According to the most recent Commercial Delinquency Report from the Mortgage Bankers Association (MBA), there has been an increase in commercial mortgage delinquencies during Q4 of 2023.

This comes after the commercial mortgage delinquencies increase experienced in Q3 of 2023, according to MBA’s December survey.

”Commercial mortgage delinquency rates rose again during the fourth quarter of 2023,” said Jamie Woodwell, MBA’s Head of Commercial Real Estate Research. “Every major capital source has seen an increase over the last six months, as higher interest rates, uncertainty about property values, and challenges in some property fundamentals work their way through the markets.”

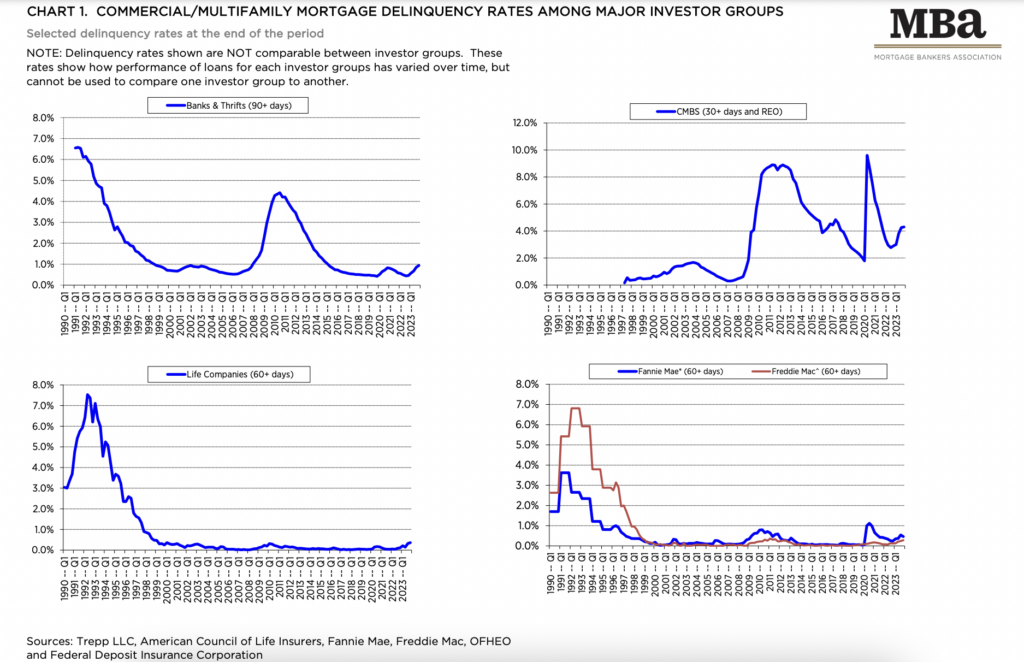

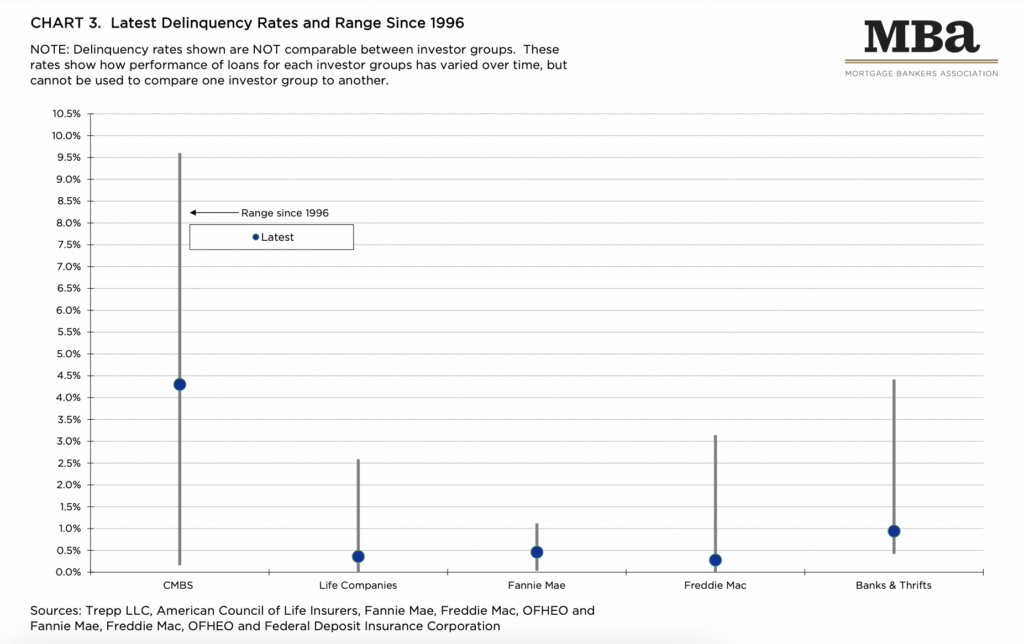

Based on the unpaid principal balance (UPB) of loans, delinquency rates for each group at the end of Q4 of 2023 were as follows:

- Banks and thrifts (90 or more days delinquent or in non-accrual): 0.94%, an increase of 0.09 percentage points from Q3 of 2023.

- Life company portfolios (60 or more days delinquent): 0.36%, an increase of 0.04 percentage points from Q3 of 2023.

- Fannie Mae (60 or more days delinquent): 0.46%, a decrease of 0.08 percentage points from Q3 of 2023.

- Freddie Mac (60 or more days delinquent): 0.28%, an increase of 0.04 percentage points from the Q3 of 2023.

- CMBS (30 or more days delinquent or in REO): 4.30%, an increase of 0.04 percentage points from Q3 of 2023.

Note: The commercial delinquency rates of five of the major investor groups—commercial banks and thrifts, life insurance companies, commercial mortgage-backed securities (CMBS), and Fannie Mae and Freddie Mac—are examined in the MBA’s quarterly analysis. Over 80% of outstanding commercial mortgage debt is held by these entities collectively. Delinquency rates are not comparable between investor groups since each one tracks delinquencies differently. For instance, Freddie Mac excludes loans that are in compliance with the terms of the forbearance agreement, but Fannie Mae counts those loans as delinquent.

To read the full report, including more data, charts, and methodology, click here.