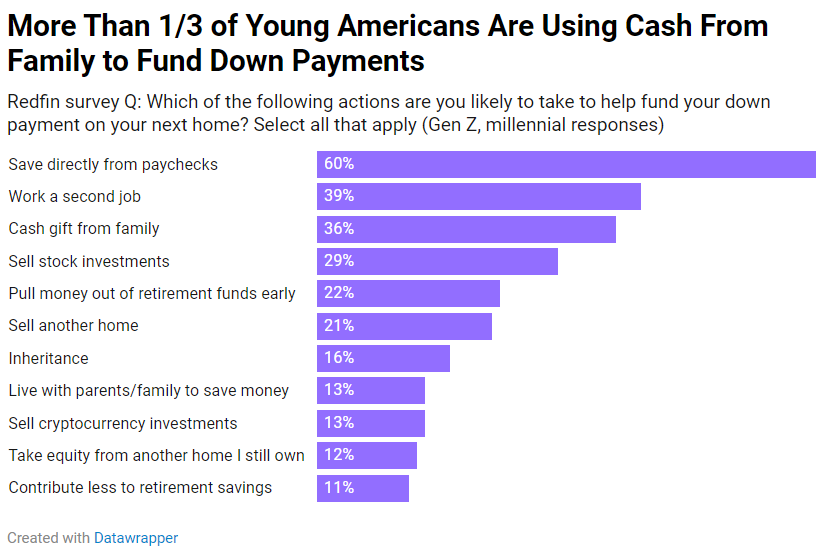

More than one-third (36%) of Gen Zers and millennials planning to purchase a home soon expect to get a cash gift from family to help fund their down payment, according to a new survey from Redfin.

Young homebuyers are also getting financial assistance from family members in different ways. Approximately one in every six (16%) Gen Zers and millennials say they will utilize an inheritance to help fund their down payment, while roughly 13% intend to live with their parents or other family members to save money for down payments.

Working to earn money is the most frequent strategy for young buyers to fund down payments, as some 60% say they’ll save directly from their salaries, while 39% plan to work a second job.

“Nepo-homebuyers have a growing advantage over first-generation homebuyers. Because housing costs have soared so much, many young adults with family money get help from Mom and Dad even when they have jobs and earn a perfectly respectable income,” said Redfin Chief Economist Daryl Fairweather. “The bigger problem is that young Americans who don’t have family money are often shut out of homeownership. Many of them earn a perfectly good income, too, but they aren’t able to afford a home because they’re at a generational disadvantage; they don’t have a pot of family money to dip into. This contributes to wealth inequality and often prevents young people from gaining economic ground on their peers who come from more privileged backgrounds.”

Young Homebuyers 2x as Likely to Use Family Money for Down Payment Than They Were Years Ago

According to a Redfin report from 2019, only 18% of millennials used a cash gift from relatives to assist fund their down payment in 2019, and that figure is expected to rise to 23% by 2023.

Young Americans are increasingly turning to family members to help with down payments, owing to the rising cost of home ownership. Home prices in the U.S. are up about 40% since before the pandemic, and they have risen 7% in the last year alone, with little inventory supporting prices despite declining demand.

In many ways, Generation Z and millennials face a more difficult financial picture than their parents had at the same age: their incomes are lower, they have greater student loan debt, and inflation has raised the cost of practically everything, including housing.

The fact that so many young Americans rely on family members to help them save for a down payment demonstrates that housing is simply too pricey. A new Redfin survey discovered that starter homes are becoming increasingly difficult to afford, pushing many Americans out of the market entirely. People who do not have financial support from their families are at a significant disadvantage when it comes to acquiring a home.

“The American Dream is just as much about class mobility as it is the home with a white-picket fence, and the housing affordability crisis has made both elements of the dream harder to attain,” Fairweather said.

Affordability Challenging the Path to Homeownership for Young Americans

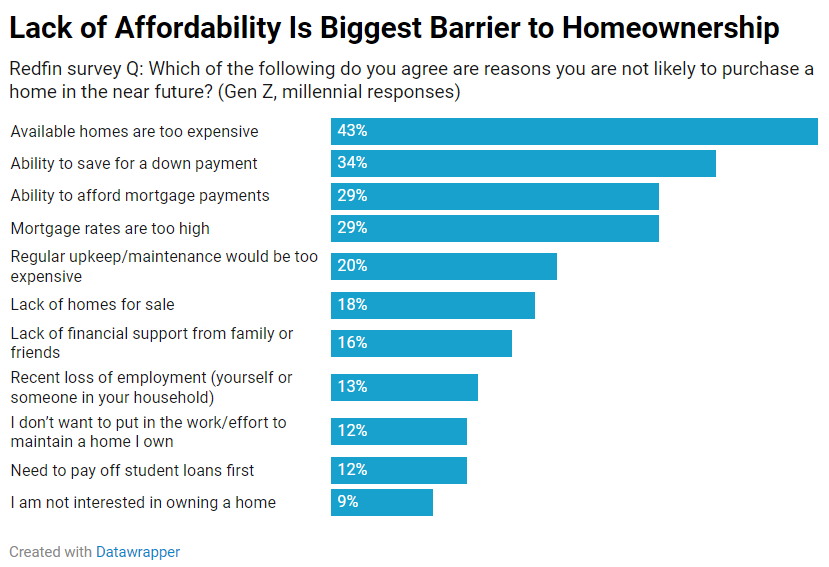

The biggest financial hurdle for young Americans who are unlikely to buy a home in the near future is a lack of affordable options.

The most prevalent reaction among Gen Zers and millennials (43%) is that they are unlikely to buy a home soon because the homes on the market are too pricey. Around one-third (34%) say their ability to save for a down payment is a barrier to buying a home; the second most prevalent response is the ability to afford mortgage payments (29%) and high mortgage rates.

Of those Gen Zers and millennials who do not want to buy a home in the near future, an estimated 16% cited a lack of financial support from family or friends as a factor. Further, more than one-tenth (12%) of young Americans believe they must pay off school loans before they can buy a home.

To read the full report, including more data, charts, and methodology, click here.