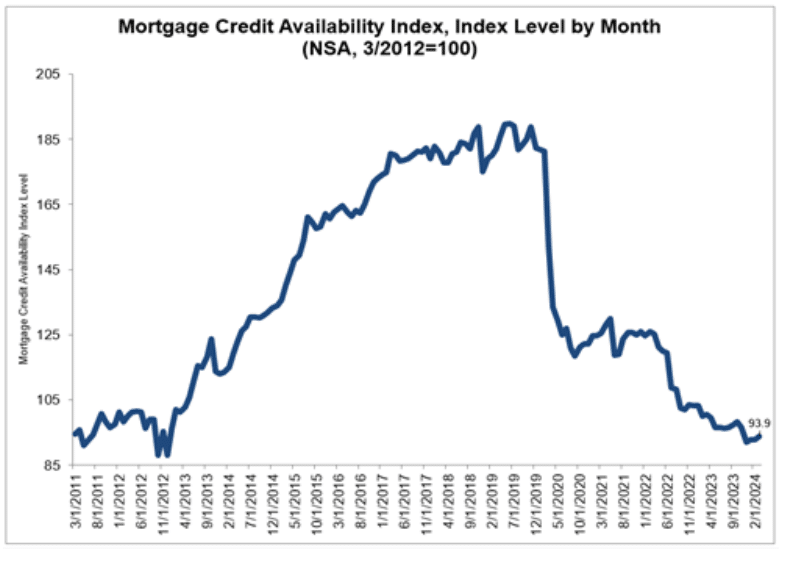

According to the Mortgage Bankers Association’s latest Mortgage Credit Availability Index (MCAI), through an analysis of ICE Mortgage Technology data, mortgage credit availability increased in March of 2024.

The MCAI rose by 1.1% to 93.9 in March. A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit. The MCAI was benchmarked to 100 in March 2012.

The Conventional MCAI increased 2.1% in March, while the Government MCAI decreased by 0.1%. Of the component indices of the Conventional MCAI, the Jumbo MCAI increased by 2.6%, and the Conforming MCAI rose by 1.2%.

“Credit availability increased in March, driven by growth in conventional credit. There were increased offerings of cash-out refinance loan programs across fixed rate and ARM loans, as well as for all occupancy types,” Joel Kan, MBA’s VP and Deputy Chief Economist. “Although credit supply increased for the third consecutive month, it remains low at nearly 7% below a year ago and still close to 2012 lows. The Jumbo Index grew 2.6% last month and was the only component seeing credit supply higher than a year ago. Growth in jumbo credit availability was driven by both non-QM and super conforming loan programs.”

Unemployment impacting mortgage credit

According to the Bureau of Labor Statistics (BLS), total nonfarm payroll employment rose by 303,000 in March 2024, and the unemployment rate changed little at 3.8%, as job gains occurred in healthcare, government, and construction. Both the unemployment rate, at 3.8%, and the number of unemployed people, at 6.4 million, changed little in March. The unemployment rate has been in a narrow range of 3.7%-3.9% since August 2023.

“Average hourly earnings increased 4.1% annually in March, outpacing the most recent inflation level of 3.2%, meaning consumers have seen their spending power improve. However, shelter costs outpaced wage growth, growing 5.4% in February,” said Realtor.com Senior Economic Data Analyst Hannah Jones. “The housing market is eager to see mortgage rates ease as rates have spent nearly a year above 6.5%, and have most recently been hovering above 6.7%. However, mortgage rate relief is dependent on falling inflation and cooling employment growth. The March jobs data and upcoming inflation data will be important inputs for the FOMC ahead of the committee’s May interest rate decision. For now, the market expects the first interest rate cut to come in the June meeting, but unexpectedly hot or cool economic data in the coming month could alter the expected timeline. Though mortgage rates will likely ease by the end of the year, housing will remain relatively expensive and present a challenge to many buyers. Nevertheless, falling mortgage rates can also help ignite seller activity, which would relieve some of the upward pressure on home prices.”

Gauging credit history

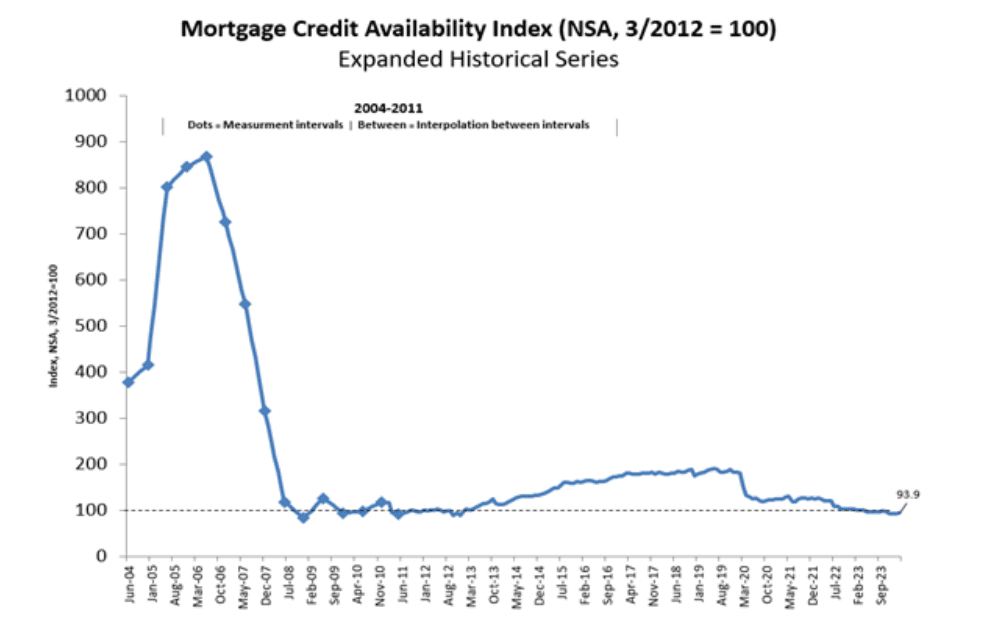

The Total MCAI has an expanded historical series that gives perspective on credit availability going back approximately 10 years (expanded historical series does not include Conventional, Government, Conforming, or Jumbo MCAI). The expanded historical series covers 2004 through 2010, and was created to provide historical context to the current series by showing how credit availability has changed over the last 10 years–including the housing crisis and ensuing recession. Data prior to March 31, 2011 was generated using less frequent and less complete data measured at six-month intervals and interpolated in the months between for charting purposes.

The MCAI is calculated using several factors related to borrower eligibility (credit score, loan type, loan-to-value ratio, etc.). These metrics and underwriting criteria for more than 95 lenders/investors are combined by MBA using data made available via ICE Mortgage Technology and a proprietary formula derived by MBA to calculate the MCAI, a summary measure which indicates the availability of mortgage credit at a point in time.