As the market continues to turn, mortgage holders nationwide continue to feel the brunt of economic headwinds, as the average national mortgage payment rose $50 month-over-month in February, according to the latest Mortgage Bankers Association (MBA) Purchase Applications Payment Index (PAPI).

Homebuyer affordability further declined as the MBA reported the national median payment applied for by purchase applicants increasing to $2,184 from $2,134 in January. Mortgage payments were up $123 in February 2024 from one year ago, equal to a 6% increase.

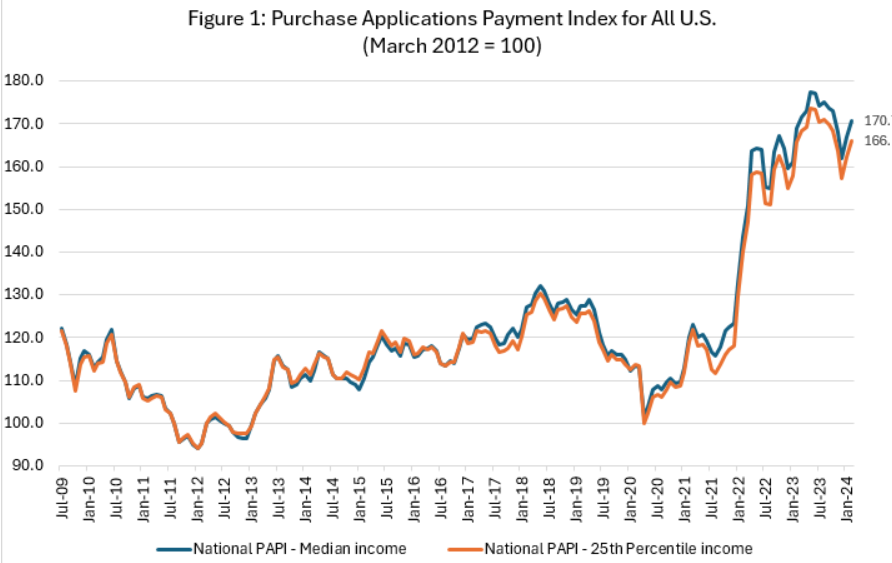

The MBA’s PAPI measures how new monthly mortgage payments vary across time–relative to income–using data from MBA’s Weekly Applications Survey (WAS).

Affordability slips further in February

“Homebuyer affordability conditions declined further in February as recent economic data on jobs and inflation continue to keep mortgage rates elevated to around 7%,” said Edward Seiler, MBA’s Associate VP, Housing Economics, and Executive Director, Research Institute for Housing America. “Challenging affordability conditions and low housing supply are keeping some prospective homebuyers on the sidelines this spring. The eventual, expected decline in rates in the coming months will hopefully spur new activity in the housing market.”

An increase in MBA’s PAPI–indicative of declining borrower affordability conditions–means that the mortgage payment to income ratio (PIR) is higher due to increasing application loan amounts, rising mortgage rates, or a decrease in earnings. A decrease in the PAPI–indicative of improving borrower affordability conditions–occurs when loan application amounts decrease, mortgage rates decrease, or earnings increase.

Charting the financial impact on America’s households

Mortgage payment increases in February did not target any particular household, as Black, Hispanic and White households all felt the financial impact of a rise in payments.

Homebuyer affordability decreased for Black households, with the national PAPI increasing from 163.1 in January to 166.9 in February, as homebuyer affordability decreased for Hispanic households, with the national PAPI increasing from 159.3 in January to 163.1 in February. Homebuyer affordability decreased for White households, with the national PAPI increasing from 170.2 in January to 174.2 in February.

Measuring payments YoY

The national PAPI increased 2.4% to 170.7 in February from 166.8 in January 2024. Median earnings were up 4.8% compared to one year ago, and while payments increased 6%, the strong earnings growth means that the PAPI is up 1.1% on an annual basis. For borrowers applying for lower-payment mortgages (the 25th percentile), the national mortgage payment increased to $1,473 in February from $1,438 in January.

The Builders’ Purchase Application Payment Index (BPAPI) showed that the median mortgage payment for purchase mortgages from MBA’s Builder Application Survey increased to $2,534 in February from $2,501 in January.

Additional PAPI findings

The national median mortgage payment for FHA loan applicants was $1,872 in February, up from $1,830 in January, and up from $1,707 in February 2023. The national median mortgage payment for conventional loan applicants was $2,194, up from $2,147 in January and up from $2,117 in February 2023.

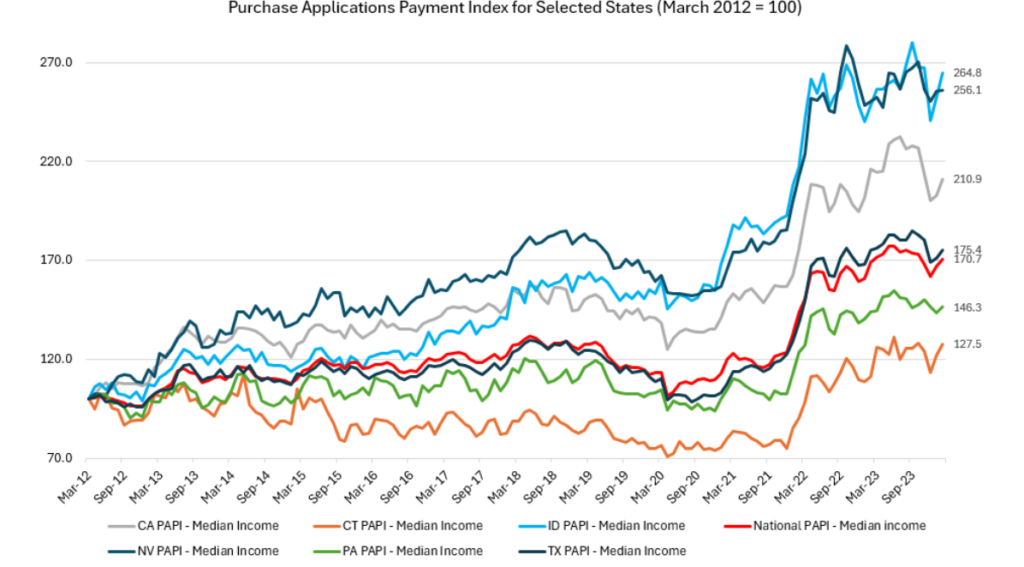

The top five states with the highest PAPI were:

- Idaho (264.8)

- Nevada (256.1)

- Arizona (223.8)

- Florida (221.8)

- Utah (216.3)

The top five states with the lowest PAPI were:

- Louisiana (127.4)

- Connecticut (127.6)

- Vermont (130.0)

- New York (130.2)

- Alaska (130.6)