According to Thumbtack Blog writer P.J. Linarducci (a Medium.com company) first-time homeowners are overwhelmed—they know what they want to find in a potential home, but they do not know the appropriate steps, and it what order, to take to achieve homeownership.

Thumbtack completed market research on who potential homeowners are, their needs, their homebuying knowledge, and compiled all this information in order to bridge this gap. As part of this deep dive into consumers wants and knowledge, they asked 2,000 homeowners in the U.S. who recently bough their first home in the last five years about their goals, challenges, and experiences.

Findings that stood out include

- They are planning to stay in their homes for the long term—an average of 20 years.

- They expect to spend about $30,000 this year across repairs, maintenance, and improvements—a striking amount given the median U.S. household income of $74,580. In fact, Americans spend far more on housing-related expenses than any other category, with a rising share of their paycheck going to mortgages, especially for recent purchases.

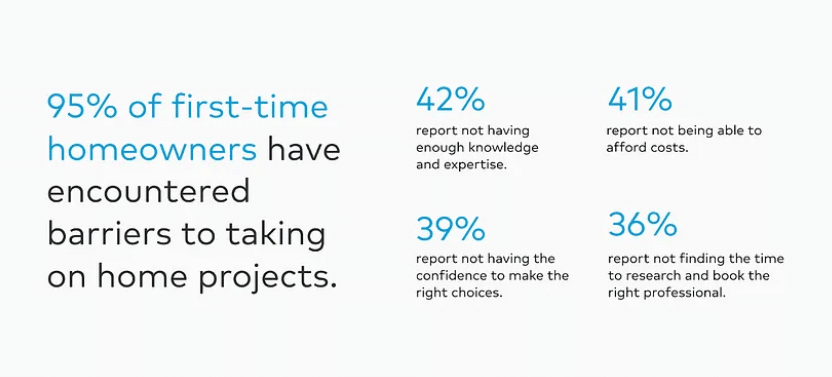

- More than four out of five (83%) were surprised by the complexity of their homes after moving in and found home projects much more time-consuming than they anticipated.

- As digital natives, 88% want a mobile app to plan and manage their home projects, an unmet opportunity we are addressing with our new all-in-one home app.

According to Thumbtack, they asked homeowners in the 25 largest U.S. metropolitan areas about their level of knowledge when they first bought their home, their level of knowledge today, and how much they’d ideally like to know. Their responses showed a noted room for improvement. While most would be satisfied with a B- grade on readiness to care for and improve their homes, the national average stands at an F on move-in day and a D after years of ownership.

Homeownership desires: space for family, proximity to work and modern amenities

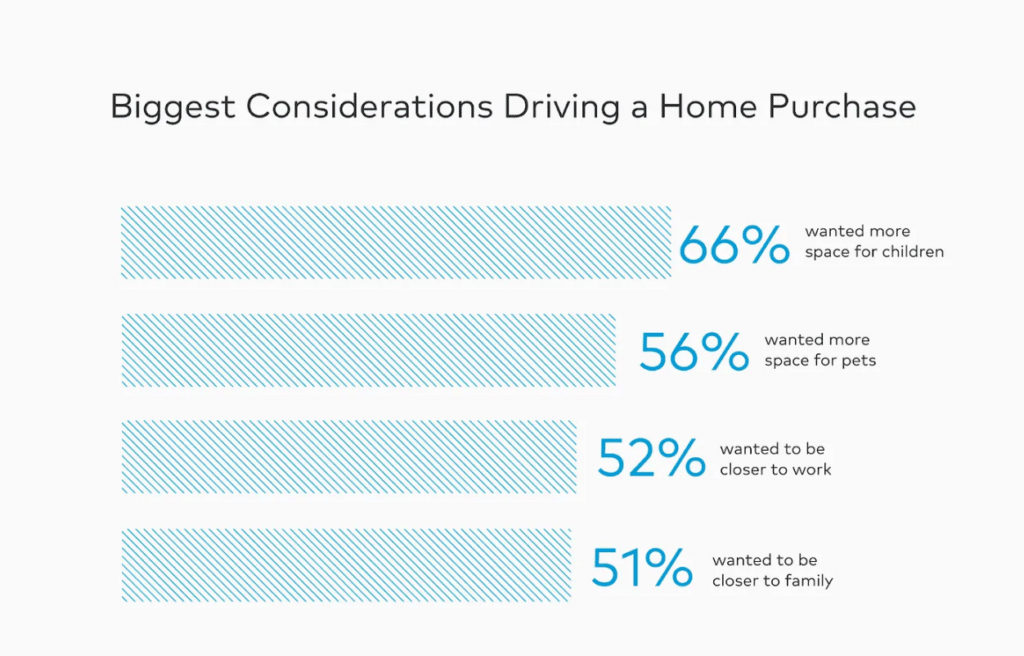

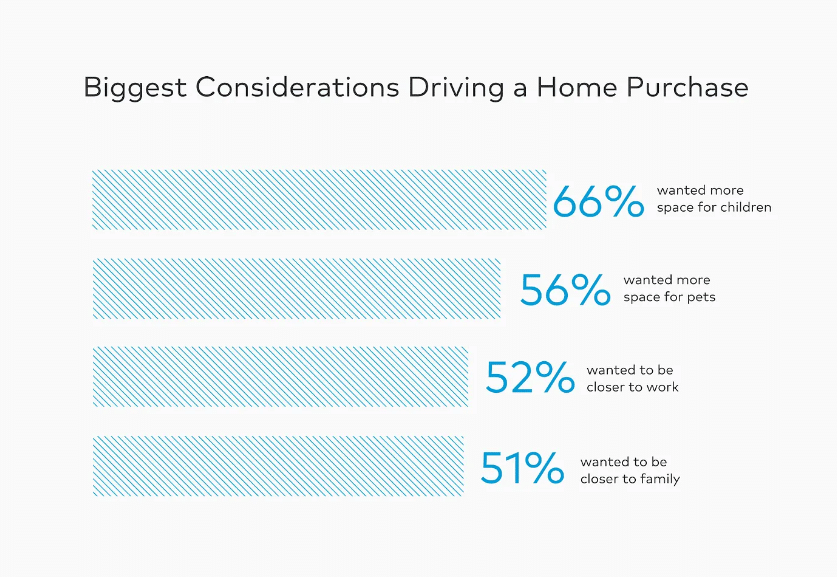

For many, if not most, Americans, buying their first home is not just a run-of-the-mill life event, it’s a major milestone. It also reflects their plans, hopes, and priorities for their lives ahead of them. The vast majority of our survey respondents are millennials (88.5%), and with 35 as the average age of a first-time buyer, it’s no surprise that the biggest consideration driving a home purchase is having more space for children and pets (66% and 56% respectively).

Location matters to buyers as well, as more than half of respondents reported wanting to be closer to work, extended family, while one-third cited they wanted to be closer to friends or to be located in a specific school district.

Asked about the type of home they wanted:

- 61% wanted a more modern or open layout.

- 59% wanted better quality appliances and smart home systems.

- 50% wanted extra space for a home office.

Click here to view the rest of the extensive article, which delves into how first-time homebuyers view their home as an investment, and how much these people expect to invest into their new property.