The Mortgage Bankers Association (MBA) reports in its Loan Monitoring Survey that the total number of loans now in forbearance remained unchanged month-over-month at 0.22% as of February 29, 2024.

The MBA estimates that 110,000 U.S. homeowners are currently in forbearance plans, and that mortgage servicers have provided forbearance plans to approximately 8.1 million borrowers since March 2020.

In the month of February, the share of Fannie Mae and Freddie Mac (GSE) loans in forbearance declined just one basis point from 0.13% to 0.12%, while Ginnie Mae loans in forbearance increased by one basis point from 0.39% to 0.40%, and the forbearance share for portfolio loans and private-label securities (PLS) increased just one basis point from 0.28% to 0.29%.

Total loans serviced that were current (not delinquent or in foreclosure) as a percent of servicing portfolio volume (#) increased to 95.73% (on a non-seasonally adjusted basis) in February 2024, up six basis points from 95.67% in January 2024 and down from 95.76% one year ago.

Total completed loan workouts from 2020 and onward (repayment plans, loan deferrals/partial claims, loan modifications) that were current as a percent of total completed workouts were 75.68% in February 2024, up from 74.88% the prior month and down from 76% one year ago.

The reach of unemployment on forbearances

The Bureau of Labor Statistics (BLS) reported that total nonfarm payroll employment rose by 275,000 in February, and the unemployment rate increased to 3.9%. Job gains occurred in healthcare, government, food services and drinking establishments, social assistance, and in transportation and warehousing.

The BLS also reported that the Consumer Price Index for All Urban Consumers (CPI-U) increased 0.4% in February on a seasonally adjusted basis, after rising 0.3% in January. Over the last 12 months, the all items index increased 3.2% before seasonal adjustment.

“The Consumer Price Index in February increased 0.4% month-over-month and 3.2% year-over-year, higher than expected,” noted First American Economist Ksenia Potapov. “Core CPI, all items less food and energy, rose 0.4% month-over-month and 3.8% year-over-year.”

The CPI for shelter rose in February, as did the Index for gasoline. Combined, these two indexes contributed more than 60% of the monthly increase in the index for all items. The energy index rose 2.3% over the month, as all of its component indexes increased. The food index was unchanged in February, as was the food at home index. The food away from home index rose 0.1% over the month.

“Shelter and service inflation are slowly decelerating. Goods deflation, common throughout the past two decades, is helping push CPI down,” added Potapov. “Zoomed out, this CPI report suggests that inflation is cooling overall, but doing so slowly.”

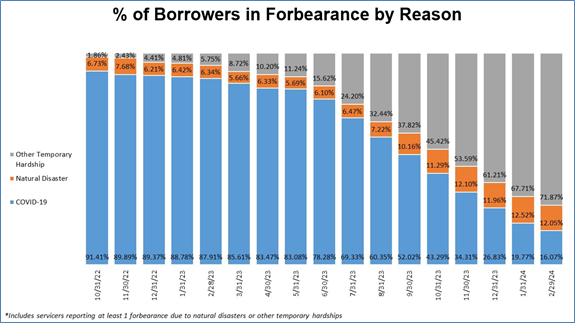

With the overall cost of living on the rise, were homeowners in decent shape in paying their mortgage? The MBA reported that by reason, 71.9% of borrowers were in forbearance plans for reasons such as a temporary hardship caused by job loss, death, divorce, or disability; while 16.1% of borrowers are in forbearance because of COVID-19. Another 12% are in forbearance due to natural disasters.

“The performance of servicing portfolios and loan workouts improved in February, as borrowers benefitted from tax refunds, the extra day in the month to submit their payments, and continued resilience in the job market,” said Marina B. Walsh, CMB, MBA’s VP of Industry Analysis. “Only around 110,000 loans nationwide remain in a forbearance plan, with little movement this month. The pandemic’s impact has waned, with only 16% of borrowers in forbearance because of COVID-19, compared to 72% for temporary personal hardships, and 12% for natural disasters.”

Measuring forbearance share

Loans in forbearance as a share of servicing portfolio volume (#) as of February 29, 2024:

- Total: 0.22% (previous month: 0.22%)

- Independent Mortgage Banks (IMBs): 0.25% (previous month: 0.26%)

- Depositories: 0.23% (previous month: 0.22%)

Gauging forbearance stages

By stage of forbearance, 56.2% of total loans in forbearance were in the initial forbearance plan stage, while 25.2% were in a forbearance extension. The remaining 18.6% were forbearance re-entries, including re-entries with extensions.

Of the cumulative forbearance exits for the period from July 1, 2020, through February 29, 2024, at the time of forbearance exit:

- 29.3% resulted in a loan deferral/partial claim.

- 17.6% represented borrowers who continued to make their monthly payments during their forbearance period.

- 18.7% represented borrowers who did not make all of their monthly payments and exited forbearance without a loss mitigation plan in place yet.

- 16.0% resulted in a loan modification or trial loan modification.

- 10.7% resulted in reinstatements, in which past-due amounts are paid back when exiting forbearance.

- 6.4% resulted in loans paid off through either a refinance or by selling the home.

The remaining 1.2% resulted in repayment plans, short sales, deed-in-lieus or other reasons.

Forbearance by region

The five states reporting the highest share of loans that were current as a percent of servicing portfolio included:

- Idaho

- Colorado

- Washington

- California

- Montana

The five states reporting the lowest share of loans that were current as a percent of servicing portfolio were found in:

- Louisiana

- Mississippi

- Indiana

- New York

- Illinois