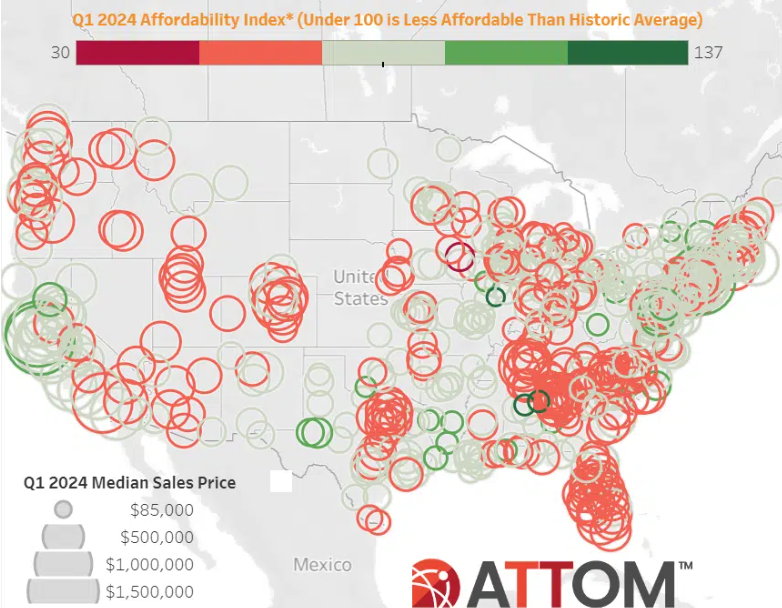

ATTOM has released its Q1 2024 U.S. Home Affordability Report, showing that median-priced single-family homes and condos remain less affordable in Q1 of 2024 compared to historical averages in more than 95% of counties around the nation with enough data to analyze. The latest trend continues a pattern, dating back to 2022, of homeownership requiring historically large portions of wages around the country.

The report also shows that major expenses on median-priced homes consume 32.3% of the average national wage in Q1, several points above common lending guidelines.

Both measures represent slight quarterly improvements, but remain worse than a year ago, and still sit at levels that have worked against home buyers for three years. That scenario has continued as increases in home values and major homeownership expenses have outpaced gains in wages, despite a small respite from the second half of last year into Q1 of 2024. As a result, the portion of average wages nationwide required for typical mortgage payments, property taxes and insurance remains up almost three percentage points from a year ago, and 11 points from early in 2021, right before home-mortgage rates began shooting up from their lowest levels in decades. The latest expense-to-wage ratio continues to sit above the 28% level preferred by mortgage lenders and marks one the highest points over the past decade.

“The picture for homebuyers is brightening a little again as affordability measures have improved for the second quarter in a row,” said Rob Barber, CEO for ATTOM. “For sure, it’s not like things are coming up roses for house hunters. Affording a home remains a financial stretch, or a pipe dream, for so many households. But with mortgage rates coming down and home prices growing only by modest amounts, it’s gotten a bit easier for average wage earners to afford a home so far this year. The upcoming Spring buying season will say a lot about whether home prices remain stable enough for this trend to continue.”

Affordability struggles linger

The Q1 patterns come as the national median home price has risen less than 2% this quarter from the previous quarter, and is still down from peaks hit last year. Further aiding buyers are mortgage rates that have dipped back down below 7% for a 30-year fixed loan after rising close to 8% in 2023. Inflation, while still running close to 4%, is less than half the levels hit in 2021. Those factors have helped reduce home ownership expenses following a period when they were shooting up faster than wages.

ATTOM’s report determined that affordability for average wage earners by calculating the amount of income needed to meet major monthly home ownership expenses—including mortgage payments, property taxes and insurance—on a median-priced single-family home, assuming a 20% down payment and a 28% maximum “front-end” debt-to-income ratio. That required income was then compared to annualized average weekly wage data from the U.S. Bureau of Labor Statistics.

Compared to historical levels, median homeownership costs in 577 of the 590 counties analyzed in Q1 of 2024 are less affordable than in the past. That number is down slightly from 584 of the same counties in Q4 of 2023, but up from 549 in Q1 of last year, and more than 10 times the figure from early 2021.

Homeownership expenses eating into average wages

The average portion of local wages consumed by major homeownership expenses on typical homes was considered unaffordable during Q1 of 2024 in 425, or 72%, of the 590 counties in the report, based on the 28% guideline. Counties with the largest populations that were unaffordable in Q1 include:

- Los Angeles County, California

- Maricopa County (Phoenix), Arizona

- San Diego County, California

- Orange County, California (outside Los Angeles)

- Miami-Dade County, Florida

The most populous of the 165 counties where major expenses on median-priced homes are still affordable for average local workers in Q1 of 2024 were found in:

- Cook County (Chicago), Illinois

- Harris County (Houston), Texas

- Wayne County (Detroit), Michigan

- Philadelphia County, Pennsylvania

- Oakland County, Michigan (outside Detroit)

Median home prices jump nationwide

The national median price for single-family homes and condos has grown to $336,250 in Q1 of 2024, just $9,000 less than the all-time high of $345,000 hit several times in the past two years. The latest figure is up 1.9% from $330,000 in Q4 of 2023, and up 5.1% from $319,900 in Q1 of last year.

Data was analyzed by ATTOM for counties with a population of at least 100,000 and at least 50 single-family home and condo sales in Q1 of 2024. Among the 46 counties in the report with a population of at least one million, the biggest year-over-year increases in median prices during Q1 of 2024 were found in:

- Orange County, California (outside Los Angeles) (up 14.6%)

- Santa Clara County (San Jose), California (up 10.3%)

- Palm Beach County (West Palm Beach), Florida (up 9.9%)

- Nassau County, New York (outside New York City) (up 8.9%)

- Miami-Dade County, Florida (up 8.7%)

Counties with a population of at least one million where median prices remain down the most from Q1 of 2023 to the same period this year were found in:

- Travis County (Austin), Texas (down 8.1%)

- New York County (Manhattan), New York (down 7.9%)

- Bexar County (San Antonio), Texas (down 3.8%)

- Tarrant County (Forth Worth), Texas (down 3.2%)

- Alameda County (Oakland), California (down 2.5%)

Prices growing faster than wages

With home values mostly up annually throughout the U.S., year-over-year price changes are outpacing changes in weekly annualized wages during the early months of 2024 in 358 (60.7%) of the counties analyzed in the report. The current list of counties where prices are increasing more than wages annually, or decreasing less, includes:

- Los Angeles County, California

- Cook County, (Chicago), Illinois

- Maricopa County (Phoenix), Arizona

- San Diego County, California

- Orange County, California (outside Los Angeles)

On the flip side, year-over-year changes in average annualized wages have bested price movements during Q1 of 2024 in 232 of the 590 counties analyzed (39.3%), with the latest group where wages are increasing more, or declining less, than prices include:

- Harris County (Houston), Texas

- Dallas County, Texas

- Tarrant County (Fort Worth), Texas

- Bexar County (San Antonio), Texas

- Alameda County (Oakland), California

Homeownership expenses mounting

With mortgage rates tracking downward in recent months after rising last year, the portion of average local wages consumed by major expenses on median-priced, single-family homes and condos has decreased from Q4 of 2023 to Q1 of 2024 in 91.5% of the 590 counties analyzed. However, it remains up annually in 90.3% of those markets. The typical $1,930 cost of mortgage payments, homeowner insurance, mortgage insurance (MI) and property taxes nationwide consumes 32.3% of the average annual national wage of $71,708 this quarter. That is down from 33.2% in Q4 of 2023 as expenses commonly have dropped almost 3% while wages have remained flat nationwide. But the latest portion is up from 29.6% in Q1 of last year, and is above the recent low point of 21.3% hit in Q1 of 2021, as wage gains have lagged behind increases in expenses over that longer time period.

The latest figure exceeds the 28% lending guideline in 425, or 72%, of the counties analyzed, assuming a 20% downpayment. That is down from 78.3% of the same group of counties in Q4 of 2023, but still up from 64.9% a year ago, and more than twice the level in early 2021.

In nearly 30% of the markets analyzed, major expenses currently consume at least 43% of average local wages–an amount considered seriously unaffordable.

Northeast and West Coast living large

The top 20 counties where major ownership costs require the largest percentage of average local wages were again reported in the Northeast or on the West Coast, with the leaders found in:

- Kings County (Brooklyn), New York (109.5% of annualized local wages needed to buy a single-family home)

- Marin County, California (outside San Francisco) (102.8%)

- Maui County, Hawaii (100.5%)

- Santa Cruz County, California (97.3%)

- San Luis Obispo County, California (95.3%)

Aside from Kings County, those with a population of at least one million where major ownership expenses typically consume more than 28% of average local wages in Q1 of 2024 include:

- Orange County, California (outside Los Angeles) (95.1% required)

- Queens County, New York (78.5%)

- Nassau County (outside New York City), New York (74%)

- Riverside County, California (71.4%)

Counties where the smallest portion of average local wages were required to afford the median-priced home during Q1 of this year were found in:

- Macon County (Decatur), Illinois (11.9% of annualized weekly wages needed to buy a home)

- Schuylkill County, Pennsylvania (outside Allentown) (12.1%)

- Jefferson County (Birmingham), Alabama (12.5%)

- Cambria County, Pennsylvania (east of Pittsburgh) (12.7%)

- Peoria County, Illinois (12.9%)

Counties with a population of at least one million where major ownership expenses typically consume less than 28% of average local wages in Q1 of 2024 include:

- Wayne County (Detroit), Michigan (13.3%)

- Allegheny County (Pittsburgh), Pennsylvania (17.3%)

- Cuyahoga County (Cleveland), Ohio (17.7%)

- Philadelphia County, Pennsylvania (18.4%)

- Harris County (Houston), Texas (24.6%)

Almost all local markets struggling with affordability

Among the 590 counties analyzed, 577, or 97.8%, are less affordable in Q1 of 2024 than their historic affordability averages. That is slightly better than the 99% level in Q4 of 2023, but worse than the 93.1% portion from of a year ago, and more than 10 times the 7.8% figure from Q1 of 2021.

Historical indexes have worsened since Q1 of last year in 90.3% of those counties, leaving the nationwide index at one of its lowest points over the past decade. Counties with the worst affordability indexes in Q1 of 2024 include:

- Linn County, Iowa (index of 30)

- Jasper County, Missouri (index of 55)

- Lucie County (Port St. Lucie), Florida (56)

- Blount County, Tennessee (outside Knoxville) (56)

- Clayton County, Georgia (outside Atlanta) (57)

Counties with a population of at least one million that were found to be less affordable than their historic averages (indexes of less than 100 are considered historically less affordable) include:

- Mecklenburg County (Charlotte), North Carolina (index of 65)

- Hillsborough County (Tampa), Florida (66)

- Collin County (Plano), Texas (67)

- Maricopa County (Phoenix), Arizona (67)

- Clark County (Las Vegas), Nevada (68)

Among counties with a population of at least one million, those where the affordability indexes have worsened most from Q1 of 2023 to Q1 of 2024 were found in:

- Orange County, California (outside Los Angeles) (index down 16.5%)

- Philadelphia County, Pennsylvania (down 13.5%)

- Santa Clara County (San Jose), California (down 12.5%)

- Nassau County, New York (outside New York City) (down 11.8%)

- Fulton County (Atlanta), Georgia (down 11.5%)

Number of affordable counties sliding

Only 13 of the 590 counties in the report (2.2%) are more affordable than their historic averages in Q1 of 2024. That is slightly more than the 1% level in Q4 of this year, but less than 6.9% a year ago, and far worse than the 92.2% portion that were historically more affordable in Q1 of 2021.

Counties that were more affordable in Q1 of this year compared to historical averages include:

- Jefferson County (Birmingham), Alabama (index of 136)

- Macon County (Decatur), Illinois (130)

- New York County (Manhattan), New York (115)

- Midland County, Texas (112)

- San Francisco County, California (109)

Breaking down the data

The ATTOM U.S. Home Affordability Index analyzed median home prices derived from publicly recorded sales deed data collected by ATTOM and average wage data from the U.S. Bureau of Labor Statistics (BLS) in 590 U.S. counties with a combined population of 260.8 million during Q1 of 2024. The affordability index is based on the percentage of average wages needed to pay for major expenses on a median-priced home with a 30-year fixed-rate mortgage, and a 20% downpayment. Those expenses include property taxes, home insurance, mortgage payments and mortgage insurance. Average 30-year fixed interest rates from the Freddie Mac Primary Mortgage Market Survey (PMMS) were used to calculate monthly house payments.