In a new study, the Federal Housing Finance Agency (FHFA) examined home evaluation disparities between white and both Black and Hispanic/Latino majority neighborhoods, outlining their strategy for addressing and eliminating racial and ethnic bias in home appraisals.

Updated data suggests a decrease in appraisal differences between white and both Black and Hispanic/Latino majority neighborhoods following initiatives by stakeholders and federal, state, and local authorities, including the publishing of the PAVE Action Plan.

The federal Interagency Task Force on Property Appraisal and Valuation Equity (PAVE) was formed in June 2021 with the goal of creating methods for identifying and eliminating racial and ethnic bias in home appraisals. The Task Force then released the PAVE Action Plan in March 2022, which outlined strategies for the government and industry to improve equity in property value. Since the PAVE Action Plan, stakeholders at the federal, state, and local levels have raised awareness of racial prejudice in property evaluations, leading to increased regulatory and supervisory focus on discriminatory appraisals. The PAVE Action Plan included strategies and recommendations for improving the data used to research and monitor valuation bias.

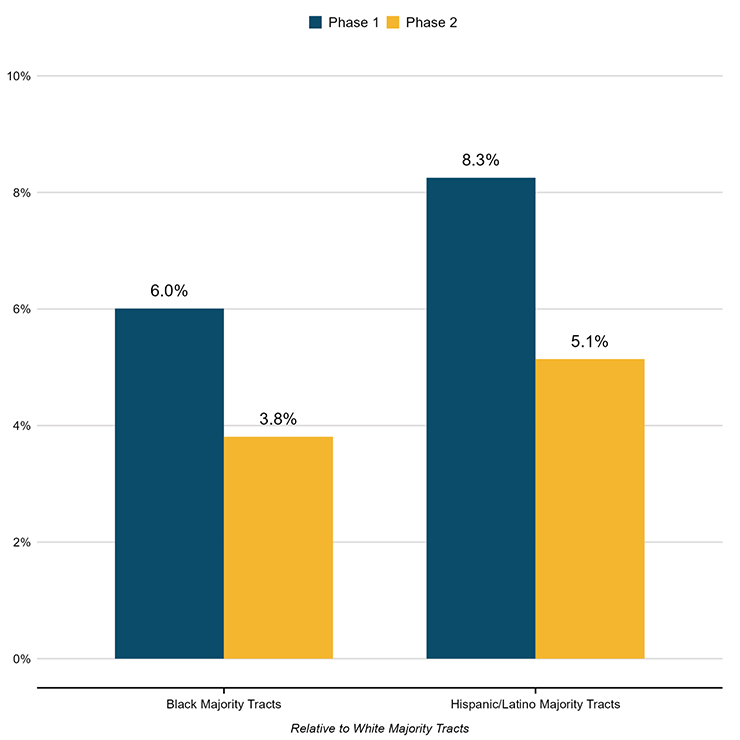

In Phase 1, the proportion of low appraisals was 7.4% in white majority tracts, 13.4% in black majority tracts, and 15.7% in Hispanic/Latino majority areas. The appraisal difference between white and Black majority tracts was 6.0 percentage points, while the gap between white and Hispanic/Latino majority tracts was 8.3 percentage points.

In Phase 2, the percentage of low appraisals remained higher in Hispanic/Latino and Black majority tracts than in white majority tracts, and the appraisal gap narrowed as the percentage of low appraisals in white majority tracts increased while the percentage of low appraisals in Hispanic/Latino and Black majority tracts decreased.

Have Property Valuation Inequalities Diminished in Black and Hispanic/Latino Neighborhoods?

FHFA research found that negative appraisal outcomes are more likely to occur in Black and Hispanic/Latino majority communities than in white majority neighborhoods. But has that gap narrowed?

Of the 27.7 million appraisals for purchase properties in the UAD Aggregate Statistics from Q1 2013 to Q4 2023, 20.3 million (73%) were in white majority tracts, 1.0 million (4%) in black majority tracts, and 1.5 million (5%) in Hispanic/Latino majority tracts.

Appraisal valuation may be at, above, or below the contract price, depending on the appraiser’s view of the property’s value. The appraisal gap is a statistic that shows differences between minority and white tracts. It is calculated as the difference in the proportion of appraisals that fall below the contract price.

When the appraised value falls below the contract price, one of several things can happen: the buyer and seller renegotiate the sales price; the buyer pays the difference in cash; the lender commissions a second appraisal; the lender/client requests that the appraiser reconsider the appraised value; or the transaction falls through. Enterprises may acquire loans with appraised values that are less than the contract price, which may impact the loan’s terms at the time of origination.

Between Q1 2013 and Q4 2023, the percentage of low appraisals was 8.1% in white majority areas, compared to 13.9% in Black majority tracts and 16.1% in Hispanic/Latino majority tracts. The percentage of low appraisals in Black majority tracts is more than one and a half times that of white majority tracts, and in Hispanic/Latino majority areas, it is nearly double. This indicates a potential racial and ethnic bias in property valuations.

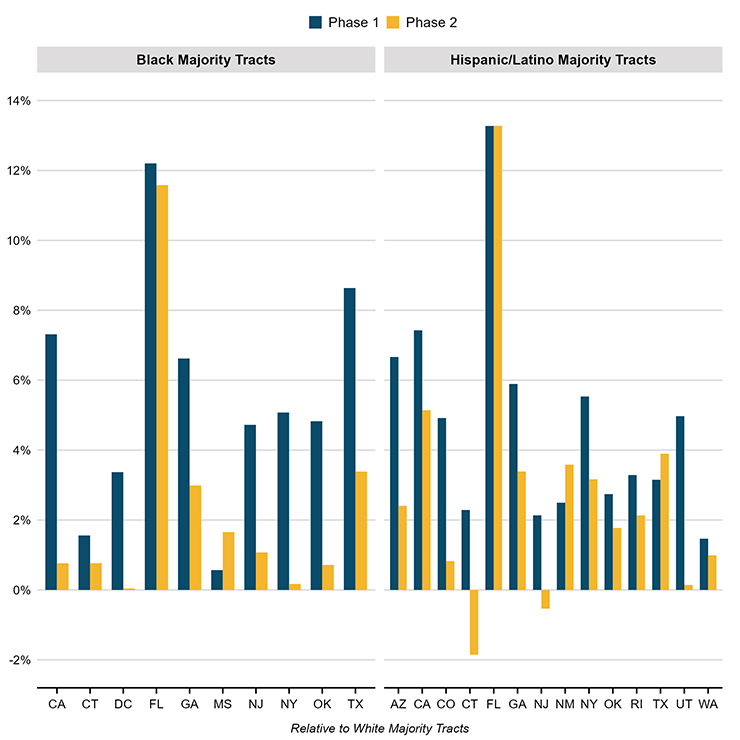

At the state level, the appraisal difference between white majority tracts and both Hispanic/Latino and Black majority tracts decreased in nearly all states with data available in Phase 2 compared to Phase 1. In Mississippi, the evaluation difference between Black and White majority tracts grew throughout Phase 2.

In three states—Florida, New Mexico, and Texas—the valuation disparity among Hispanic/Latino majority tracts and white majority tracts widened throughout Phase 2.

In Phase 2, the percentage of low appraisals in Hispanic/Latino majority tracts was less than that in white majority tracts in two states: Connecticut and New Jersey. In all other states, Hispanic/Latino and Black majority tracts still had a higher percentage of low appraisals than white majority tracts, but the disparity has shrunk significantly for the majority.

To read the full report, including more data, charts, and methodology, click here.