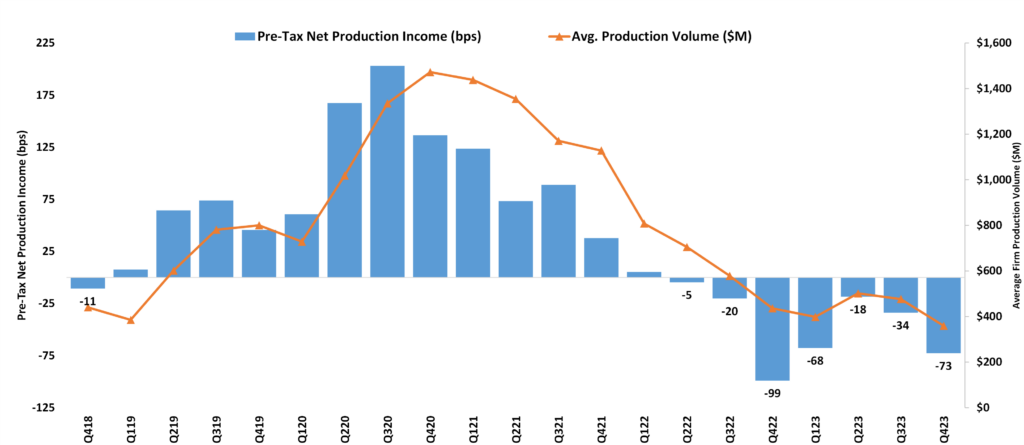

- The average pre-tax production loss was 73 basis points (bps) in the fourth quarter of 2023, compared to an average net production loss of 34 bps in the third quarter of 2023, and a loss of 99 basis points one year ago. The average quarterly pre-tax production profit, from the fourth quarter of 2008 to the most recent quarter, is 43 basis points.

- The average production volume was $359 million per company in the fourth quarter, down from $477 million per company in the third quarter. The volume by count per company averaged 1,170 loans in the fourth quarter, down from 1,497 loans in the third quarter.

- Total production revenue (fee income, net secondary marketing income and warehouse spread) increased to 334 bps in the fourth quarter, up slightly from 329 bps in the third quarter. On a per-loan basis, production revenues decreased to $10,376 per loan in the fourth quarter, down from $10,426 per loan in the third quarter.

- The purchase share of total originations, by dollar volume, was 87 percent. For the mortgage industry as a whole, MBA estimates the purchase share was at 81 percent in the fourth quarter of 2023.

- The average loan balance for first mortgages decreased to $336,757 in the fourth quarter, down from $341,708 in the third quarter.

- Total loan production expenses – commissions, compensation, occupancy, equipment, and other production expenses and corporate allocations – increased to $12,485 per loan in the fourth quarter, up from $11,441 per loan in the third quarter of 2023. From the fourth quarter of 2008 to last quarter, loan production expenses have averaged $7,389 per loan.

- Median productivity – measured as loans closed per retail / consumer direct production employee – decreased to 1.1 loans per employee in the fourth quarter, down from 1.3 loans per employee in the third quarter.

- Servicing net financial income for the fourth quarter (without annualizing) was a negative $24 per loan, down from a positive $90 per loan in the third quarter. Servicing operating income, which excludes MSR amortization, gains/loss in the valuation of servicing rights net of hedging gains/losses, and gains/losses on the bulk sale of MSRs, was $108 per loan in the fourth quarter, up from $104 per loan in the third quarter.