Through the magic of equity, homeowners typically have higher net worths and are more financially well-off than renters, but that does not tacitly mean they are automatically wealthy.

According to a new study from LendingTree, in fact, some homeowners—and renters too—live in poverty, if not abjectly.

Using data from the latest U.S. Census Bureau American Community Survey data reveals that over three million families who live in single-family owner-occupied homes in the country earn an income below the poverty threshold for their family size.

This shows that while homeownership can be a pathway to long-term wealth creation, it’s far from the only thing needed to secure a family’s financial security.

Key findings

- 7,386,335 families across the nation’s 50 states earn incomes below their poverty threshold. That equates to 8.88% of families living in poverty.

- Of the families in poverty, 41.09% live in owner-occupied housing units. Meanwhile, 58.91% live in renter-occupied housing units.

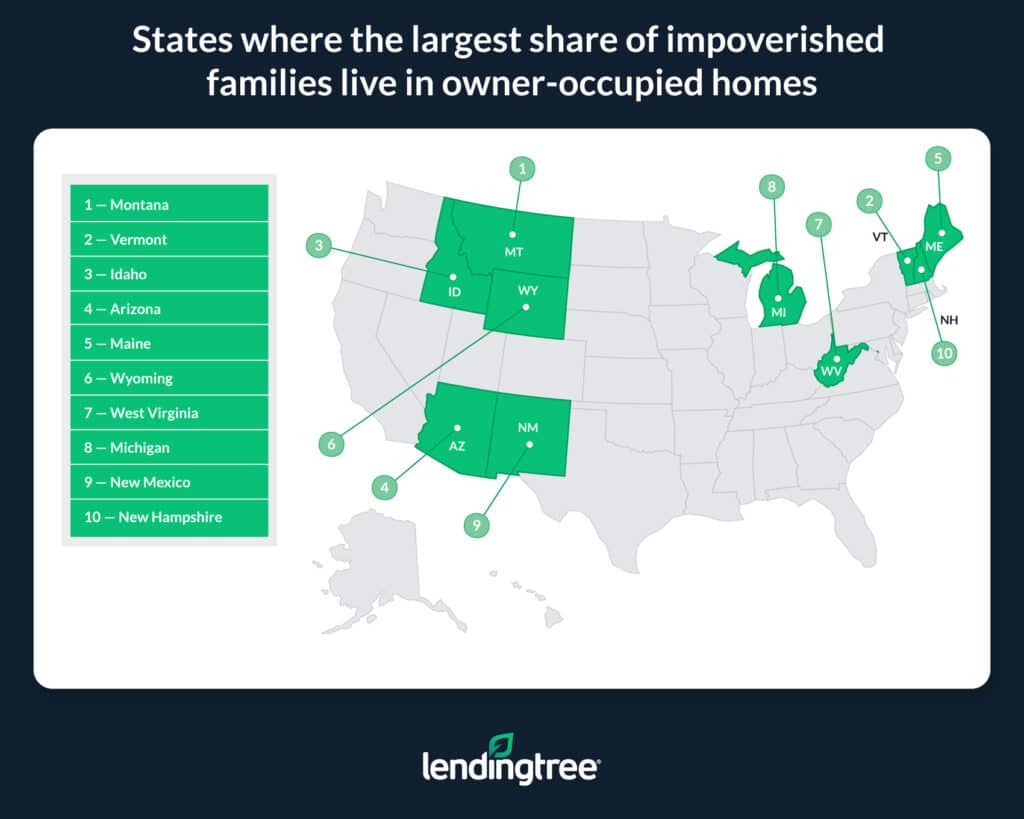

- Montana, Vermont and Idaho have the largest share of impoverished families living in owner-occupied homes. On average, 55.46% of families living in poverty in these states reside in homes occupied by their owners. While exceptions exist, impoverished families are more likely to be homeowners in more rural parts of the country. Lower home prices and greater availability of lower-cost housing options, like manufactured homes, likely help fuel this trend.

- Impoverished families are more likely to be homeowners in only eight states. Besides the aforementioned Montana, Vermont and Idaho, a majority of families below the poverty level in Arizona, Maine, Wyoming, West Virginia and Michigan live in owner-occupied homes. New Mexico is the only state where the share of impoverished families living in owner-occupied homes is the same as the share of impoverished families living in renter-occupied homes.

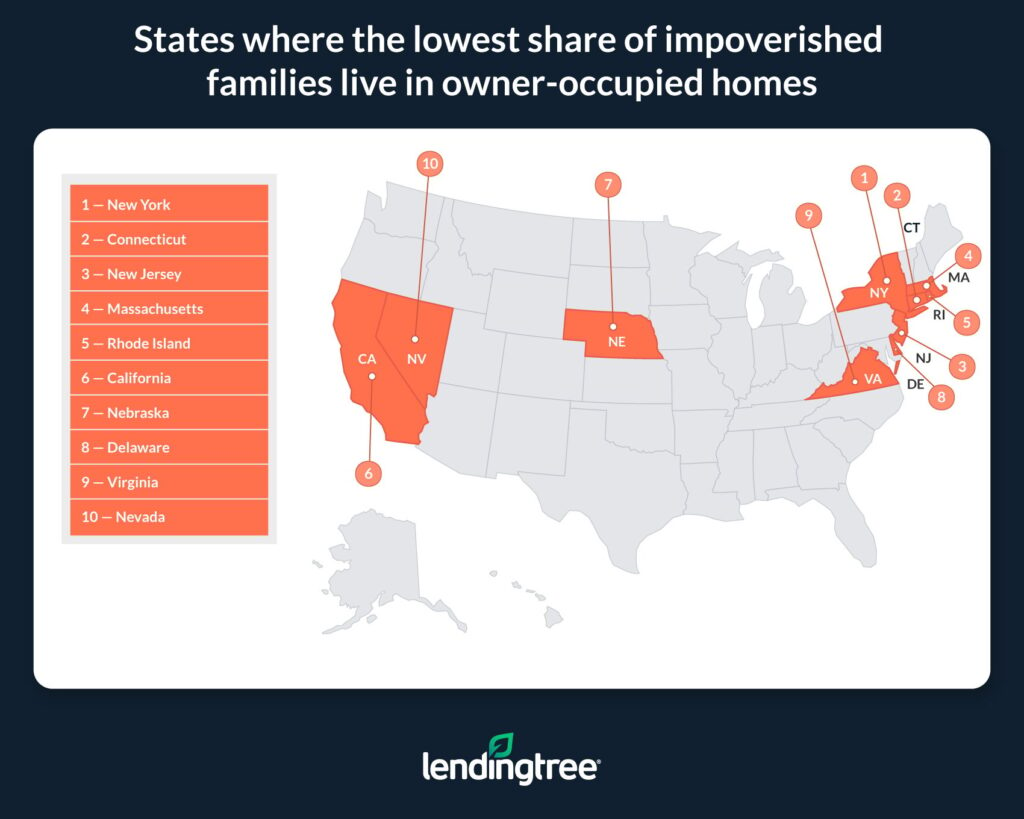

- New York, Connecticut and New Jersey have the smallest share of impoverished families living in owner-occupied homes. Across these states, an average of 29.06% of families who earn incomes below their poverty threshold live in owner-occupied housing units.

According to LendingTree, owning a home no longer guarantees wealth. As this study shows, plenty of families in the U.S. own their home but live in poverty.

One reason is that while a home can be treated as an investment, maintaining a property is often expensive. Typical recurring costs like mortgages or utility payments can quickly add up. Further, surprise costs like those associated with emergency repairs can be anything but cheap.

Though homeowners are typically aware of these expenses before buying a house, it can be difficult for some to realize how much money owning property can require. On top of that, some homeowners, like those who lose their jobs or see their incomes fall, can find themselves quickly overwhelmed by once-manageable housing costs.

Click here for the full report.