According to March 2024 commentary from the Fannie Mae Economic and Strategic Research (ESR) Group, expectations for total home sales and mortgage originations in 2024 have been slightly lowered due to the increase in mortgage rates in February. The 30-year fixed mortgage rate is now expected to conclude the year at 6.4% by the ESR Group, up from 5.9% in the previous forecast released last month.

The ESR Group notes that labor market indicators are mixed and disinflation will likely resume, but it also thinks that recent data are unlikely to give the Fed the “greater confidence” it needs to start easing monetary policy in the near future. Strong headline jobs numbers and hotter-than-expected inflation data had led financial markets to price in a less aggressive rate-cutting path by the Federal Reserve. However, the ESR Group anticipates that existing home sales will rise in 2024, partly because of a rise in activity from households who are less susceptible to the interest rate lock-in impact because they are likely forced to relocate due to life events.

The ESR Group provided evidence that the gradual “thawing” of housing market activity is likely to continue in the coming months and quarters, pointing to the recent upward trend in new home listings and the relative strength in the most recent Fannie Mae Home Purchase Sentiment Index (HPI) “good time to sell” component.

“The housing market is likely to continue to face the dual affordability constraints of high home prices and elevated interest rates in 2024,” said Doug Duncan, Fannie Mae Senior VP and Chief Economist. “Hotter-than-expected inflation data and strong payroll numbers are likely to apply more upward pressure to mortgage rates this year than we’d previously forecast, as markets continue to evolve their expectations of future monetary policy. Still, while we don’t expect a dramatic surge in the supply of homes for sale, we do anticipate an increase in the level of market transactions relative to 2023—even if mortgage rates remain elevated.”

2024 Housing & Mortgage Forecast Changes

- Mortgage Rates: Following the increase in interest rates in February, Fannie Mae’s interest rate forecast has been upgraded this month. It is now projected that the average 30-year fixed rate mortgage rate will increase by four tenths and five tenths, respectively, to 6.6% in 2024 and 6.2% in 2025. Fannie Mae’s forecast for interest rates is further complicated by the fact that mortgage rates remain unstable, especially in light of shifting Fed policy expectations.

- Existing Home Sales: In January, the seasonally adjusted annualized rate (SAAR) of existing house sales was reported to be an estimated 4 million. Due to the anticipated higher interest rate environment, Fannie Mae has revised projections downward through 2025, although the GSE (Government-Sponsored Enterprise) believes that current sales will trend upward over time.

- New Home Sales: Sales of brand-new single-family homes increased 1.5% in January to a SAAR of 661,000. Home sales in 2024 were revised lower, in line with our current prediction, as a result of higher interest rate assumptions and an update based on recently received data. The small number of existing homes for sale continues to boost new home sales, and Fannie Mae anticipates that this trend will continue in the upcoming months.

- Single-Family Housing Starts: While permits increased to 1.02 million in January, single-family home starts decreased to a SAAR of 1.00 million. Fannie Mae anticipates a decline in Q1 of 2024, and primarily to account for the increased interest rate expectation, we have lowered our estimate. In the medium run, Fannie Mae still anticipates that the lack of existing homes for sale will contribute to an increase in new home building.

- Multifamily Housing Starts: While permits decreased more gradually to a SAAR of 468,000, multifamily housing starts plummeted precipitously to a SAAR of 327,000 in January. Due to the reduced national rent increase and the approaching completion of additional multifamily units, Fannie Mae has decreased its near-term prediction to reflect the new data. Multifamily starts are still expected to decline in 2024.

- Single-Family Home Prices: According to the most current non-seasonally adjusted Fannie Mae HPI, home prices increased by 7.1% in Q4/Q4 of 2023. On a Q4/Q4 basis, prices are expected to increase by 3.2% in 2024.

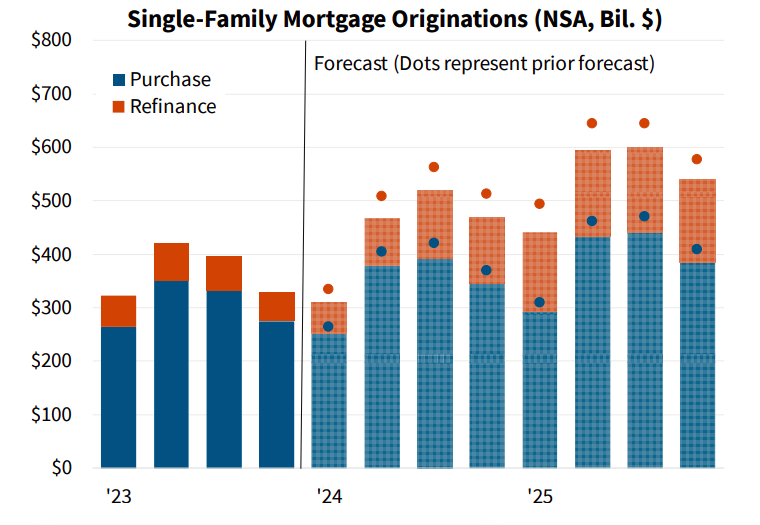

- Single-Family Mortgage Originations: Due to downgrades in the home sales projection (which are a result of a higher mortgage rate outlook) and incoming data showing a persistently larger cash share of purchase transactions, Fannie Mae has reduced its outlook for purchase originations. The GSE anticipates that purchase origination volume will reach $1.4 trillion in 2024—up 12% from 2023 but down $90 billion from the previous estimate. Fannie Mae projects purchasing volume to increase by an additional 14% to $1.6 trillion in 2025. They lowered their previous estimate by $62 billion to $397 billion for refinance originations in 2024. Since mortgage rates are predicted to gradually decline throughout 2025 and more borrowers would have an incentive to refinance due to lower interest rates, Fannie Mae projects refinancing originations to total $626 billion in 2025, which is a downgrade from the previous forecast but represents growth from 2023.

Fannie Mae’s overall home sales forecast was revised downward to 4.91 million in 2024 (originally 5.00 million) and 5.40 million in 2025 (formerly 5.54 million)—primarily due to changes in mortgage rate expectations. They adjusted their predictions for the total originations of single-family mortgages to $1.76 trillion in 2024 (from $1.92 trillion) and $2.18 trillion in 2025 (from $2.36 trillion). Additionally, Fannie Mae slightly revised down its projection for mortgage originations as recent data led them to revise expectations higher for the cash portion of home purchases.

Whether the Fed starts lowering interest rates in June or later in the year is probably not going to have much of an effect on the macroeconomy or mortgage rates, according to Fannie Mae. On the other hand, Fannie Mae thinks that mortgage rates will probably be more significantly impacted by the market’s expectations of the total change in the fed funds rate over the course of the next two to three years.

To read the full release, click here.