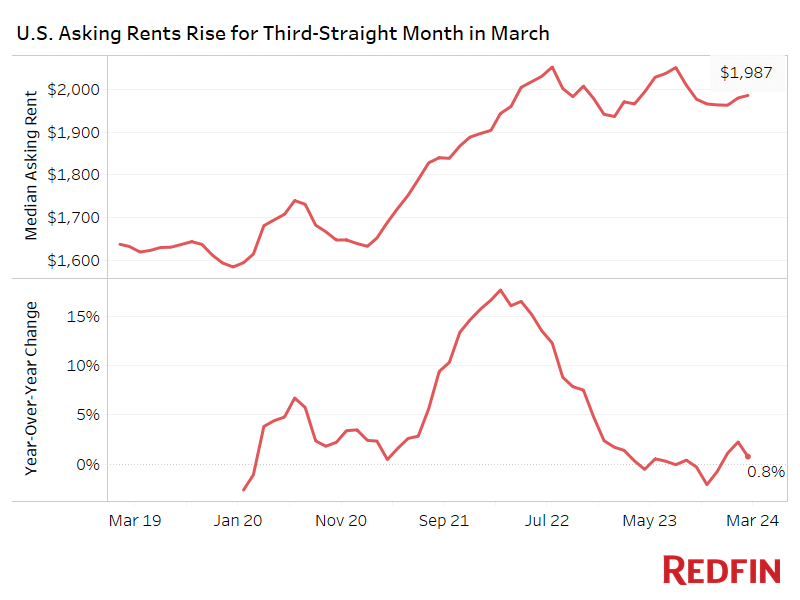

According to a new survey from Redfin, the median U.S. asking rent increased 0.8% year-over-year to $1,987 in March, representing the third straight increase after three months of declines. Asking rents saw little change from February (+0.3%).

Rising rents in the Midwest and Northeast contributed to the national increase in rents, and higher mortgage rates were other potential factors. The average 30-year-fixed mortgage rate is 6.82%, down from the 23-year high of nearly 8% in October but still more than double the all-time low of 2.65% set during the epidemic. Many people are delaying their home purchases since monthly payments for homebuyers are nearing a record high. This increases rental demand and, consequently, rent prices.

Housing costs are also so high that many Americans cannot afford to buy a home; however, rents are also rising, leaving many people looking for housing between a rock and a hard place. The median asking rent in March was barely 3.3% ($67) lower than the record high of $2,054 set in August 2022.

The good news for renters is that prices are not rising as quickly as they were during the pandemic, and they are more predictable. Rents increased by up to 17.7% year on year in 2022 as a result of the pandemic’s moving frenzy, but then soon fell by up to 2.1% in 2023 as an inflow of apartment supply drove increasing vacancies.

In addition, the report showed that since the beginning of 2023, year-over-year rent growth has remained below 3%. The number of units under construction is around a record high, indicating that there is still a lot of supply in the pipeline, which will likely keep rents from rising drastically in the near term.

“During the pandemic, you saw property owners charging $2,800 a month in rent for a house that a year earlier cost $2,000,” said Heather Mahmood-Corley, a Redfin Premier real estate agent in Phoenix. “But the economy has changed, and many people are trying to curb their spending, which means it’s harder for property owners to get renters to agree to big rent hikes.”

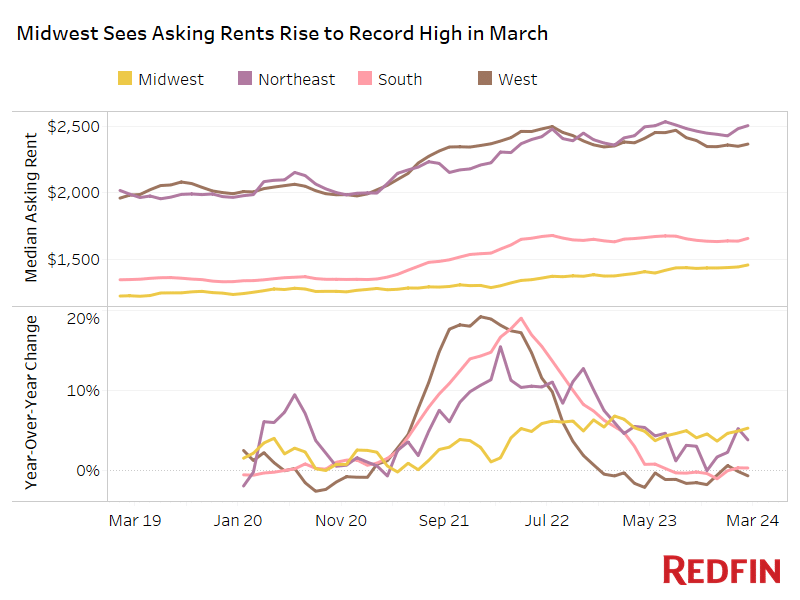

Midwest Experiences Record High Asking Rents

In March, the Midwest’s median asking rent reached a new high of $1,456, up 5.3% from the previous year, the most increase of any area. The second largest increase was in the Northeast, when asking rents rose 3.8% to $2,504. Rents remained relatively constant in the South (+0.3% to $1,656) but falling somewhat in the West (-0.7% to $2,365).

Rents are anticipated to hold up best in the Midwest and Northeast since those regions haven’t built as much housing as the South and West, putting landlords under less pressure to fill vacancies. Fewer vacancies mean more competition among renters, making it easier for landlords to hike rents.

The Midwest is also the most affordable region to reside in, which helps keep demand steady at a time when home affordability is so tight. It also boasts a lower-than-average unemployment rate and has recently attracted large tech corporations.

To read the full report, including more data, charts, and methodology, click here.