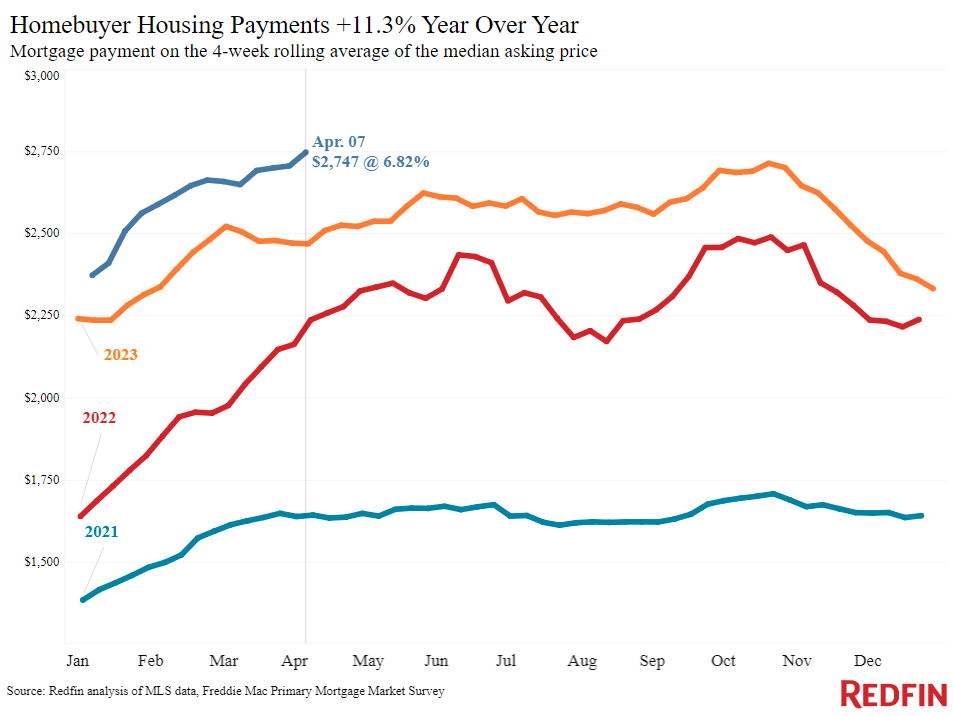

The median monthly housing payment in the U.S. reached an all-time high of $2,747 during the four weeks ended April 7, up 11% from the previous year—this according to a a new report from Redfin.

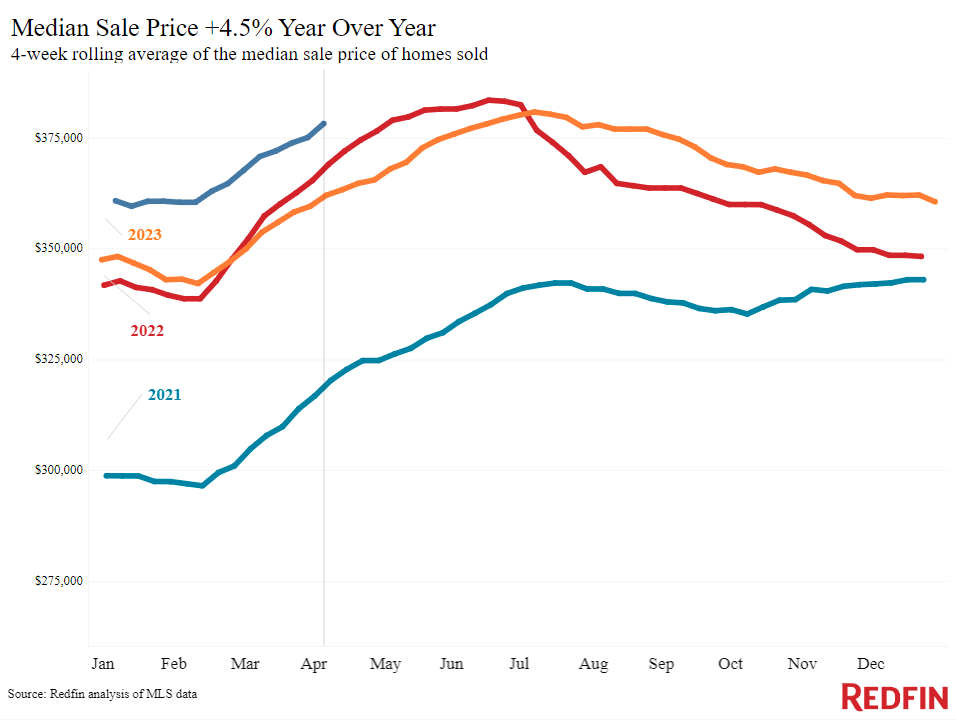

Housing payments are rising due to increasing home prices and mortgage rates. The median home-sale price is $378,250, up 4.5% year-over-year (YoY) and barely $5,000 short of the record high set in June 2022. The average 30-year fixed mortgage rate is 6.82%, which is lower than the near-8% rates seen last October but still more than double pandemic-era lows.

Prices remain stubbornly high because there is enough homebuying demand to support them. The Redfin Homebuyer Demand Index, which measures demand for tours and other buying services from Redfin brokers, has reached its highest level since July.

A separate measure of tours shows that they have climbed 33% since the beginning of 2024, which is significantly greater than last year’s gain over the same period. Even though supply is increasing—new listings increased 14% year-over-year—inventory remains low in comparison to usual spring levels, indicating competition for many of the houses on the market.

Mortgage rates—the second factor driving increasing monthly housing payments—continue to rise because the Fed has kept interest rates high this year. Daily average mortgage rates rose to their highest level since November this week as the March inflation report was hotter than predicted, after a rise last week as the latest jobs report showed a stronger-than-expected economy.

“For homebuyers, the latest CPI report means mortgage rates will stay higher for longer because it makes the Fed unlikely to cut interest rates in the next few months,” said Chen Zhao, Economic Research Lead at Redfin.

Metros with Biggest YoY Increases in Median Sale Price:

- Anaheim, CA (22.2%)

- West Palm Beach, FL (17.4%)

- Pittsburgh (15.2%)

- San Jose, CA (13.9%)

- New Brunswick, NJ (13.9%)

The U.S. median sale priced declined year-over-year in just one metro: San Antonio (-1.7%).

Metros with Biggest YoY Increases in Pending Sales:

- San Jose, CA (22.6%)

- San Francisco (15.8%)

- Cincinnati (5.7%)

- Milwaukee (5.5%)

- Seattle (5.4%)

Pending sales decreased year-over-year in Atlanta (-15.3%); Houston (-13.5%); Nassau County, NY (-12.1%); Fort Lauderdale, FL (-11.2%); and West Palm Beach, FL (-10.9%).

Metros with Biggest YoY Increases in New Listings:

- San Jose, CA (56.8%)

- Sacramento, CA (39.2%)

- Austin, TX (30.7%)

- Jacksonville, FL (30.5%)

- Oakland, CA (30.4%)

New listings declined in just six U.S. metros: Newark, NJ (-3.1%); Milwaukee (-3%); Chicago (-2.9%); Providence, RI (-2.2%); Atlanta (-2%); and Cleveland (-0.1%).

“Housing costs are likely to continue going up for the near future, but persistently high mortgage rates and rising supply could cool home-price growth by the end of the year, taking some pressure off costs,” Zhao said.

To read the full report, including more data, charts, and methodology, click here.