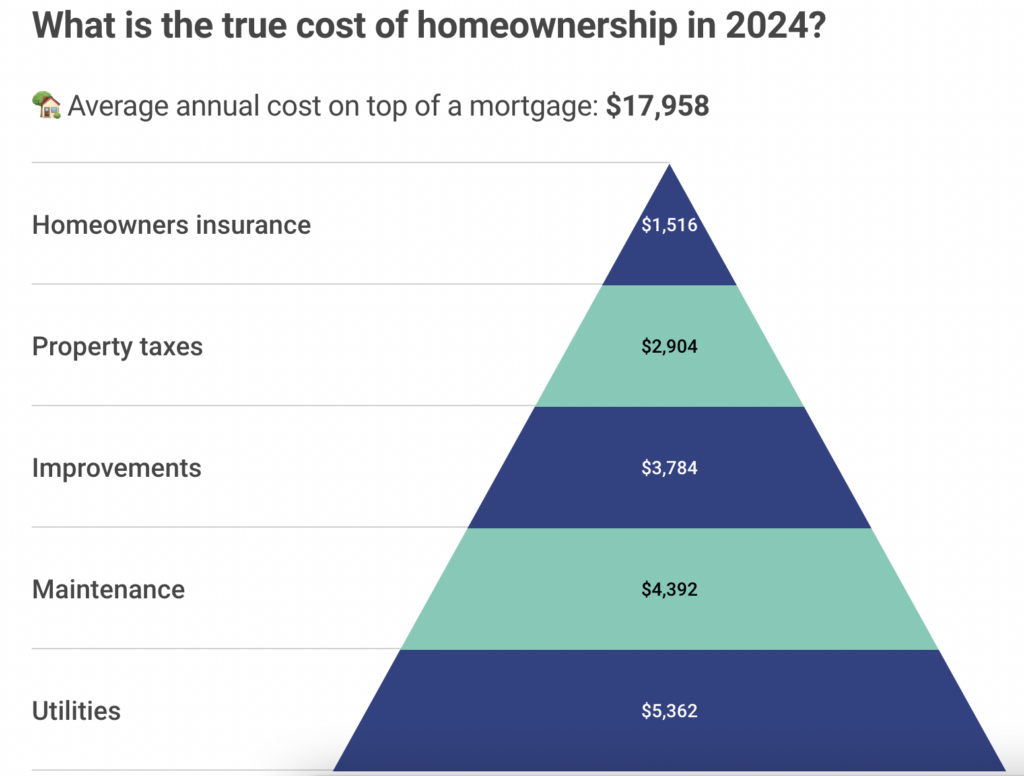

Money, money, money! Everything costs money! In addition to their mortgage, the average homeowner spends $17,958 per year on expenses like as home upkeep, upgrades, utilities, property taxes, and insurance, according to new Real Estate Witch data.

So, what does the average homeowner spend per year?

Annually, average homeowners spend:

- Roughly $4,392 on maintenance and repairs

- An estimated $3,784 on renovations and improvements

- Approximately $5,362 on utilities

- A total of $2,904 on property taxes

- Nearly $1,516 on homeowners insurance

Over the course of a 30-year mortgage, this equates to a whopping $538,740 in additional expenses—enough to purchase a second home.

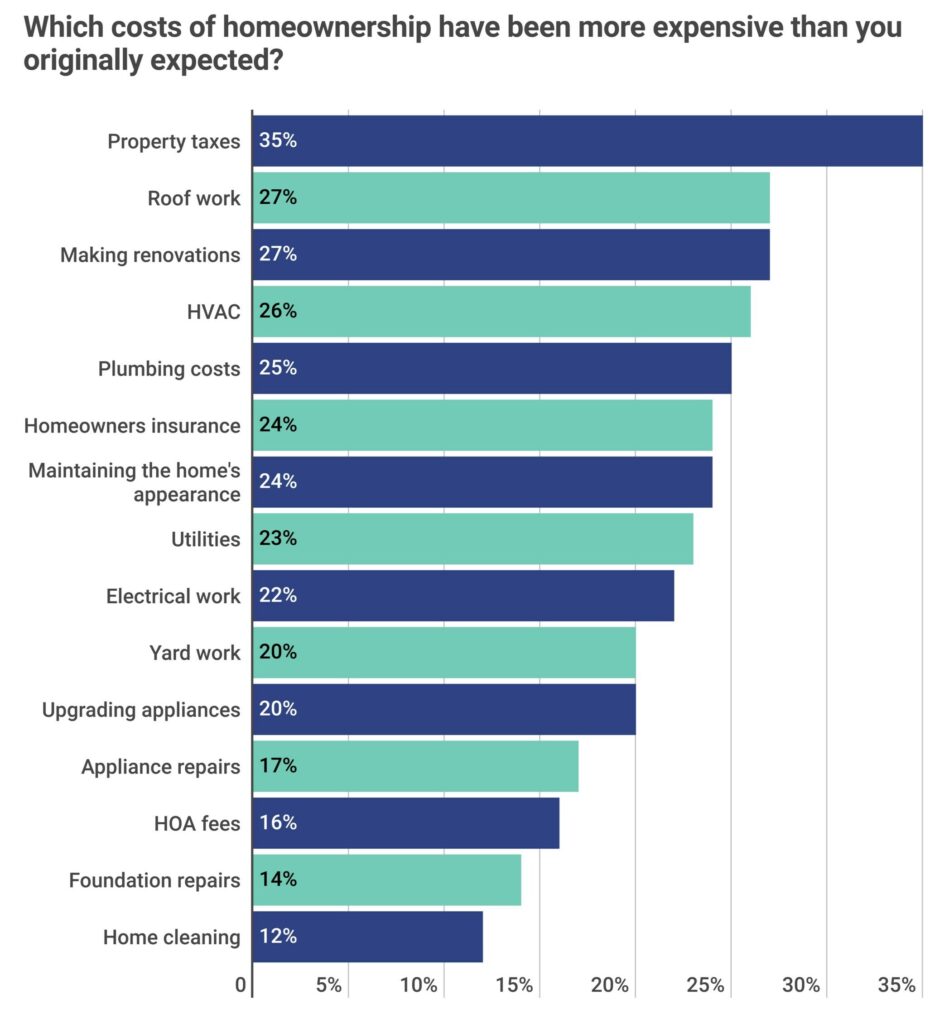

Plus, nearly a quarter of homeowners (23%) spend more than 30% of their income on house expenses in addition to their mortgage payments. Unsurprisingly, 88% believe the true cost of purchasing a home is higher than they anticipated, and 67% have regrets about their purchase. In fact, 26% of homeowners believe they overpaid for their property, with 46% of 2023 and 2024 buyers experiencing both high home prices and high mortgage rates.

More than one-third (36%) of homeowners report that their home has had a negative influence on their finances, and nearly one-fourth (23%) report that it has had an adverse effect on their mental health.

On average, homeowners spend 588 hours a year working on house maintenance and improvements, which equates to approximately 11.3 hours per week or 24.5 days per year. That means that every 15 years, the average homeowner loses one year of their life (365 days) to home maintenance and improvements. In addition, one-fifth of households (19%) cannot afford a $500 emergency repair without incurring credit card debt.

Nearly 9 in 10 Homeowners Say the True Cost of Homeownership is More Expensive Than Expected

Almost 9 out of 10 homeowners (88%) believe the actual cost of buying a home is higher than they anticipated. Approximately 67% have regrets about their property purchase.

Some people believe that the cost of homeownership is too high, both financially and emotionally. Approximately 36% of homeowners report that their home has had a negative influence on their money, while 23% report that it has harmed their overall mental health.

In the face of rising costs, more than one-fourth of homeowners (28%) say they’ve contemplated returning to renting, and 20% have taken on additional debt to cover the cost of homeownership.

To read the full report, including more data, charts, and methodology, click here.