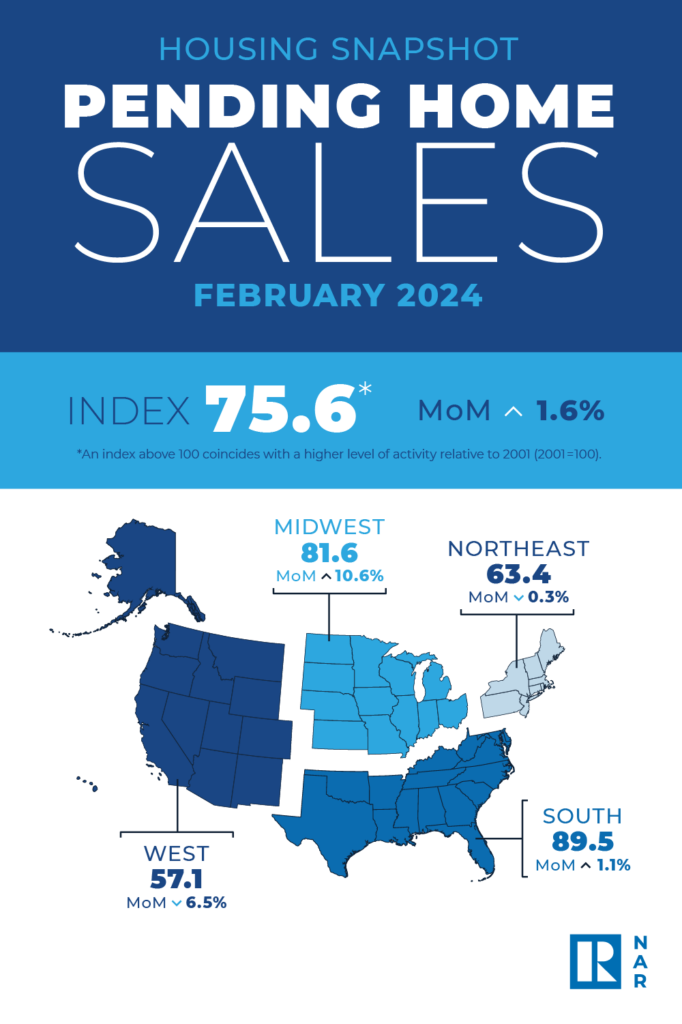

In a new study, the National Association of Realtors has reported that pending home sales increased by 1.6% in February. The Midwest and South saw monthly transaction increases, while the Northeast and West saw decreases. All four U.S. areas had year-over-year declines. Overall, the Pending Home Sales Index (PHSI) rose to 75.6 in February, and year-over-year, pending transactions were down 7.0%.

“Pending home sales climbed 1.6% in February to an index of 75.6, but remained 7.0% lower annually as climbing mortgage rates kept many would-be buyers on the sidelines,” said Hannah Jones, Senior Economic Research Analyst for Realtor.com. “New home sales, which are also a measure of contract signings, fell just slightly on a monthly basis in February, but were still 5.9% higher than one year prior. Existing home inventory was still relatively scarce in February, but improved over the previous year, helping fuel a 9.5% monthly surge in existing home sales.”

This comes after pending home sales in January dropped nearly 5%, declining in all U.S. regions. In January, the Northeast PHSI increased 0.8% from last month to 63.6, a decline of 5.5% from January 2023. The Midwest index decreased 7.6% to 73.7 in January, down 11.6% from one year ago.

“February’s increase in pending home sales seems like good news, but its nuances reflect a housing market that’s still struggling,” said Kate Wood, Home and Mortgage Expert at NerdWallet. “Year-over-year, sales were down 7%. And the increase wasn’t spread evenly—the northeast and west both saw pending sales drop in February. Homes going under contract in the midwest and south propped up the figure.”

Pending Home Sales Regional Breakdown:

- The Northeast PHSI fell 0.3% from last month to 63.4, a 9.0% drop from February 2023.

- The Midwest index rose 10.6% to 81.6 in February, down 2.5% from a year ago.

- The South PHSI increased 1.1% to 89.5 in February, down 8.5% from the previous year.

- The West index declined 6.5% in February to 57.1, a 7.9% decrease from February 2023.

“Pending home sales surged 10.6% in the Midwest, but remained 2.5% lower annually in the region,” Jones said. “The South saw a 1.1% monthly improvement, but contract signings were 8.5% lower year-over-year. The relatively high-priced Northeast and the West both saw falling pending home sales on both a monthly and an annual basis. Contract signings were down 0.3% monthly and 9.0% annually in the Northeast, and fell 6.5% monthly and 7.9% annually in the West.

Jones continued, “Overall, active inventory grew 14.8% annually in February and prices remained relatively stable compared with the previous year as more affordable inventory made its way into the market. Though the market saw nearly 40% fewer homes for sale in February compared with pre-pandemic, home shoppers enjoyed more homes for sale and more affordable options than one year prior, which could boost buyer activity despite still-elevated mortgage rates.”

“Pending home sales increased 1.6% in February, slightly more than the expected 1.5%,” said Odeta Kushi, Deputy Chief Economist at First American. “Yet, pending home sales remain down 7% compared with one year ago. Even though mortgage rates increased in February, the supply of existing homes for sale ticked up as well. Affordability constraints and still-low inventory levels will continue to dampen housing market potential. Overall, the level of sales activity remains sluggish, but the uptick in pending sales is a welcome and promising sign for the housing market.”

According to Jones, as mortgage rates rose, both new and pending house sales leveled off from their December highs. However, the number of homes listed between $200,000 and $350,000 climbed by 20.6% annually in February 2024, providing possibilities for purchasers looking to obtain a property despite rising mortgage rates. With the Best Time to Sell approaching, property buyers may expect increased for-sale inventory in the coming months.

“While modest sales growth might not stir excitement, it shows slow and steady progress from the lows of late last year,” said Lawrence Yun, Chief Economist at NAR. “Ongoing job gains are clearly increasing demand along with more inventory. The high-cost regions in the Northeast and West experienced pullbacks due to affordability challenges. Home prices rising faster than income growth is not healthy and adds challenges for first-time buyers.”

Yun further noted, “There will be a steady rise in inventory from recent growth in home building. Additionally, many sellers, who delayed listing in the past two years, will begin to put their homes on the market to move to a different home that better fits their new life circumstances—such as changes in family composition, jobs, commuting patterns and retirees wanting to be closer to their grandkids.”

To read the full report, including more data, charts, and methodology, click here.