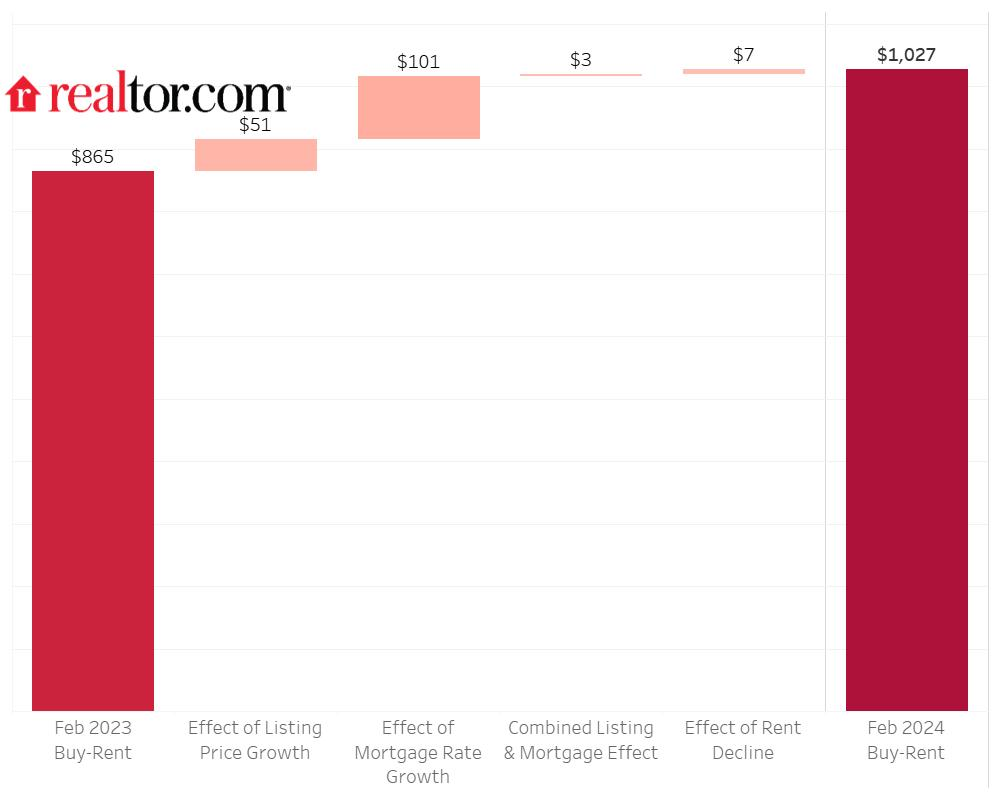

According to the Realtor.com Rental Report, rising mortgage interest rates, still-high housing prices, and lowering rents have made renting more reasonable than buying in all 50 major U.S. metros. In February, the mortgage payment for a starter home in the major metros was $1,027 (+60.1%) higher than the average monthly rent in those regions. At the same time last year, roughly 45 metros preferred renting.

Key Findings:

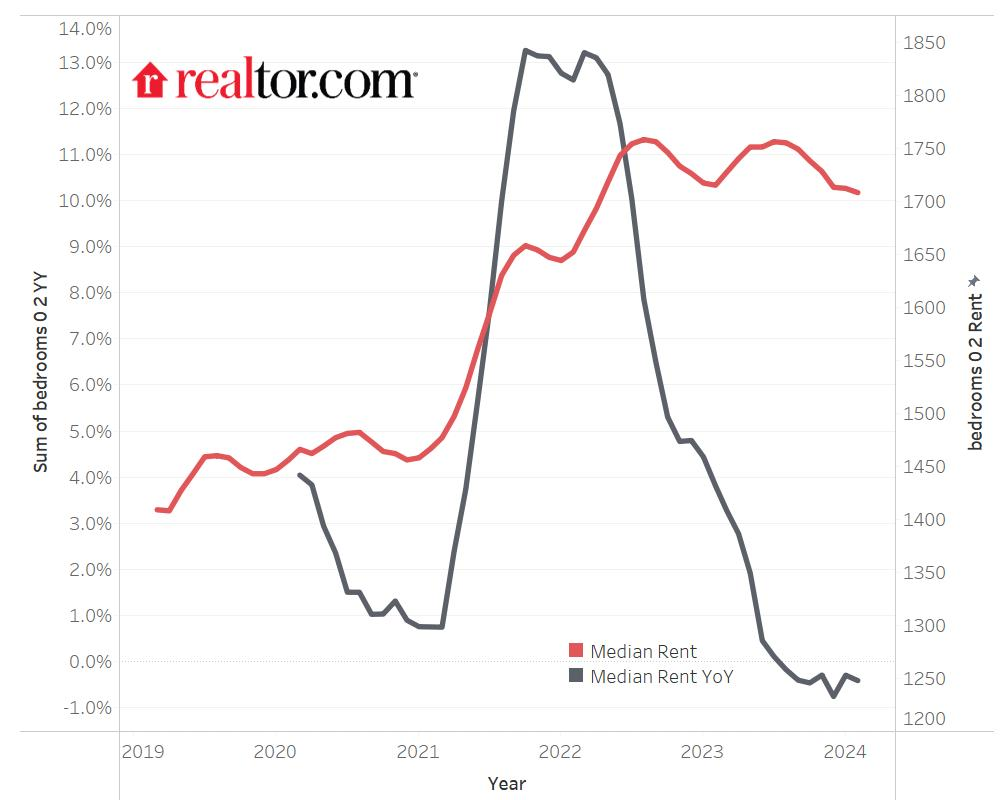

- February 2024 marks the seventh year-over-year rent decline in a row for 0-2 bedroom properties observed since trend data began in 2020. Asking rents dipped by $7 or -0.4% year-over-year (Y/Y).

- The median asking rent in the 50 largest metros decreased to $1,708, down by $4 from last month and down $50 (-2.8%) from its August 2022 peak.

- Median rent was mixed across size categories: Studio: $1,426, down $21 (-1.5% ) year-over-year; 1-bed: $1,587, down $6 ( -0.4%) year-over-year; 2-bed: $1,889, down $15 (-0.8% ) year-over-year.

- In all of the 50 largest U.S. metros, renting a starter home is a more affordable option than buying one. In these markets, the monthly cost of buying a starter home in February 2024 was $1,027 more or 60.1% higher than the cost of renting.

- The monthly savings from renting were $162 higher compared to the prior year across the top 50 metros.

“With rents continuing to fall and the cost of buying a home remaining high, exacerbated by the rise in mortgage rates in the later half of 2023, renting a home is now a more cost-effective option in all major U.S. markets,” said Danielle Hale, Chief Economist at Realtor.com. “Deciding whether to rent or buy often goes beyond a financial advantage though, and likely depends on a consumer’s circumstances.”

Top 10 Metros with the Largest Rent vs. Buy Savings:

1. Austin-Round Rock-Georgetown, Texas: $2,165 monthly rent savings (141.5% difference)

2. Seattle-Tacoma-Bellevue, WA: $2,422 (121.1%)

3. Phoenix-Mesa-Chandler, AZ: $1,528 (99.0%)

4. San Francisco-Oakland-Berkeley, CA: $2,689 (95.5%)

5. Los Angeles-Long Beach-Anaheim, CA: $2,539 (89.7%)

6. San Jose-Sunnyvale-Santa Clara, CA: $2,780 (86.7%)

7. Nashville-Davidson-Murfreesboro-Franklin, TN: $1,366 (86.0%)

8. Portland-Vancouver-Hillsboro, Oregon, WA: $1,396 (84.4%)

9. Sacramento-Roseville-Folsom, CA: $1,514 (82.1%)

10. Houston-The Woodlands-Sugar Land, Texas: $1,103 (80.0%)

Advantages of Renting Growing in Most U.S. Markets

In February, the cost of buying a starter house in the top 50 metros was $1,027 (60.1%) greater than renting one, while in February 2023, the cost to buy was $865 higher than renting, resulting in a $162 bigger monthly savings from renting than the previous year. The savings are primarily driven by falling rent prices and rising purchasing costs, particularly interest rates – the 30-year fixed mortgage rate stayed at 6.78% in February 2024, up from 6.26% the previous year.

The benefits of renting have become “more pronounced” in major U.S. cities. Looking particularly at the top 10 metros that prefer renting to buying, the average monthly prices for purchasing a starter house were $1,950 (95.6%) higher than rents, or nearly double the cost. Those metros are primarily marketplaces with a higher proportion of tech workers and high earners, and their average rent and purchase expenses are higher than the national average.

“Renters often prize flexibility while the biggest reasons homebuyers cite are that they want a place of their own and to be closer to family and friends,” Hale said. “The financial scales have tipped monthly costs in favor of renting over buying, but it does not bring the benefit of housing wealth gains over time that owning does and movers should consider their long-term housing plans and personal situation as they make this decision.”

Renting Outpaces Buying in All Major Metros, Especially in the South and West

In February, median rents dropped for all unit sizes. Despite seven months of yearly rent declines, median rents are $252 (17.3%) higher than they were in 2020, before to the epidemic. Last February, 45 metros favored renting, but in the last year, Memphis, TN, Birmingham, AL, Pittsburgh, St. Louis, and Baltimore metros have shifted from buying to renting. Four out of five of those markets were among the top markets with a large percentage of investor activity, which may have expedited the growth of housing prices and increased the overall costs of purchasing a home, tipping those markets even further toward renting over buying.

Austin, Texas, led the list of markets that favored renting, with the monthly cost of owning a starter house being $3,695—an estimated 141.5% higher than the monthly rent of $1,530, for a monthly savings of $2,165. Seattle, Phoenix, San Francisco, and Los Angeles were all among the top markets for renting rather than owning. San Jose, CA, Dallas, San Francisco, Columbus, Ohio, Miami, and Minneapolis were among the metro areas with declining rental advantages.

While the advantages of renting have been obvious in most metropolitan areas, the discrepancies between buying and renting in San Jose, CA, Dallas, and San Francisco, Columbus, Ohio and Miami, have seen a decrease in dollar value. Specifically, purchasing a starter home in San Jose cost $2,780 (86.7%) more than renting one in February 2024, but it was $115 less than the buy-cost gap found in February 2023. In Dallas, TX, the difference between purchasing and renting was $1,183 (79.3%), $45 less than the gap observed a year ago.

The buy-rent discrepancy in San Francisco fell by $29 in the last year, while in Columbus, OH, the gap narrowed from $926 (76.9%) in February 2023 to $902 (76.4%). Over the last year, the buy-rent gap in Miami has fallen by $16, while the gap in Minneapolis has decreased by just $1.

Investors Taking Up Their Share of the Homebuying Pie

Memphis, TN , together with Pittsburgh, PA, St. Louis, MO, Baltimore, MD and Birmingham, AL are the five metros that flipped from buy-favoring to rent-favoring over the past 12 months. In other words, the buy-rent gap in these five metros are smaller than their peers. Specifically, Pittsburgh was the metro seeing the smallest buy-rent gap across the top 50 metros in February of this year.

In addition, Memphis, TN, St. Louis, Baltimore, and Birmingham, AL, were among the top markets, seeing a high share of homebuying from investors. This trend may be accelerating the growth of home prices, increasing the overall cost of home buying, and tilting these markets further toward rent-favoring.

To read the full report, including more data, charts, and methodology, click here.