While the start of April kicked off National Fair Housing Month, CoreLogic has published the CoreLogic Home Price Index (HPI) and HPI Forecast for the month of February in 2024.

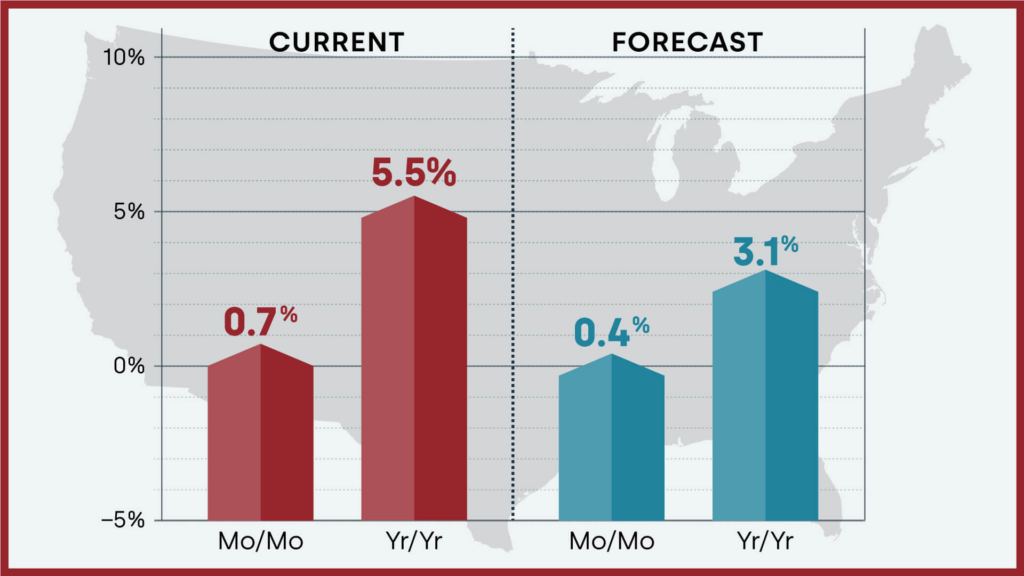

As the effect of comparing gains with weak 2022 home prices eventually wore off, the annual growth in U.S. home prices ultimately dropped, remaining largely steady with numbers observed since last fall in February. For the remainder of 2024, CoreLogic predicts that annual increases in home prices will grow more slowly, providing prospective homebuyers who have been holding off on making a purchase more assurance.

Key Findings:

- U.S. single-family home prices (including distressed sales) increased by 5.5% year-over-year (YoY) in February 2024 compared with February 2023. On a month-over-month basis, home prices increased by 0.7% compared with January 2024.

- In February, the annual appreciation of detached properties (5.8%) was 1.2 percentage points higher than that of attached properties (4.6%).

- CoreLogic’s forecast shows annual U.S. home price gains relaxing to 3.1% in February 2025.

- Miami posted the highest YoY home price increase of the country’s 10 highlighted metro areas in January, at 10.2%. San Diego saw the next-highest gain at 9.9%.

- Among states, South Dakota ranked first for annual appreciation in January (up by 13.8%), followed by New Jersey (up by 12.5%) and Rhode Island (up by 11.6%). Only Idaho recorded a YoY home price loss of -0.1%.

“Home price growth pivoted in February, as the impact of the January 2023 Home Price Index bottom finally faded,” said Dr. Selma Hepp, Chief Economist for CoreLogic. “As a result, the U.S. should begin to see slowing annual home price gains moving forward.”

“Nevertheless,” Hepp continued, “with a 0.7% increase from January to February 2024, which is almost double the monthly increase recorded before the pandemic, spring home price gains are already off to a strong start despite continued mortgage rate volatility. That said, more inventory finally coming to market will likely translate to more options for buyers and fewer bidding wars, which typically keeps outsized price growth in check. Still, despite affordability challenges, homebuyer demand appears to favor already expensive, coastal markets with a limited availability of properties for sale.”

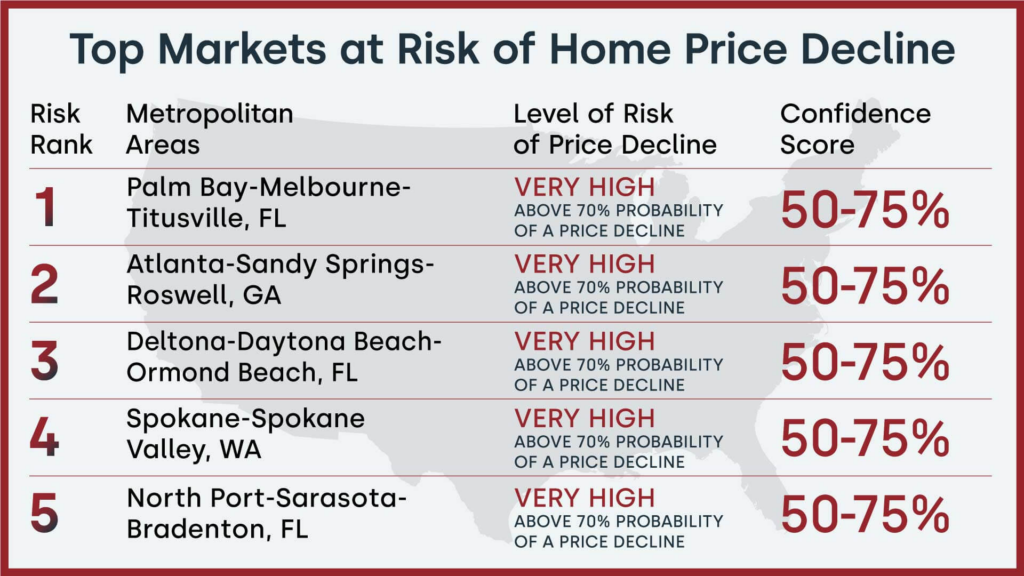

Markets to Watch: Top Markets at Risk of Home Price Decline

The CoreLogic Market Risk Indicator (MRI) predicts that the following markets are at risk of home price declines in the next 12 months:

- Palm Bay-Melbourne-Titusville, FL (70%-plus probability)

- Atlanta-Sandy Springs-Roswell, GA

- Deltona-Daytona Beach-Ormond Beach, FL

- Spokane-Spokane Valley, WA

- North Port-Sarasota-Bradenton, FL

YoY Home Price Gains Stay Above 5% in February

As the effect of comparing gains with weak 2022 home prices eventually wore off, the annual growth in U.S. home prices ultimately dropped, remaining largely steady with numbers observed since last fall in February.

For the remainder of 2024, CoreLogic predicts that annual increases in home prices will grow more slowly, providing prospective buyers who have been holding off on making a purchase more assurance. Increased for-sale inventory helps prospective buyers as well, as stated in the most recent US CoreLogic S&P Case-Shiller Index report. However, affordability is still a worry, especially if mortgage rates stay high throughout the spring homebuying season.

The next CoreLogic HPI press release, featuring March 2024 data, is scheduled to be issued on May 7.

To read the full report, including more data, charts, and methodology, click here.