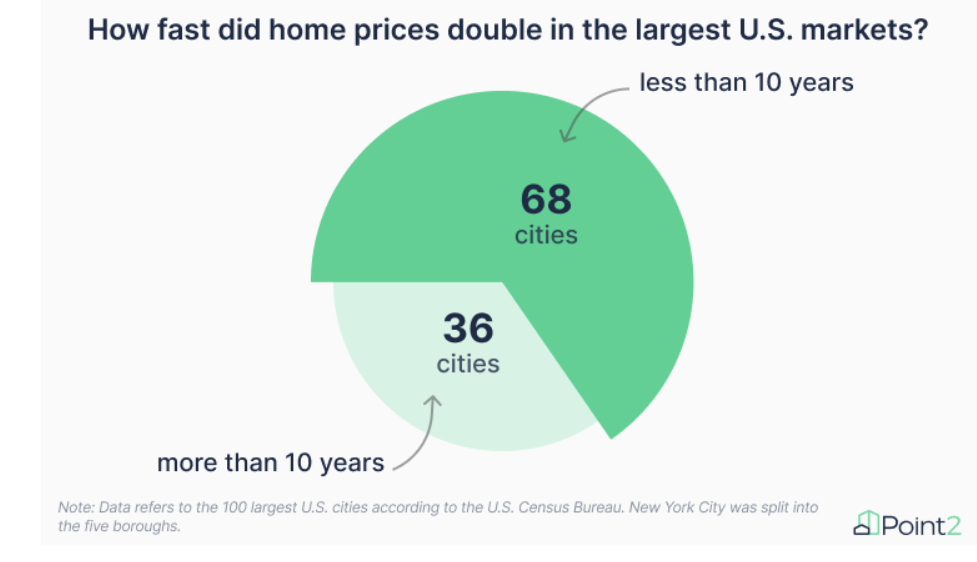

A new study from Point2, conducted by Creative Writer Alexandra Ciuntu, found that home prices have doubled in less than 10 years in 68 of the country’s largest 100 cities. The study found that home prices in Detroit; Spokane, Washington; and many of the larger markets in Florida and Arizona were priced at half of today’s prices just a decade ago.

Over the past decade, the average home in the U.S. went from around $200k to Zillow’s latest average U.S. home value of $347,716, led by inflation, a short supply, and increased demand.

For the report, Point2 analysts looked at historical data to calculate how many years it took for home prices in the 100 largest U.S. cities to double and hit today’s market rates.

Where are prices rising the most?

Those seeking a home in Detroit could buy a home for $40,000 at the start of 2019. According to Zillow, home values in the Detroit region today average nearly $70,000. Similarly, data shows that prices also doubled quickly in Spokane, Washington, where not that long ago, in March 2018, a home cost just $184,500, compared to $371,000 these days.

In Arizona, seven of the state’s largest cities doubled in price in just six to seven years. Prices increased twofold in Scottsdale, Arizona, where the average home costs an average of $837,500, compared to $416,000 just seven years ago at the end of 2017. And in Phoenix, it took 6.8 years according to the study in order for housing process to double, as the average Phoenix home value is $422,001 according to Zillow.

In the Golden State of California, the Irvine region, home to a University of California campus, multiple tech companies, and financial institutions, found home prices jumping to nearly $1.5 million versus $750,000 back in 2017, making Irvine the most expensive big market in the U.S.

Due to its proximity to Silicon Valley and the presence of companies like Tesla and Facebook, homes in Fremont, California went from an average of $740,000 in late 2015, to nearly double that at $1,476,849 today.

Investor interest and revitalization drive prices

Home prices in Miami and Tampa, Florida have doubled since 2018, as they have in Baltimore and Spokane, Washington potentially in light of investor interest and urban revitalization efforts according to Point2 analysts.

Buyers in Irvine, CA, have been holding onto their seats (and wallets) as home prices doubled from $750,000 to $1.5 million within the last seven years.

Where are home prices crawling?

In a colder climate like Anchorage, Alaska, price appreciation took its time to rise, as geographical constraints and a dwindling population have caused it to take as long as 21 years for home prices to double from 2003’s average of $179,600 to reach today’s average of approximately $360,000.

Likewise, it took nearly two decades for homes to double in cost in seven other major cities, including urban Honolulu, Hawaii; Washington, D.C.; Corpus Christi, Texas; Virginia’s Arlington, Chesapeake, and Virginia Beach; as well as Brooklyn, New York.

Various factors play into the slowing pace of price appreciation, ranging from scarce new housing developments in areas like Honolulu, to Alaska’s colder climate making Anchorage a less active housing market.

Single-family homes lead the way

And while median home prices may have doubled at a rapid pace, historical data reveals that, in some cities, single-family dwellings doubled faster than the overall housing market. Single-family homes in Tampa, Florida, are now twice as expensive as they were in 2019. Similarly, as recently as 2020, single-family homes in Detroit were half of today’s prices.

In 45 of the country’s 100 major cities, the median price for single-family dwellings has doubled faster than that of all residential property types combined.

According to the report, one of the primary factors behind single-family homes picking up steam quicker than other types of housing was the pandemic.

The cost of a single-family home doubled faster in Philadelphia, as the average home took the last 19 years or so to double in price, but it took eight fewer years for single-family dwellings to go for twice the price and reach today’s average of $201,000. Similarly, single-family homes in Brooklyn, New York doubled in the last 12 years, as opposed to the 19 years it took the average residential property.

Click here for more information on Point2’s analysis of U.S. markets where prices have risen the most.