A combination of high home prices, mortgage rates at 6.79%, and insufficient housing inventory are all barriers to those looking to achieve the American dream of homeownership. To that end, potential buyers are exercising some unique strategies to get into homes, especially first-time homebuyers.

According to a new study from StorageCafe, those new to the market are resorting to renovations and purchasing fixer-upper homes to enter the housing market at a reasonable price point.

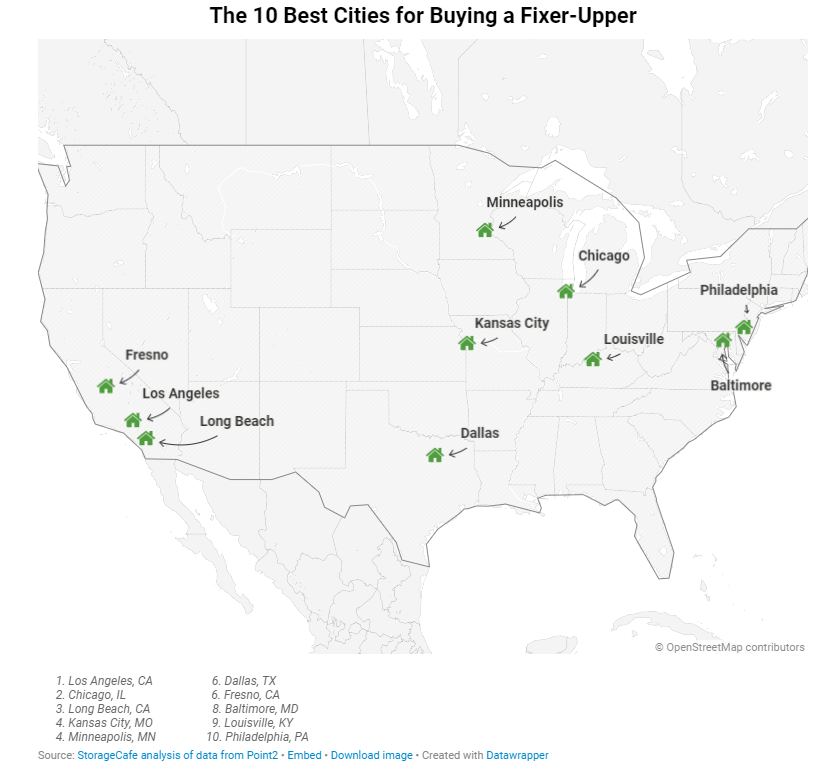

For the study, StorageCafe ranked the locations in the U.S. analyzing more than 70,000 active listings from search portal Point2 for homes for sale in 50 of the most populous cities and calculated the difference in asking prices between homes displaying fixer-upper characteristics, compared to regular listings.

Overall, the study found that fixer-upper homes come with a an average median price point of $283,000, 29% lower than the average move-in ready home. The study also found that buying a fixer-upper as opposed to a turnkey home may result in savings of nearly $117,000 on average, and in 20 out of the 50 largest cities, fixer-uppers were priced at least 50% cheaper than regular homes.

Where are the best values found?

Los Angeles ranked number one in locations favorable to renovators with 26% of the area’s for-sale inventory comprised of fixer-upper homes. Turnkey homes in the City of Angels had an average price tag in excess of $1.9 million, a fixer-upper home calls for slightly more than $1 million. Purchasing a fixer-upper amounts to a difference of $945,000, the largest savings potential among all cities. Remodeling in Los Angeles averaged another $155,000.

And while buyers may find big savings in Los Angeles, the tradeoff is a smaller living space at an average of approximately 1,730-square feet, 660-square feet less compared to a turnkey home (the combined size of a living room and small kitchen).

Midwestern comfort

Chicago ranked second nationally on the list for fixer-upper homes, as approximately 19% of local listings qualified as fixer-uppers with potential savings that hit $190,000 on average. While a home ready to move in listed for $424,000, the average fixer-upper home listed for $235,000. Home improvements average nearly $75,000 in the Chicago area, lower than most other urban hubs including those in California, Texas, Florida and New York.

Bargains continue in the Golden State

Ranking third, Long Beach, California reported that 20% of homes listed for sale were fixer-uppers, and with a median sales price of $837,000 buying a home that carries a fixer label can bring you savings to the tune of $134,500, one of the highest in the study’s rankings.

Coming in fourth place on StorageCafe’s list, 13% of the listings in Kansas City, Missouri were fixer homes, a location where regular homes averaged $400,000, while a fixer-upper averaged $170,000.

Another Midwest location, Minneapolis, reported fixer-uppers comprising 20% of all active listings and ranked fifth on the list. Regular homes in the Twin Cities area came in at $330,000 on average, but the price of a fixer-upper home was even cheaper, averaging just $204,000, a potential savings of around $125,000. Investments averaged $65,000 to remodel a property in the Twin Cities, according to the report.

Rounding out the top 10 were:

- Dallas, Texas’

- Fresno, California

- Baltimore, Maryland

- Louisville, Kentucky

- Philadelphia, Pennsylvania

Click here for more on StorageCafe’s study on the nation’s fixer-upper market.