According to the Realtor.com Monthly Housing Market Trends Report for March 2024, homebuyers may expect an optimistic mix of increased inventory and home price decreases heading into the spring season.

Per the report, the percentage of homes with price reductions jumped to 15.0% in March—representing the highest share in 5 years—and the total number of homes actively for sale increased by 23.5% over the previous March (but remains significantly below pre-pandemic levels).

Top 10 Metro Areas with the Largest Share of Price Reductions of Total Inventory:

- Tampa-St. Petersburg-Clearwater, FL: 27.6%

- Phoenix-Mesa-Chandler, AZ: 23.0%

- Austin-Round Rock-Georgetown, Texas: 22.3%

- Jacksonville, FL: 22.1%

- San Antonio-New Braunfels, Texas: 21.8%

- Orlando-Kissimmee-Sanford, FL: 20.2%

- Portland-Vancouver-Hillsboro, OR-WA: 20.1%

- Miami-Fort Lauderdale-Pompano Beach, FL: 19.7%

- Dallas-Fort Worth-Arlington, Texas: 19.5%

- Memphis, TN-MS-AR: 19.3%

Overall, price reductions were higher across the country than the previous year. It increased by 3.5 percentage points in the South, 1.0 percentage point in the Midwest, 0.5 percentage point in the Northeast, and 0.2 percentage point in the West.

“Sellers are starting to warm up to the current environment, wading into the market in increasing numbers despite market mortgage rates that are likely above their existing rate, if they have a mortgage. As a result, data shows surprisingly competitive pricing trends among sellers, especially in the lead up to this year’s Best Time to Sell, which Realtor.com reported will be between April 14th-20th,” said Danielle Hale, Chief Economist of Realtor.com. “As seller optimism swells, we may see even further inventory gains later in the season that will likely create a more balanced environment for hopeful homebuyers.”

Between January and March 2024, the inventory of properties actively for sale reached its highest level since 2020. While inventory appears to be increasing, it’s worth noting that the market is still 37.9% lower than it was before the outbreak. In February 2024, one price category in particular surpassed all others, with housing supply between $200,000 and $350,000 increasing by 30.5% over March 2023. Several metros had significant increases in active inventory for sale, including Tampa, FL (+58.3%), Orlando, FL (53.3%), and Miami (48.2%).

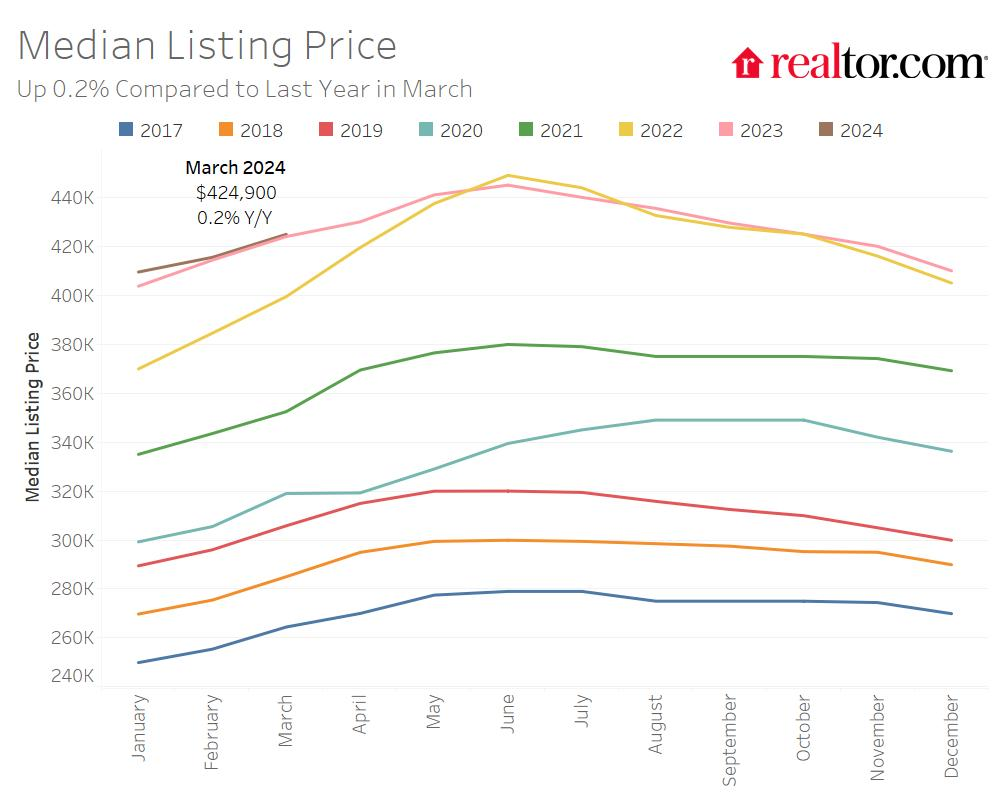

Median List Price is in Flux; But Remains Stable from Last Year

The national median list price rose from $415,500 to $424,900 between February and March 2024. However, compared to previous year, the median list price grew by only 0.2% in March 2023. In two weeks of March, the median list price fell below last year’s levels.

Out of the 50 largest metros, approximately 18 saw their median list price fall compared to the previous year, including Miami (-8.4%), Oklahoma City (-8.3%), and San Francisco (-7.6%), while Los Angeles (+15.1%), Richmond, VA (+11.8%), and Pittsburgh (+11.6%) saw the most rises. With mortgage rates holding between 6.6% and 7% over the previous three months, the cost of financing a home (assuming a 20% down payment) has risen by $63 since March.

In February, average hourly earnings increased by 4.3% annually, finally overtaking the growth in the cost of purchasing the median-priced home, nine months after salaries first overtook overall inflation.

Sellers Turn Out as New Listings Climb, Market Activity Heightens

Home sellers turned out in greater numbers this March, boosting overall inventory, with newly listed houses 15.5% higher than last year. This was the seventh month of increased listing activity following a 17-month drop.

Fannie Mae’s Home Purchase Sentiment Index indicated an uptick in house selling sentiment. In February, the net share of respondents who said it was a good time to sell jumped by 11 percentage points from the previous month and 20 percentage points from the same month last year.

On average, new listings in the 50 largest metro areas increased by an estimated 11.6% from the previous year in March. The West experienced the highest growth in newly listed home inventory, at 21.3%, followed by the South at 15.6%, the Midwest at 14.1%, and the Northeast at 7.9%.

In March, 48 of the 50 largest metros on our list saw new listings increase over the previous year. The metros that saw the largest growth in newly listed homes included:

- Sacramento (+32.5%)

- Tampa (+29.3%)

- San Diego (+25.9%)

The two metro areas that lagged behind were Richmond, VA (-9.4%) and New Orleans (-4.8%).

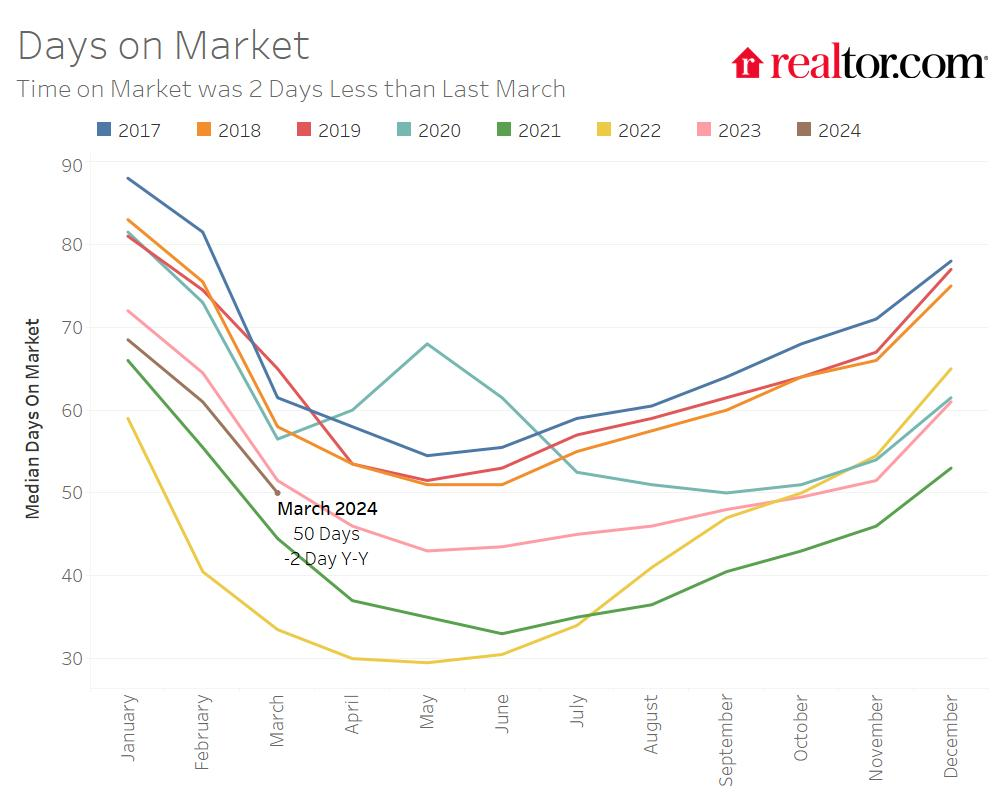

Homes Spending Less Time On the Market Than Last Year, But “the Gap is Shrinking”

The average home lasted 50 days on the market in March, which is two days fewer than the same time last year and nearly two weeks (12 days) less than the average March from 2017 to 2019. However, the difference between last year and this year is closing as inventory increases.

The average home in the 50 largest metro areas stayed on the market for 40 days, four days less than in March of last year. This month, not all regions experienced inventory of homes for sale spend less time on the market than the previous year.

In the South, where housing inventory has increased the most, the average home spent the same length of time on the market in March as the previous year. However, properties in the Midwest (-6 days), Northeast (-6 days), and West (-5 days) continue to spend less time on the market than in March of last year.

In March, a whopping 41 of the 50 largest metro regions saw a drop in time on the market compared to last year. It dropped the most in Kansas City, MO (-20 days), Las Vegas (-15 days), and Austin, Texas (-11 days).

In eight of the 50 largest metros, time on the market increased only slightly from the previous year, including New Orleans (+9 days), Hartford, CT (+8 days), and Louisville, KY(+4 days). However, nine markets, notably Portland, OR (+9 days) and Los Angeles (+6 days), saw properties spend more time on the market than usual from 2017 to 2019, prior to the epidemic.

As said earlier, the percentage of residences with price reductions rose from 12.7% in March last year to 15% this year. The percentage of price decreases is now matched with 2019 for the highest March level since our records began in 2017, as sellers react to more competitive property listings and homebuyer demand is limited by years of declining affordability compared to incomes.

To read the full report, including more data, charts, and methodology, click here.