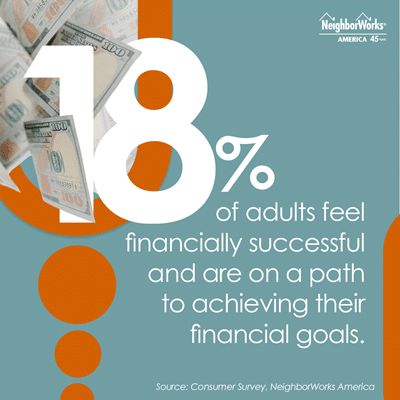

In a new survey, NeighborWorks America revealed that only 18% of respondents feel financially successful and are on track to meet their financial goals. Even the most basic tools, such as budget spreadsheets, are used by less than 30% of adults to manage their finances, with those earning less than $50,000 per year being just under half as likely to use these tools as those earning more.

Only 7% of low-income participants utilize a financial coach, while 15% of members earn more than $50,000 each year. Participants who work with a financial coach are twice as likely to use technologies such as spreadsheets and mobile apps for money management.

“NeighborWorks America is building this trust and supporting the vision of thriving communities with a focus on affordable housing and homeownership,” said Marietta Rodriguez, President and CEO of NeighborWorks America. “We are driving partnerships and programs aimed to close the racial wealth gap, one homeowner at a time. Through our direct support and that of our network of organizations across the county, we are committed to holistic partnerships connecting health, housing, and economic resilience.”

Key Findings:

- Younger adults, ages 18-34 (20%) are using financial coaches at a higher rate than any other age group. They’re five times more times as likely to use a financial coach than those 65+ (4%), and significantly more likely than those ages 35-44 (12%) and 45-64 (7%).

- Younger adults are also using budgeting/spending documents at double the rate of those 65+ (19%). They’re also significantly more likely to use these than those ages 35-44 (33%) and 45-64 (24%).

- Adults in urban (33%) and suburban (30%) communities are more likely than rural adults (22%) to use these resources.

Adults who had less trust in various financial sources reported using fewer methods to manage their financial health, highlighting the need for trustworthy resources. NeighborWorks reported that developing that trust can help consumers take the first step toward greater financial security, making the path to homeownership easier.

According to the NeighborWorks study, women are 11 percentage points more likely than men to feel financially precarious right now. Women were also less hopeful about their abilities to generate and pass on wealth to future generations.

Financial competence programs, which provide individual services, group instruction, and access to financial instruments, can help to lessen the wage difference that women face as a result of a lack of confidence in their financial stability and ability to pass on money to future generations. There is a significant disparity in trust and financial stability among lower-income households and women.

Younger and Lower-Income Adults Having a Harder Time Managing Their Finances

Despite a high level of optimism about creating and passing on wealth in the future, younger adults are struggling to manage their finances in the present. Younger adults are less likely than older adults to believe they can handle various types of debt, and they are more likely to have borrowed money from friends or family to cover an unexpected need in the last year.

Despite current signals of hardship, some 61% of persons aged 18 to 34 believe they will be able to create and pass on wealth to future generations, the greatest percentage of any age group.

Lower-income folks continue to face challenges, as do those who struggle to afford monthly expenses or believe they cannot save for the future.

Less than half of those earning <$50k per year (42%), or those who identify themselves as financially insecure (27%) or stable (45%), are hopeful about establishing intergenerational wealth.

Only 44% of people earning less than $50,000 per year believe they can keep up with new financial tools and services.

Financial Optimism Varies Based On Access to Financial Tools and Resources

Optimism in generating intergenerational wealth may depend on which resources are used.

Adults who use tools like a financial coach, planner/advisor, or accountant are 29 to 39 percentage points more likely to feel confident in their ability to earn and pass on money than those who do not.

Those who utilize apps, spreadsheets, or paperwork to manage credit card debt or make budgeting decisions are more likely to be optimistic about passing on money than those who do not.

Women, older persons, and those living in rural areas are considerably less likely to use financial tools and resources than their male, younger, urban, or suburban colleagues.

Per the report, financial resources are underutilized throughout the board. However, there are differences in how men and women, as well as age groups and community kinds, use financial tools and resources.

Only 5% of women work with a financial coach. This contrasts sharply with males, who use a financial coach at a rate of 17%.

Men were also more likely to keep track of their expenses than women. The survey revealed that 34% of males and 19% of women utilized budgeting applications. Men were also more likely than women to utilize documents/spreadsheets to track their spending. The results revealed that 35% of men and 23% of women utilized documents/spreadsheets to track their spending.

Molly Barackman-Eder, Director of Financial Competence at NeighborWorks, stated that “the training and expertise provided by NeighborWorks focuses on building trusting relationships through courses, including trauma-informed financial counseling. These courses also offer training on equitable service delivery to encourage inclusivity and are focused on clients’ overall well-being.”

Expanding educational initiatives on financial stability for persons in difficult situations is critical to improving outcomes across all income levels. Ensuring that organizations have financial coaches in place as a resource can further help support communities and consumers through good times and bad. In conclusion, lower-income folks continue to face challenges, as do those who struggle to afford monthly expenses or believe they cannot save for the future.

To read the full report, including more data and methodology, click here.