According to a new report, the Fannie Mae Home Purchase Sentiment Index (HPSI) fell 0.9 points to 71.9 in March, the first dip since November 2023, due mostly to heightened pessimism about the outlook of mortgage rates. Some 34% of consumers now anticipate mortgage rates will rise over the next year, up from 32% last month and higher than the 29% who predict rates will fall.

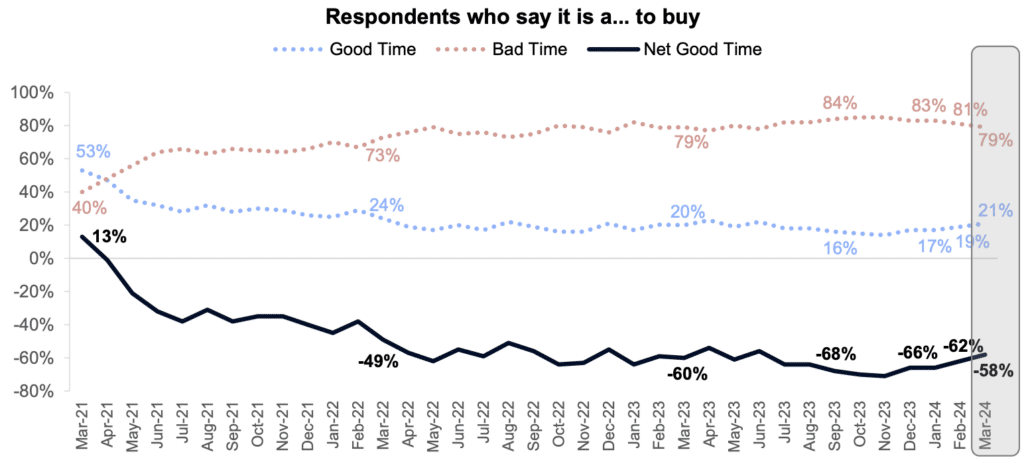

Despite the increase in pessimism about interest rates, consumer evaluations of homebuying and home-selling circumstances improved somewhat in March, and both measures have now climbed for several months in a row. However, the overall lack of housing affordability continues to weigh on consumers’ perception that now is a “good time to buy” a home, with only 21% agreeing with that sentiment. Overall, the index is up 10.6 points year-over-year.

“The HPSI remained relatively flat in March, but we’re seeing signs that consumers may be adjusting their expectations for the housing market to better accommodate the higher mortgage rate and home price environment,” said Doug Duncan, Fannie Mae Senior VP and Chief Economist. “Both our ‘good time to buy’ and ‘good time to sell’ measures continued their slow upward drift this month. However, consumers took a slightly more pessimistic view on the likely direction of mortgage rates, likely reflecting the fact that actual mortgage rates have moved upward since the start of the year. With the historically low rates of the pandemic era now firmly behind us, some households appear to be moving past the hurdle of last year’s sharp jump in rates, an adjustment that we think could help further thaw the housing market.”

Home Purchase Sentiment Index (HPSI) Highlights:

Fannie Mae’s Home Purchase Sentiment Index (HPSI) decreased in March by 0.9 points to 71.9. The HPSI is up 10.6 points compared to the same time last year.

- Good/Bad Time to Buy: The percentage of respondents who say it is a good time to buy a home increased from 19% to 21%, while the percentage who say it is a bad time to buy decreased from 81% to 79%. As a result, the net share of those who say it is a good time to buy increased 4 percentage points month-over-month (MoM).

- Good/Bad Time to Sell: The percentage of respondents who say it is a good time to sell a home increased from 65% to 66%, while the percentage who say it’s a bad time to sell decreased from 35% to 34%. As a result, the net share of those who say it is a good time to sell increased 2 percentage points MoM.

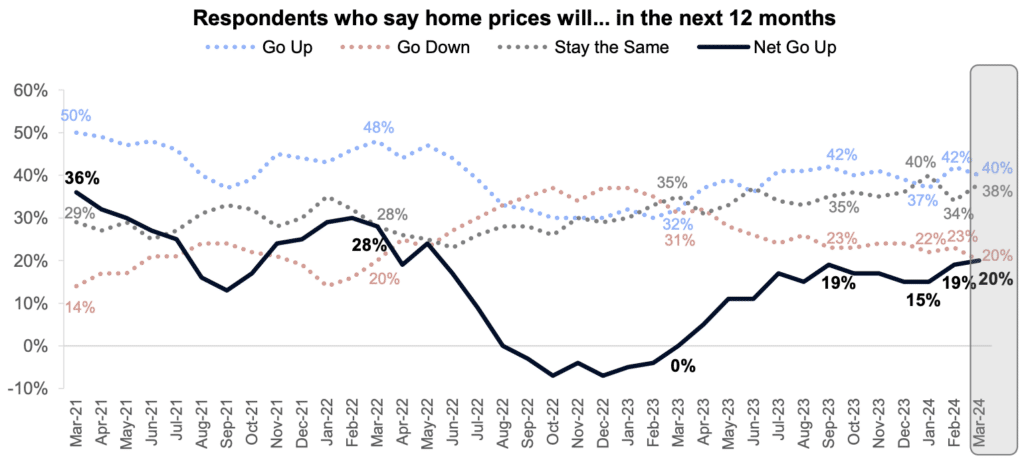

- Home Price Expectations: The percentage of respondents who say home prices will go up in the next 12 months decreased from 42% to 40%, while the percentage who say home prices will go down decreased from 23% to 20%. The share who think home prices will stay the same increased from 34% to 38%. As a result, the net share of those who say home prices will go up in the next 12 months increased 1 percentage points MoM.

- Mortgage Rate Expectations: The percentage of respondents who say mortgage rates will go down in the next 12 months decreased from 35% to 29%, while the percentage who expect mortgage rates to go up increased from 32% to 34%. The share who think mortgage rates will stay the same increased from 32% to 36%. As a result, the net share of those who say mortgage rates will go down over the next 12 months decreased 8 percentage points MoM.

- Job Loss Concern: The percentage of respondents who say they are not concerned about losing their job in the next 12 months decreased from 78% to 77%, while the percentage who say they are concerned increased from 22% to 23%. As a result, the net share of those who say they are not concerned about losing their job decreased 2 percentage points MoM.

- Household Income: The percentage of respondents who say their household income is significantly higher than it was 12 months ago remained unchanged at 19%, while the percentage who say their household income is significantly lower increased from 11% to 12%. The percentage who say their household income is about the same decreased from 70% to 68%. As a result, the net share of those who say their household income is significantly higher than it was 12 months ago decreased 2 percentage points MoM.

“We noted in our latest monthly forecast that we expect to see a gradual increase in home listings and sales transactions in the coming year,” Duncan said. “We believe this will be driven not only by those coming off the sidelines due to a rate-related recalibration, but also by households who may need to move for other life reasons.”

Consumers anticipate a 6.7% average increase in rental prices over the next year, with a monthly increase of 0.5 percentage points. Over the next year, home prices are predicted to rise by 1.6% on average, up 0.5 percentage points from the previous month.

To read the full report, including more data, charts, and methodology, click here.