In a new report, Matic Insurance research revealed the effects of credit restriction laws on home insurance premiums in the U.S.

Matic found that there are notable variations in the cost of insurance based on an individual’s credit score in a study examining the relationship between credit scores and house insurance premiums, especially in states where there are no limitations on the use of credit information by insurance companies.

Some states have established laws restricting the use of credit-based insurance ratings by insurance carriers in order to provide equitable access to insurance regardless of an individual’s financial situation, even though most states in the union permit this practice.

Eight U.S. states currently prohibit or significantly limit insurance companies from using credit information to make policy decisions, including:

- California

- Hawaii

- Maryland

- Michigan

- Massachusetts

- Oregon

- Utah

- Nevada

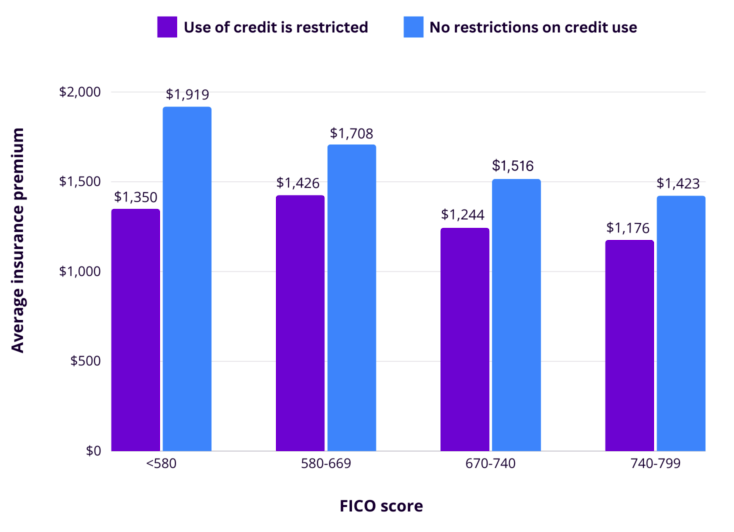

Credit restriction laws assist in stabilizing insurance costs but do not entirely relieve the burden on homeowners with poorer credit scores, according to Matic’s premium and coverage A (Cov A) statistics gathered between June 1, 2022 and March 1, 2024. Even yet, homeowners in places where credit use is restricted and whose credit scores were below 580 paid around 15%, or $174, more than homeowners with FICO scores between 740 and 799.

However, in states where there were no limits, the difference was much greater at $496, or around 35%, suggesting that homeowners with worse credit scores might benefit in states where there are rules limiting credit. Homeowners in states without credit limitation laws pay 42% more for insurance than homeowners in states with credit restrictions who have the same score.

Homeowners in places where credit limitation laws are in place pay less for insurance, even with greater Cov A, the portion of a policy that covers the primary structure of a home if it becomes damaged or destroyed. For individuals with FICO scores between 740 and 799, the average Cov A is $412,236 in states with credit limits compared to $376,060 in areas without credit restrictions.

People with lower FICO scores seem to be taking on greater risk with bigger deductibles in order to cut their premiums, in addition to being at a disadvantage in places without regulations restricting credit. For instance, the average deductible for homeowners with FICO scores between 580 and 669 was $1,397 from January 2022 to March 2023, but the average deductible increased by $315 from January 2023 to March 2024 to $1,712. On the other hand, homeowners with FICO scores between 740 and 799 paid a $1,349 deductible from January 2022 to March 2023, and their next year’s deductible increase was less severe at $262.

To read the full report, including more data, charts, and methodology, click here.